🔴 Insanely Simple & Profitable "EMA Parabolic SAR" Trading Strategy For Beginners (and PROS)

Interesting complete video top searched Learn How to Trade, Forex Beginners – 2 Extremely Popular Indicators and How to Use Them, and 20 50 Ema Trading Rule, 🔴 Insanely Simple & Profitable "EMA Parabolic SAR" Trading Strategy For Beginners (and PROS).

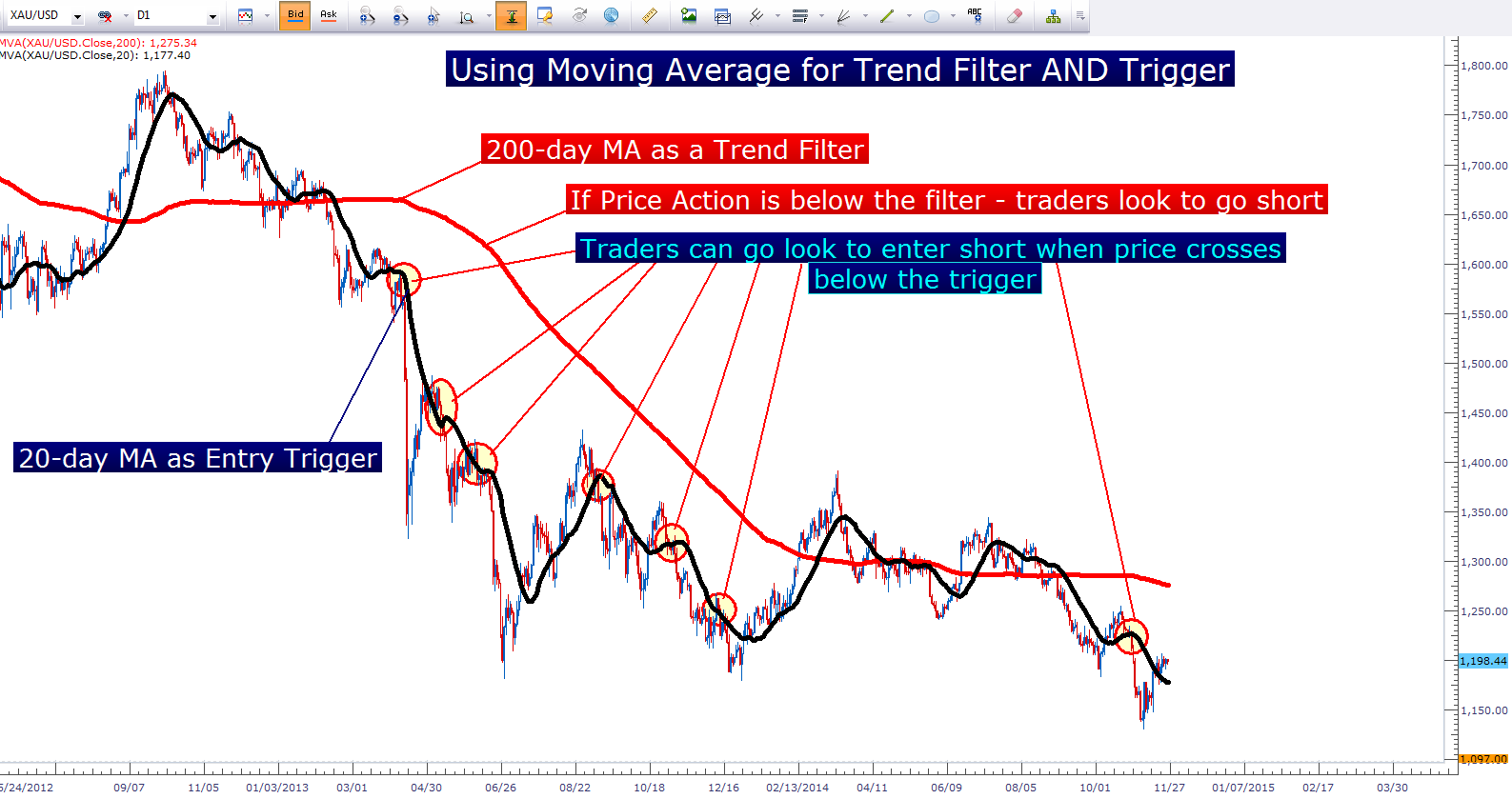

Up until now, we’ve looked at technical indicators that mainly focus on catching the beginning of new trends.

