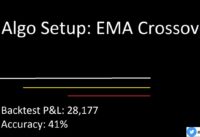

TRADING STRATEGY USING FORCE INDEX CROSSOVER AND EXPONENTIAL MOVING AVERAGE (EMA) CROSSOVER

Popular vids highly rated Sell Strategy, Trading Tool, Forex Scalping, and What Is Ema Crossover, TRADING STRATEGY USING FORCE INDEX CROSSOVER AND EXPONENTIAL MOVING AVERAGE (EMA) CROSSOVER.

keywords: trading strategy, forex trading, force index, exponential moving average, EMA, crossover, technical indicator.

What Is Ema Crossover, TRADING STRATEGY USING FORCE INDEX CROSSOVER AND EXPONENTIAL MOVING AVERAGE (EMA) CROSSOVER.

Why Utilize Technical Indications?

I discover that the BI often exposes the bias of a stock for the day. When choosing a trading system, it is essential to consider the frequency of trades. Some individuals want to make trading so tough.

TRADING STRATEGY USING FORCE INDEX CROSSOVER AND EXPONENTIAL MOVING AVERAGE (EMA) CROSSOVER, Find new high definition online streaming videos relevant with What Is Ema Crossover.

Trading Forex – Best Currencies To Trade

So which ones will react quicker to the marketplace and be more apt to give incorrect signals? Typically you will be searching for a short-term earnings of around 8-10%. Oil had its largest percentage drop in 3 years.

After the last couple of years of wide swings in the stock exchange, oil, gold, etc, a simple financial investment technique that works is at the top of lots of financiers’ desire list. Many retired people have seen 20 to 40 percent losses in their retirement funds. The perfect investment strategy would keep portfolios invested during all significant up market relocations and be on the sidelines during significant down relocations. Any method used should also avoid over trading. Too much in and out trading can be both psychologically and financially damaging. The understanding and use of easy moving averages will accomplish this.

Out of all the stock trading suggestions that I have actually been given over the ears, bone assisted me on a more practical level than these. Moving Average Trader Utilize them and utilize them well.

Another excellent way to use the sideways market is to take scalping trades. Although I’m not a huge fan of scalping there are many traders who successfully make such trades. You take a brief trade when cost approaches the resistance level and exit at the support level. Then you make a long trade at the assistance level and exit when cost approaches the resistance level.

In the middle of this horrible experience, her 12 year old daughter got home from School and found her mom in tears. “What’s incorrect Forex MA Trading?” her child asked. “Oh, this option trading will be the death of me beloved,” Sidney sobbed.

Let us say that we wish to make a brief term trade, between 1-10 days. Do a screen for Stocks MA Trading in a new up trend. Bring up the chart of the stock you are interested in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving average the stock is going to continue up and should be purchased. But as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

You will be thought about a pattern day trader no matter you have $25,000 or not if you make four or more day trades in a rolling five-trading-day duration. If your account equity falls listed below $25,000, a day trading minimum equity call will be released on your account requiring you to deposit additional funds or securities.

I have actually discussed this numerous times, but I believe it deserves mentioning once again. The most common moving average is the 200-day SMA (basic moving average). Very basically, when the marketplace is above the 200-day SMA, traders say that the market remains in an uptrend. When price is listed below the 200-day SMA, the market remains in a sag.

At the day level there are durations likewise that the rate does not mainly and periods that the cost change largely. The risky time periods are when London stock opens ad when USA stock opens. Also there are large modifications when Berlin stock opens. After each one opens, there are frequently big modifications in the prices for a male hours. The most risky time periods is the time at which two stocks are overlapped in time.

As a perk, 2 MAs can likewise function as entry and exit signals. So, when the market is ranging, the very best trading technique is variety trading. It can be a 10 day MA, 50 day MA, 100 Day MA or 200 Day MA.

If you are looking more entertaining videos related to What Is Ema Crossover, and Forex Tra, Knowing When to Buy and Sell Stocks, Trading Plan, Stock Trading please list your email address in email subscription DB totally free.