Which moving average is Best ? (EMA VS SMA) #shorts #ytshorts

Trending vids top searched Stock Market Information, Foreign Currency Trading, Megadroid Trading Robot, Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, and Which Ema Is Best for Trading, Which moving average is Best ? (EMA VS SMA) #shorts #ytshorts.

In share market everyone think that How to start trading and how to judge where market can move….and on that time everyone came to an fascinating word called as #Indicators.

So what is indicators and how they help participants or Trader to understand where can market go…

1- moving average.

: Exponential moving average.

: Simple moving average.

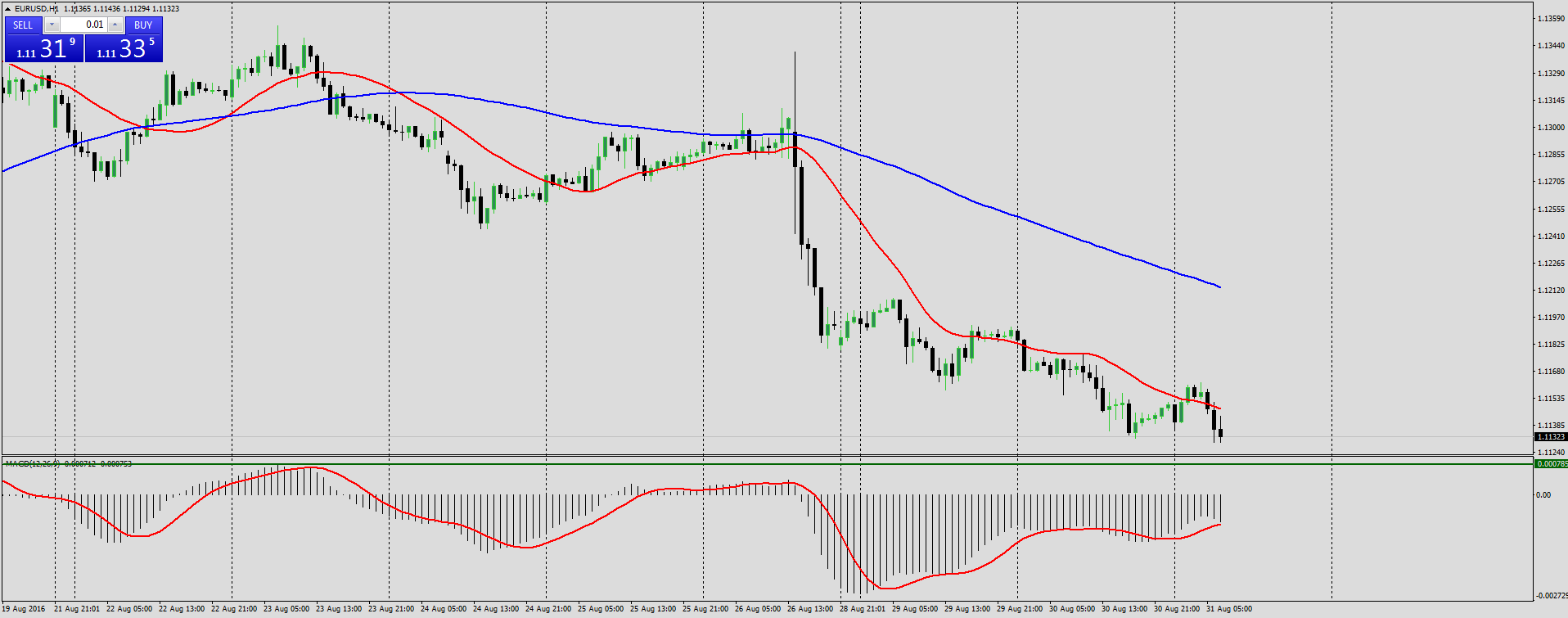

Example of simple moving average and exponential moving average.

Why mostly trader use exponential moving average over simple moving average.

Understand all basic things about moving average through example and as well as short explanation about that.

Moving average help to identify big moves before that happens.

So mostly traders use exponential moving average for trading as a #entry and #exit.

EMA VS SMA

So subscribe to our channel and we are going to start #live trading program. Soon

Which Ema Is Best for Trading, Which moving average is Best ? (EMA VS SMA) #shorts #ytshorts.

My Leading 3 Technical Indications For Trading Stocks Like A Pro

Now when a market is trending, it has picked a clear instructions. The price didn’t quite make it, closing at $11.83 on the day of expiry (point 7). Too much in and out trading can be both mentally and economically hazardous.

Which moving average is Best ? (EMA VS SMA) #shorts #ytshorts, Play interesting reviews related to Which Ema Is Best for Trading.

Forex Scalping Trading Systems

When you understand which method the market is going you have a much better concept of what it will do next. Lots of stocks, especially tech stocks, fell sharply on above average incomes and assistance.

Every so often the technical indicators begin making news. Whether it’s the VIX, or a moving average, somebody picks up the story and soon it’s on CNBC or Bloomberg as the news of the day. So, as a financier one has to ask, “are technical signs really a reason to offer or buy?” In some aspects the response is no, considering that “investing” is something various from swing trading or day trading.

3) Day trading suggests quick profit, do not hold stock for more than 25 minutes. You can always sell with earnings if it begins to fall from leading, and after that buy it back later if it Moving Average Trader end up going upward once again.

Peter cautioned him nevertheless, “Keep in mind Paul, not all trades are this simple and end up too, but by trading these kinds of patterns on the daily chart, when the weekly pattern is likewise in the exact same direction, we have a high possibility of a successful outcome in a big percentage of cases.

Now when we use 3 MAs, the moving average with the least number of durations is identified as quick while the other two are defined as medium and sluggish. So, these 3 Forex MA Trading can be 5, 10 and 15. The 5 being fast, 10 medium and 15 the slow.

During these times, the Stocks MA Trading regularly breaks assistance and resistance. Of course, after the break, the costs will typically pullback before continuing its method.

During long-lasting secular bear markets, a buy and hold technique hardly ever works. That’s because over that time, the marketplace may lose 80% in worth like it performed in Japan in the 90s. But even because nonreligious bearishness, there were substantial cyclical bull markets. In the case of Japan for instance, the biggest rally was an excellent 125% from 2003-2007.

Once the buzz settles and the CME finishes its margin boost on Monday, we should see silver costs support. From my point of view, I see $33 as a level I may very carefully start to purchase. I think support will be around $29 till the Fed chooses it’s time to cool inflation if silver breaks below that level.

Always understand your feelings and never ever make a trade out of fear or greed. This is more difficult than it appears. The majority of amateur traders will pull out of a trade based upon what is happening. But I ensure you this is always bad. To earn money consistently you need to develop a strategy and stay with it. If this implies setting stops and targets and leaving the room, so be it! This might be harder to practice than it sounds however unless you get control of your emotions you will never be an effective trader.

Even though I’m not a big fan of scalping there are lots of traders who effectively make such trades. This could increase your profit aspect and offer you more trading chances.

If you are looking rare and entertaining reviews relevant with Which Ema Is Best for Trading, and Day Moving Average, Accurate Forex Signals please subscribe our email list totally free.