Although it is important to be able to identify new trends, it is equally important to be able to identify where a trend ends.

20 50 Ema Trading Rule, 🔴 Insanely Simple & Profitable "EMA Parabolic SAR" Trading Strategy For Beginners (and PROS).

Bollinger Band Trading

Another constraint with MAs is that they tend to whipsaw a lot in a choppy market. This tool offers a relative meaning of rate highs/lows in terms of upper and lower bands. You simply need to have persistence and discipline.

🔴 Insanely Simple & Profitable "EMA Parabolic SAR" Trading Strategy For Beginners (and PROS), Get most searched full length videos related to 20 50 Ema Trading Rule.

Top 5 Technical Inidcators That Will Make You Rich

To keep dangers down, I suggest simply choosing the 200 Day Moving Typical. You require to set really specified set of swing trading rules. Paul accepted study hard and to attempt to conquer his feelings of fear and greed.

In less than four years, the price of oil has increased about 300%, or over $50 a barrel. The Light Crude Continuous Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil rates will eventually slow financial development, which in turn will cause oil rates to fall, ceritus paribus.

Always utilize stop losses. You should constantly secure your trades with a stop loss. If you are trading part time and you do not keep an eye on the market all day long, this is definitely essential Moving Average Trader . It likewise helps to reduce your stress levels as you understand ahead just how much you are likely to loss if the trade does not go in your favour.

There are a number of possible explanations for this. The very first and most apparent is that I was merely setting the stops too close. This might have allowed the random “sound” of the rate movements to activate my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was taking part in “stop searching”. I’ve composed a more complete post on this subject already, but generally this involves market players who attempt to push the price to a point where they believe a great deal of stop loss orders will be triggered. They do this so that they can either enter the market at a better price for themselves or to trigger a cumulative move in an instructions that benefits their existing positions.

“This easy timing system is what I use for my long term portfolio,” Peter continued. “I have 70% of the funds I have actually assigned to the Stock Forex MA Trading invested for the long term in leveraged S&P 500 Index Funds. My financial investment in these funds forms the core of my Stock portfolio.

Given that we are using historic information, it is worth noting that moving averages are ‘lag Stocks MA Trading indicators’ and follow the real period the higher the responsiveness of the chart and the close it is to the real price line.

Let’s expect you are in the same camp as we are and you believe the long term outlook on gold is really favorable. So, each time it dips listed below a particular value level, you add more to your portfolio, essentially “purchasing on the dips”. This may be rather different from another person who looked at a roll over as a factor to sell out. Yet, both traders are taking a look at the very same technical levels.

The second action is the “Ready” step. In this step, you might increase your cash and gold allotments even more. You might also begin to move cash into bear ETFs. When the market goes down, these funds go up. Funds to think about include SH, the inverse of the S&P 500, DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

Always be conscious of your emotions and never ever make a trade out of fear or greed. This is harder than it seems. A lot of amateur traders will pull out of a trade based upon what is taking place. But I assure you this is always bad. To make cash regularly you must develop a method and persevere. So be it if this indicates setting targets and stops and leaving the space! This may be more difficult to practice than it sounds but unless you get control of your emotions you will never be a successful trader.

What they want is a forex strategy that turns into a revenue within minutes of participating in the trade. There is a huge selection of investment suggestion sheets and newsletters on the web.

If you are searching unique and engaging reviews related to 20 50 Ema Trading Rule, and What Are the Best Indicators to Use, Demarker Indicator you should signup our email list now.