Valutrades Basic Trading Course – Lesson 10: Moving Average Crosses on MT4

Top replays highly rated Simple Moving Average, Beginner Trading, and Ma Crossover mt4, Valutrades Basic Trading Course – Lesson 10: Moving Average Crosses on MT4.

Welcome to the Valutrades Basic Trading Course!

Free FX Trading Signals from Valutrades: www.valutrades.com/en/trading-signals

This is a series of videos, designed to launch the journey of beginning traders, in every aspect of trading with Valutrades.

In our tenth video, let’s take a look at Moving Average Crosses.

In our last video, we showed you how to set up a Moving Average on MT4.

Often, the very first trading strategy used by many beginning traders can be some variety of Moving Average Cross.

Just as we did last time, let’s open a Moving Average in the same way.

This one will be a 10-Period Moving Average.

The MA Method will be Exponential.

And, it should have a distinctive colour like Blue.

We can see how a 10-Period Moving Average follows price action quite closely.

Now, let’s set up another Moving Average.

This one will be a 40-Period Exponential Moving Average (EMA) and we will make it another distinctive colour.

Now we have 2 Moving Averages.

The 40-Period EMA is what we call the Slow Moving Average and the 10-Period EMA is what we call the Fast Moving Average.

A general guideline states that the Slow Moving Average should be 4 times that of the Fast Moving Average but you may experiment with many combinations.

The concept is, when the Slow Moving Average crosses below the Fast Moving Average, this can be considered a bearish signal.

On the contrary, when the Slow Moving Average crosses above the Fast Moving Average, this can be considered a bullish signal.

You will also note that when the two Moving Averages separate, this may be a signal of a reversal.

To create a Moving Average Cross strategy, that is more or less conservative, you may modify the settings by scrolling over the line, right-click and selecting Properties.

So, let’s change the 40-Period to an 80-Period EMA.

We can change the other Moving Average in the same way or we can right-click on the chart and select Indicators List.

Select the Moving Average and select Edit.

Change the Period to 20, select OK and you will see a slightly more conservative set of Moving Averages.

