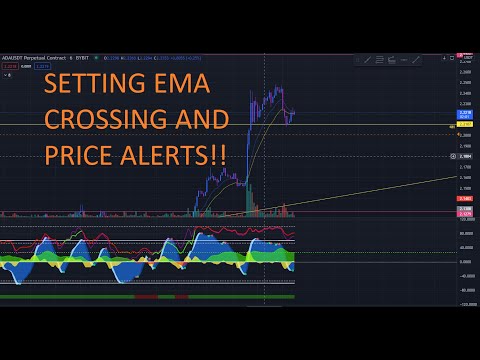

TradingView 2 EMA Alert Set up

Interesting full videos related to Pips Currency Trade, Swing Trading Basics, Trending Market, Trading Without Indicators, and How to Add Ema on Tradingview, TradingView 2 EMA Alert Set up.

** Like & Subscribe **

If you use EMA’s and you are finding it difficult to set up alerts on your price chart or the EMA’s crossing then this is the video for you!

How to Add Ema on Tradingview, TradingView 2 EMA Alert Set up.

Use These Killer Day Trading Tricks To Assist You Generate Income In The Markets

I trusted Marcus and so decided to offer it a shot by downloading it for $149. Did you get cash in the current stock bull-run began since March of 2009? Moving averages are incredibly popular indications in the forex.

TradingView 2 EMA Alert Set up, Play popular replays about How to Add Ema on Tradingview.

5 Steps To Trading Success Utilizing Technical Analysis

What were these basic experts missing? Once a trend remains in motion, we like to track stops behind the 40 day ma. An uptrend is shown by greater highs and greater lows. Due to the fact that they are lagging signs.

Would not it be good if you were just in the stock exchange when it was increasing and have everything moved to money while it is decreasing? It is called ‘market timing’ and your broker or monetary planner will tell you “it can’t be done”. What that person simply informed you is he doesn’t understand how to do it. He does not understand his job.

Every trade you open should be opened in the direction of the everyday pattern. No matter the timeframe you utilize (as long as it is less than the day-to-day timeframe), you ought to trade with the general direction of the marketplace. And fortunately is that discovering the day-to-day pattern Moving Average Trader is not difficult at all.

There are a couple of possible explanations for this. The first and most apparent is that I was simply setting the stops too close. This might have permitted the random “sound” of the cost motions to activate my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was participating in “stop searching”. I’ve written a more total article on this subject currently, but essentially this involves market players who try to press the cost to a point where they think a great deal of stop loss orders will be activated. They do this so that they can either get in the marketplace at a much better cost for themselves or to trigger a snowballing relocation in an instructions that benefits their current positions.

You need to identify the beginning of the break out that created the relocation you are going to trade versus. Many people use Assistance and resistance lines to determine these locations. I discover them to be very Forex MA Trading reliable for this function.

Taking the high, low, close and open worths of the previous day’s rate action, strategic levels can be recognized which Stocks MA Trading or might not have an influence on cost action. Pivot point trading puts focus on these levels, and uses them to assist entry and exit points for trades.

When determining a trade’s suitability, the new short positions will have protective stops positioned reasonably close to the market considering that danger should constantly be the number one factor to consider. This week’s action clearly revealed that the market has actually lacked individuals ready to develop brand-new short positions under 17.55. Markets constantly run to where the action is. The decreasing ranges integrated with this week’s reversal bar lead me to think that the next relocation is higher.

For example, two weeks ago JP Morgan Chase cut its projection for 4th quarter growth to only 1.0%, from its already reduced forecast of 2.5% just a couple of weeks earlier. The firm likewise slashed its forecast for the first quarter of next year to simply 0.5%. Goldman Sachs cut its projections dramatically, to 1% for the 3rd quarter, and 1.5% for the fourth quarter.

A way to determine the speed or significance of the relocation you are going to trade versus. This is the trickiest part of the equation. The most common method is to measure the slope of a MA against an otherwise longer term pattern.

You might also start to move money into bear ETFs. Since each of us has different personality and a particular trading technique might not fit for everybody. Let’s start with a system that has a 50% possibility of winning.

If you are searching updated and engaging comparisons related to How to Add Ema on Tradingview, and Forex Trading Software Online, Chinese Growth Stocks, Currency Trading Course, Biotech Stocks please join in email alerts service totally free.