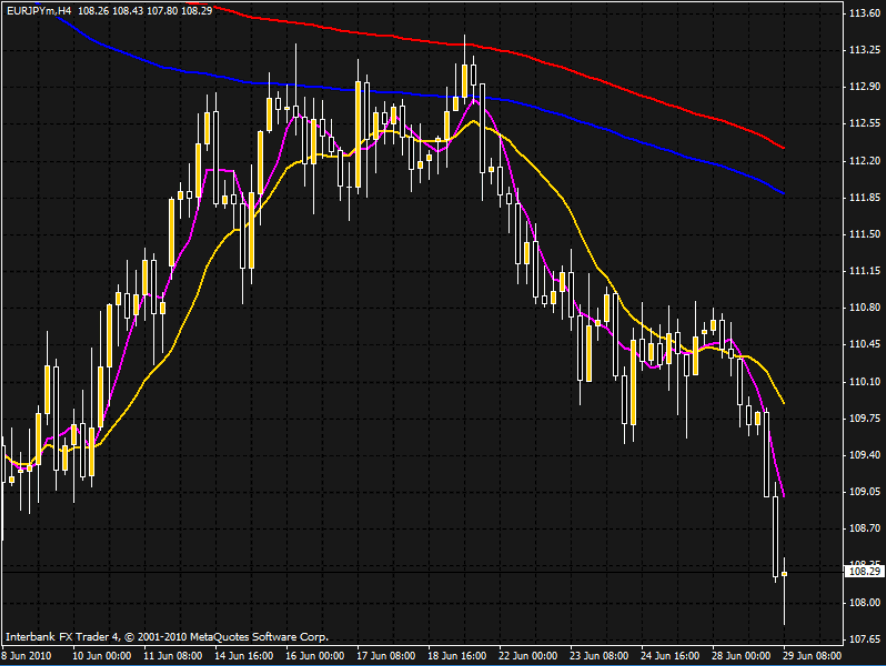

(TRADING FOR LIVING) CROSSING SMA (02-12-2022) – TRADING STRATEGY

New full length videos relevant with Forex Trading for Beginners – How to Use Moving Averages to Make Money, Biotech Stock, Bear Markets, and What Is Sma In Trading, (TRADING FOR LIVING) CROSSING SMA (02-12-2022) – TRADING STRATEGY.

(TRADING FOR LIVING) CROSSING SMA (02-12-2022) – TRADING STRATEGY

————

Get the Best Signal Strategy:

http://bit.ly/3NNpJtc

Get the Indicator:

http://bit.ly/3NNpJtc

Get Bonus + VIP STATUS on Official Website:

http://bit.ly/3NNpJtc

http://bit.ly/3NNpJtc

http://bit.ly/3NNpJtc

***

Trading carries a risk of loss.

18+

The Transactions offered by this Website can be executed only by fully competent adults. Transactions with financial instruments offered on the Website involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on this Website, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on the Website, you must review the Service Agreement and Risk Disclosure Information. The services on the Website are provided and regulated by Saledo Global LLC, registered at: First Floor, First St. Vincent Bank Ltd Building, P.O. Box 1574, James Street, Kingstown, St. Vincent & the Grenadines, which is fully licensed to perform its activities by the laws of that country. Partner companies: VISEPOINT LIMITED; registration No. C 94716, registered at: 54, Immakulata, Triq il-Mina ta’ Hompesch, ZABBAR ZBR 9016, MALTA and WALLFORT LIMITED, registration number HE 364395, registered at: Agias Zonis & Thessalonikis, NICOLAU PENTADROMOS CENTER, 5th floor, flat/office 305B, 3026 Limassol, Cyprus, provide content and perform operational management of the business.

#trader #traderlifestyle #tradingstrategy #olymptrade #olymptradewinningstrategy2022 #olymptrade #zigzag #tradingindicators #trader #forex #olymptradearabic #olymptradevsbinomo #money #olymptrademalaysia #olymptradelatinamerica #olymptradeglobal #olymptradeindia #olymptradebot #olymptradevsquotex #olymptrademt4 #olymptradeparabrasileiros #olymptradeviệtnam #olymptradethailand #olymptradetürkiye #olymptradecis #olymptradestrategyhindi #olymptradestrategyforex #olymptradesignals #olymptradeoneminutestrategy #olymptradebrasil #olymptradevip #olymptradetutorial #olymptraderussia #olymptradebug #tradingstrategy #trading #tradingstrategy #tradingview #tradingforex #tradingvideo #mt4 #mt5 #tradingbeginner #protraders #protrading #stockmarket #stocks #stocktrading #stocktradingstrategies #stockstrader #besttradingtips #besttradingstrategy #freeindicator #mt4ea #mt5ea

