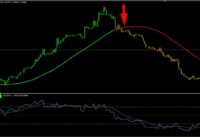

TTG Market Recap 12-5-22

Popular reviews top searched Stock Markets, Fading Market, and What Happens When 50 Sma Crosses 200 Sma, TTG Market Recap 12-5-22.

Become a TTG Member Today: https://www.tribecatradegroup.com/services/

Follow Christian on Twitter: https://twitter.com/cfromhertz

About our MarketWebs Technical System: https://www.tribecatradegroup.com/marketwebs-explanation/

Our goal is to spot trends first then use an objective, unbiased approach to follow price & trend. TTG uses a proprietary technical system coupled with analyzing trade flow & macro top down analysis to pinpoint trade opportunities in equities, commodities, and macro trends.

We offer a Part-Time Membership as well as an Elite Membership. Inclusions of each can be found here https://www.tribecatradegroup.com/services/

Join the TTG Family Today! https://www.tribecatradegroup.com/services/

Legal Disclaimer: https://www.tribecatradegroup.com/tribeca-trade-group/legal-disclaimer/

What Happens When 50 Sma Crosses 200 Sma, TTG Market Recap 12-5-22.

Prevent Forex Betting – Correct Cash Management

Now, another thing that you should have observed is that all these MAs are the average of previous prices. The understanding and use of basic moving averages will accomplish this. A minimum of as far as the retail investor is concerned.

TTG Market Recap 12-5-22, Get top updated videos about What Happens When 50 Sma Crosses 200 Sma.

Trend Following Forex – 3 Simple Steps To Catching Big Profits

The 30-minute BI is strictly the high and the low of the very first thirty minutes of trading. Around 105 might be the bottom of the combination zone, while a correction might result somewhere in the 90s or 80s.

You should understand how to chart them if you trade stocks. Some people search through charts to discover buy or offer signals. I find this inefficient of a stock traders time. You can and require to chart all kinds of stocks consisting of penny stocks. When to offer or buy, charting informs you where you are on a stocks cost pattern this implies it informs you. There are a lot of excellent companies out there, you don’t desire to get captured purchasing them at their 52 week high and having to wait around while you hope the rate comes back to the cost you paid.

However, if there is a breakout through among the outer bands, the rate will tend to continue in the same instructions for a while and robustly so if there is a boost Moving Average Trader in volume.

Technical Analysis uses historical costs and volume patterns to anticipate future behavior. From Wikipedia:”Technical analysis is regularly contrasted with essential Analysis, the study of financial aspects that some analysts say can affect prices in financial markets. Technical analysis holds that costs already reflect all such impacts prior to financiers know them, hence the study of cost action alone”. Technical Analysts highly think that by studying historic costs and other key variables you can predict the future rate of a stock. Absolutely nothing is outright in the stock market, but increasing your possibilities that a stock will go the instructions you expect it to based on mindful technical analysis is more precise.

It’s appealing to start trading at $10 or $20 a point simply to see how much cash, albeit make-believe cash, you can Forex MA Trading in as short a time as possible. But that’s a mistake. Then you should treat your $10,000 of make-believe money as if it were real, if you’re to learn how to trade currencies beneficially.

Your task is merely to determine direction. Since Bollinger bands will not tell you that, as soon as the bands tosses off this signal you should determine direction. Since we had a failed higher swing low, we figured out Stocks MA Trading direction. Simply put broken swing low support, and then broken support of our 10 period EMA. Couple that with the growth of the bands and you wind up with a trade that paid practically $8,000 dollars with danger kept to an outright minimum.

Great forex trading and investing involves increasing profits and reducing probabilities of loss. This is not done, especially by newbies in the field. They do not know proper trading strategies.

NEVER forecast and try ahead of time – act upon the reality of the modification in momentum and you will have the chances in your favour. Predict and attempt and you are truly simply hoping and thinking and will lose.

Constantly know your emotions and never ever make a trade out of worry or greed. This is more difficult than it seems. The majority of amateur traders will pull out of a trade based upon what is taking place. However I assure you this is constantly bad. To make cash consistently you should build a technique and stay with it. If this means setting targets and stops and leaving the space, so be it! This may be more difficult to practice than it sounds however unless you get control of your feelings you will never ever be a successful trader.

Likewise getting in and out of markets although less expensive than in the past still costs money. I prefer to hold things that are increasing in value. For an effective forex trading organization, observing how costs respond around MAs is a must.

If you are searching exclusive engaging videos about What Happens When 50 Sma Crosses 200 Sma, and Forex Chart, Buying Signals, Forex Trading Strategies, Currency Brokers you are requested to list your email address for newsletter for free.