Catching Profits in the 3/8 Trap

Popular vids highly rated Current Sector Trends, How to Read Stock Charts, and Trading Ema Crossover, Catching Profits in the 3/8 Trap.

Catching Profits in the 3/8 Trap

✅Get the 3/8 Trap Scan Here: https://goo.gl/1Veew8

✅Try Right Way Options for 60 days – http://bit.ly/RWO60daytrial

✅One of my favorite and most profitable trading patterns I call, “Pop-Out-Of-The-Box.” You can get the full Pop-Out-Of-The-Box workshop course here – https://bit.ly/2QQixxH

✅There is no easier way to make money in the market than finding a trending stock and just waiting for the next entry. I show you how I’ve made a career out of swing trading trends in the course “Trends With Benefits.” Get the full course here – https://bit.ly/2Pygkqk

✅Visit our website: https://hitandruncandlesticks.com/

✅Like us on Facebook: https://www.facebook.com/RightWayOptions/

✅Follow us on Twitter: https://twitter.com/RightWayOptions

Follow us on StockTwits: https://stocktwits.com/RightWayOptions

Trading Ema Crossover, Catching Profits in the 3/8 Trap.

Know What A Stock Beta Calculation Is

It’s not clear which companies will be affected by this decree but Goldcorp and DeBeers have mining jobs there. What does the stock action need to look like for your approach? Also active trading can affect your tax rates.

Catching Profits in the 3/8 Trap, Get latest high definition online streaming videos about Trading Ema Crossover.

3 Things You Need To Understand About Range Trading

Moving average is among numerous technical analysis signs. However even in that secular bear market, there were substantial cyclical booming market. The wedge is compressing, which need to continue to create volatility.

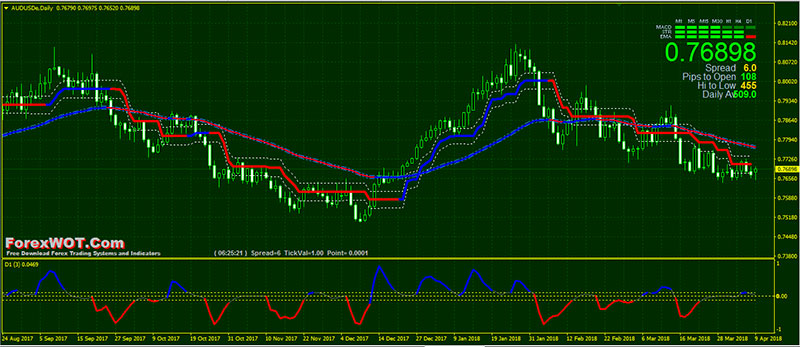

The Bollinger Bands were produced by John Bollinger in the late 1980s. Bollinger studied moving averages and explored with a new envelope (channel) sign. This study was one of the first to determine volatility as a vibrant movement. This tool provides a relative definition of cost highs/lows in regards to upper and lower bands.

However, if there is a breakout through one of the external bands, the price will tend to continue in the very same instructions for a while and robustly so if there is a boost Moving Average Trader in volume.

Assistance & Resistance. Support-this term explains the bottom of a stock’s trading range. It resembles a flooring that a stock price discovers it difficult to penetrate through. Resistance-this term describes the top of a stock’s trading range.It’s like a ceiling which a stock’s cost doesn’t appear to rise above. When to purchase or offer a stock, assistance and resistance levels are important clues as to. Lots of effective traders buy a stock at assistance levels and offer short stock at resistance. If a stock handles to break through resistance it could go much higher, and if a stock breaks its support it might signal a breakdown of the stock, and it might go down much even more.

Picking a timespan: If your day trading, purchasing and selling intra day, a 3 year chart will not help you. For intra day trading you wish to utilize 3,5 and 15 minute charts. Depending on your longterm investment technique you can look at a 1 year, which I utilize frequently to a ten years chart. The yearly chart give me a take a look at how the stock is doing now in today’s market. I’ll look longer for historical support and resistance points however will Forex MA Trading my buys and offers based upon what I see in front of me in the annual.

The frequency is essential in choice. For instance, offered two trading systems, the first with a higher revenue factor but a radio frequency, and the second a greater frequency in trades however with a lower revenue factor. The 2nd system Stocks MA Trading have a lower revenue aspect, but because of its greater frequency in trading and taking little earnings, it can have a greater total revenue, than the system with the lower frequency and higher revenue aspect on each specific trade.

Here is a best example of a method that is simple, yet creative enough to assure you some added wealth. Start by choosing a particular trade that you think is profitable, say EUR/USD or GBP/USD. When done, select 2 indicators: weighted MA and basic MA. It is suggested that you use a 20 point weighted moving average and a 30 point moving average on your 1 hour chart. The next step is to look out for the signal to offer.

To get in a trade on a Pattern Turnaround, he requires a Trendline break, a Moving Typical crossover, and a swing greater or lower to get set in an uptrend, and a trendline break, a Moving Typical crossover and a lower swing low and lower swing high to get in a downtrend.

Combining these 2 moving averages gives you an excellent foundation for any trading plan. If you wait on the 10-day EMA to agree with the 200-day SMA, then opportunities are excellent that you will have the ability to earn money. Just use great finance, don’t run the risk of excessive on each trade, and you ought to be great.

This is an evaluation on the easy moving average (SMA). As your stock goes up in cost, there is an essential line you wish to view. They right away abandon such a trade without awaiting a few hours for it to turn lucrative.

If you are searching unique and engaging videos relevant with Trading Ema Crossover, and Trading Info, Forex Day Trading Strategy please subscribe in a valuable complementary news alert service for free.