Day Trading Moving Averages Explained!

Interesting high defination online streaming top searched Counter Trend, Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, and Which Ema to Use for Day Trading, Day Trading Moving Averages Explained!.

Talking about Day Trading Moving Averages in this video and how you can use them to Profit! I personally use the 9 EMA and 20 EMA when I’m DayTrading and Ill explain in this video how I use them every single day. Understanding all the tools available for you to DayTrade with will help become more consistent! Don’t just take my word for but apply some Moving Averages to your Chart today!

If you enjoyed this video please Subscribe to the channel for more videos coming soon! Just click link below! http://www.youtube.com/channel/UCTovm…

Find out more info about our Chatroom Real Time Alerts at http://plandaytradeprofit.com

Follow Along on Social Media

On Twitter- http://twitter.com/plantradeprofit

Instagram- http://www.instagram.com/plantradeprofit

Personal Instagram- http://www.instagram.com/PatrickWieland

StockTwits-https://stocktwits.com/PlanTradeProfit

Which Ema to Use for Day Trading, Day Trading Moving Averages Explained!.

Currency Trading – The Stepping Stones Towards Effective Trading

What is proper for the trending market may not be suitable for a range bound or a combining market. Trading in the Forex market has become much easier throughout the last number of years.

Day Trading Moving Averages Explained!, Find latest high definition online streaming videos relevant with Which Ema to Use for Day Trading.

There Is No Such Thing As “Good” Stock

What were these essential experts missing out on? As soon as a pattern is in movement, we like to trail stops behind the 40 day ma. An uptrend is indicated by higher highs and higher lows. Because they are lagging indicators.

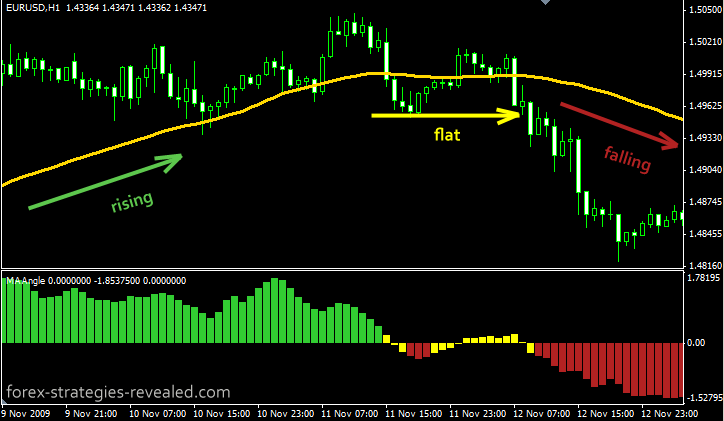

There are an excellent variety of forex indications based upon the moving average (MA). This is an evaluation on the basic moving average (SMA). The easy moving average is line produced by computing the average of a set number of period points.

If it is going to be feasible, the DJIA has to stick around its 20-day Moving Average Trader average. The DJIA has to arrive otherwise it could go down to 11,000. A rebound can result in a pivot point closer to 11,234.

The dictionary prices estimate a typical as “the quotient of any sum divided by the variety of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

While there is no way to anticipate what will happen, it does recommend that you should be prepared in your investments to act if the Forex MA Trading begins to head south.

Let us state that we wish to make a short-term trade, between 1-10 days. Do a screen for Stocks MA Trading in a brand-new up trend. Bring up the chart of the stock you are interested in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and need to be purchased. However as soon as the 9 day crosses over the 4 day it is a sell signal. It is that easy.

As bad as things can feel in the rare-earth elements markets nowadays, the fact that they can’t get too much even worse needs to console some. Gold especially and silver are looking great technically with gold bouncing around strong support after its second perform at the age-old $1,000. Palladium looks to be holding while platinum is anybody’s guess at this point.

It’s really true that the marketplace pays a lot of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the difference was a line made use of a chart. Moving averages for example are best research studies in when big blocks of cash will buy or offer. Watch the action surrounding a 200 day moving average and you will see very first hand the warfare that occurs as shorts attempt and drive it under, and longs purchase for the bounce. It’s cool to enjoy.

Integrating these 2 moving averages gives you a good foundation for any trading plan. Chances are excellent that you will be able to make money if you wait for the 10-day EMA to agree with the 200-day SMA. Simply use great finance, do not risk excessive on each trade, and you must be great.

3) Day trading indicates fast earnings, do not hold stock for more than 25 minutes. They may get the best benefits but they take the most risks and are more gambler than financier. You may likewise begin to move money into bear ETFs.

If you are looking instant engaging comparisons about Which Ema to Use for Day Trading, and Forex Day Trading Strategy, Momentum Indicators you should list your email address for newsletter for free.