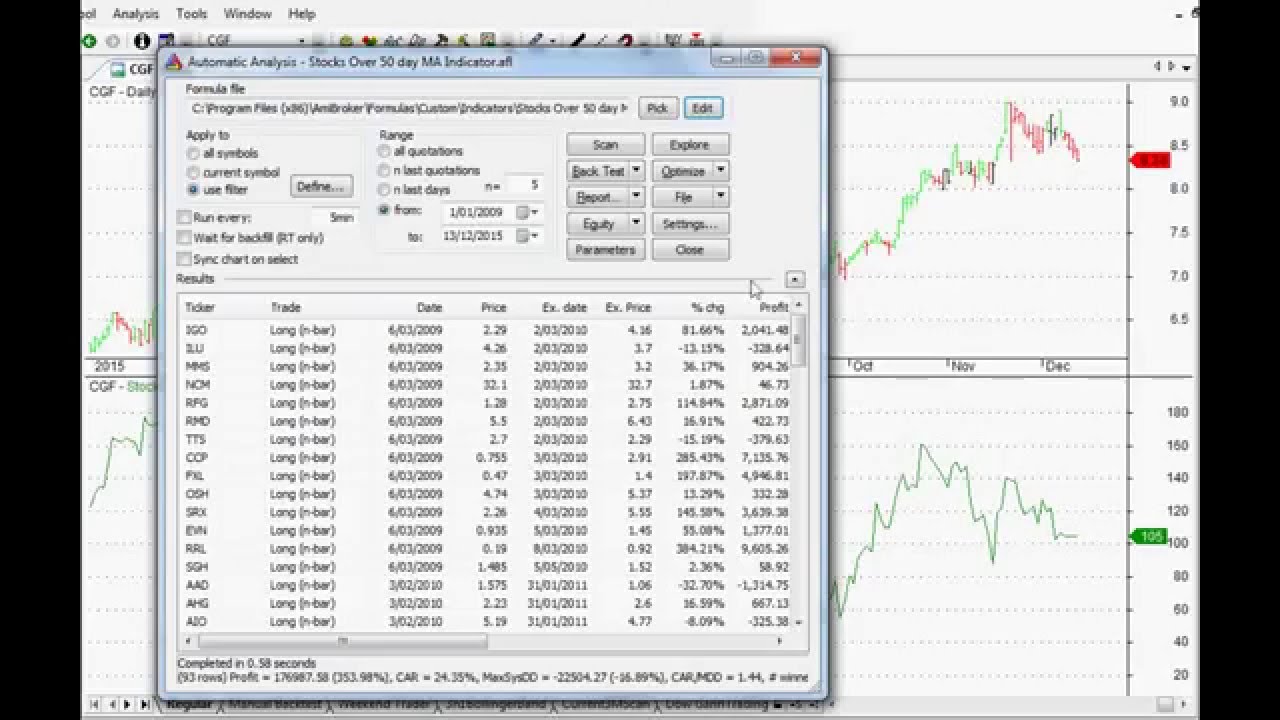

You should experiment with a variety of values, and backtest with different symbols and chart timeframes, to suit your trading style.

You may also add other indicators like oscillators…the MACD for example… to confirm your decisions to enter and exit positions.

We will look at other indicators, including oscillators, in later videos.

That’s all for now.

In the next lesson we will be looking at different styles of trading.

Happy trading with Valutrades and we will see you soon.

CFDs and FX are leveraged products and your capital may be at risk.

Ma Crossover mt4, Valutrades Basic Trading Course – Lesson 10: Moving Average Crosses on MT4.

Trend Trading – Trading Stocks Utilizing Technical Analysis And Swing Trading Strategies

You may discover on stock charting websites a line called MA, SMA, or EMA. Nasdaq has actually been creating a rising wedge for about 2 years. The understanding and usage of simple moving averages will accomplish this.

Valutrades Basic Trading Course – Lesson 10: Moving Average Crosses on MT4, Play new full length videos relevant with Ma Crossover mt4.

Trading Strategies Of The Professionals

3) Day trading suggests fast profit, do not hold stock for more than 25 min. They do not understand proper trading strategies. This suggests that you need to know how to manage the trade before you take an entry.

Everybody wishes to learn currency trading, or so it appears from the variety of people being drawn into the foreign currency, or forex, trend. However, as with a lot of things, there’s a wrong way and a right method. And the best way has 3 crucial ingredients.

A common forex rate chart can look really irregular and forex candlesticks can obscure the pattern even more. The Moving Average Trader average provides a smoothed chart that is outlined on top of the forex chart, together with the japanese candlesticks.

The most standard application of the BI principle is that when a stock is trading above its Bias Indication you should have a bullish predisposition, and when it is trading listed below its Bias Indication you need to have a bearish predisposition.

Market timing is based on the “truth” that 80% of stocks will follow the direction of the broad market. It is based upon the “fact” that the Forex MA Trading trend gradually, have actually been doing so since the start of easily traded markets.

Now that you have actually identified the daily pattern, fall to the lower timeframe and look at the Bollinger bands. You are trying to find the Stocks MA Trading cost to strike the severe band that protests the daily pattern.

A 50-day moving average line takes 10 weeks of closing rate data, and after that plots the average. The line is recalculated daily. This will show a stock’s rate pattern. It can be up, down, or sideways.

I have mentioned this several times, but I believe it deserves mentioning again. The most common moving average is the 200-day SMA (easy moving average). Extremely put simply, when the marketplace is above the 200-day SMA, traders state that the market remains in an uptrend. The market is in a downtrend when price is listed below the 200-day SMA.

Always know your feelings and never ever make a trade out of fear or greed. This is more difficult than it seems. The majority of amateur traders will pull out of a trade based upon what is happening. But I assure you this is always bad. To generate income regularly you should construct a strategy and stay with it. So be it if this implies setting stops and targets and leaving the space! This may be more difficult to practice than it sounds but unless you get control of your emotions you will never be a successful trader.

This is an evaluation on the basic moving average (SMA). As your stock goes up in price, there is a crucial line you wish to enjoy. They immediately abandon such a trade without awaiting a couple of hours for it to turn rewarding.

If you are searching exclusive exciting comparisons related to Ma Crossover mt4, and Foreighn Exchange Market, Channel Trading dont forget to subscribe our newsletter for free.