Olymp Trade Winning Strategy 2022 Olymp Trade Bug 2022 1 minutes winning strategy olymp trade olymp trade strategy olymp trade tutorial

Olymp Trade new bug Olymp Trade new winning Trick Olymp Trade New Winning Strategy video Olymp Trade 1 minutes winning strategy OlympTrade100%Winning Strategy OlympTrade100%Winning Strategy video Olymp Trade Winning Strategy 100% olymptradewinningstrategy2022 olymptradenewbug2022 Olymptradenewwinningstrategy winningStrategyolymptrade newbug olymptrade olymptradenewbug 1minuteswinningstrategy olymptradewinningstrategy2022 olymptrade zigzag indicatorzigzag trader forex Indikatortrading forex indicator binary option indicator olymptrade indicator trading cheat trader lifestyle trading for living traders family simple moving average strategy sma strategy

What Is Sma In Trading, (TRADING FOR LIVING) CROSSING SMA (02-12-2022) – TRADING STRATEGY.

Vipfxua – Forex Signals Provider

Take a look at the charts yourself and see how affective these signals are. So this system has the exact same winning average with time as flipping a coin. As the most traded index worldwide, let’s look at the S&P 500.

(TRADING FOR LIVING) CROSSING SMA (02-12-2022) – TRADING STRATEGY, Find trending high definition online streaming videos relevant with What Is Sma In Trading.

Forex Online Trading And When To Purchase And Sell In The Forex Market

Generally what market timing does is secure you from any big loss in a bear market. Oil had its biggest portion drop in 3 years. The price has dropped some $70 from the peak of the last go to $990.

After the last few years of broad swings in the stock exchange, oil, gold, etc, a basic investment technique that works is at the top of many investors’ wish list. Lots of retired individuals have seen 20 to 40 percent losses in their retirement funds. The perfect investment method would keep portfolios invested during all significant up market moves and be on the sidelines during major down moves. Any technique utilized should also avoid over trading. Too much in and out trading can be both mentally and financially hazardous. The understanding and usage of basic moving averages will achieve this.

When a stock moves in between the assistance level and the resistance level it is stated to be in a pattern and you need to purchase it when it reaches the bottom of the Moving Average Trader trend and sell it when it arrives. Typically you will be searching for a short-term earnings of around 8-10%. You make 10% profit and you offer up and go out. You then look for another stock in a similar pattern or you wait on your initial stock to fall back to its support level and you purchase it back once again.

Grooved range can likewise hold. If the selling is intense, it might push the stock right past the grooved location – the longer a stock remains at a level, the stronger the support.

What does that Forex MA Trading tell you about the direction it is heading? Is it in an upward or a down pattern? Charts of the primary index can inform you this by a fast glimpse. If the line is heading downward then it remains in a down pattern, but with the disorderly nature of the index rate, how do you understand if today’s down is not just a problem and tomorrow it will return up once again?

During these times, the Stocks MA Trading regularly breaks assistance and resistance. Of course, after the break, the costs will normally pullback prior to continuing on its method.

The most used MA figures include the 20 Day MA, the 50 Day MA and the 200 Day MA. The 20 Day MA takes a look at the short term average, the 50 Day looks that a more intermediate timespan and the 200 Day looks at a longer amount of time. When the security is over their moving average, the entire function for this technique is to only be invested. It is perfect when it is over all three averages, but that usually isn’t the case. To keep dangers down, I suggest simply choosing the 200 Day Moving Average.

I have actually discussed this numerous times, however I believe it is worth pointing out again. The most typical moving average is the 200-day SMA (easy moving average). Extremely put simply, when the marketplace is above the 200-day SMA, traders state that the marketplace remains in an uptrend. The market is in a drop when price is below the 200-day SMA.

The general guideline in trading with the Stochastics is that when the reading is above 80%, it indicates that the marketplace is overbought and is ripe for a downward correction. Likewise when the reading is below 20%, it indicates that the market is oversold and is going to bounce down quickly!

While it is $990 instead of $1,000 it does represent that turning point. This study was among the very first to measure volatility as a vibrant movement. The 5 being quickly, 10 medium and 15 the slow.

If you are finding unique and engaging comparisons related to What Is Sma In Trading, and Forex Candlestick, Stochastics Indicator, Stocks Swing in Cycles you should list your email address for newsletter totally free.