Trading Definitions: 50-Day Simple Moving Average (SMA)

Popular reviews relevant with Make Money in the Market, Penny Stocks, Learn About Stock Market, and How To Use Sma In Trading, Trading Definitions: 50-Day Simple Moving Average (SMA).

In this video, you’ll learn about the 50- day or 50-period simple #movingaverage (SMA) which can help you to identify and confirm intermediate trends.

—

👊Achieve #FinancialFreedom 👉 https://bit.ly/options-live

—

💥 Join the best Discord community of traders ››› https://discord.gg/pycrh4JDVw

—

🏅 Get a Free 15-Day Pro Membership today. Sign up here now: https://bit.ly/jointacklepro

—

🛑 Book a FREE 30-Minute Coaching Consultation with a Tackle Trading Coach ››› https://bit.ly/consultation-go

—

✓ Subscribe to our Channel and #learntotrade like a PRO!

How To Use Sma In Trading, Trading Definitions: 50-Day Simple Moving Average (SMA).

Forex Online Trading And When To Buy And Sell In The Forex Market

And properly has three important components. Every trade you open ought to be opened in the instructions of the day-to-day trend. The two charts listed below program SPX started the recent rally about a month prior to OIH.

Trading Definitions: 50-Day Simple Moving Average (SMA), Get most shared explained videos about How To Use Sma In Trading.

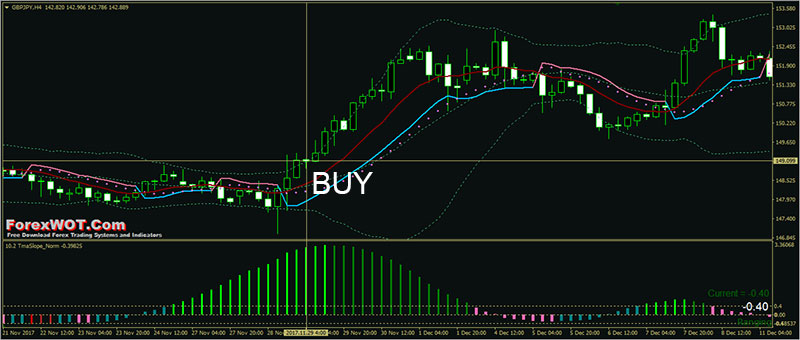

Bollinger Band Trading

Moving averages can tell you how quickly a trend is moving and in what instructions. We only want the average to help us spot the trend. Achieving success in currency trading involves a high level of discipline.

New traders typically ask the number of indications do you suggest using at one time? You don’t need to come down with analysis paralysis. You need to master only these 2 oscillators the Stochastics and the MACD (Moving Typical Merging Divergence).

This environment would suggest that the currency pair’s price is trending up or down and breaking out of its current trading variety. This usually happens when there are changes affecting the currency’s nation. A quick trending day can be seen when the cost of the currency pair rises listed below or above the 21 Exponential Moving Typical and after that going back to it. A Moving Average Trader must study the fundamentals of the nation prior to deciding how to trade next.

The 2 charts below are same period daily charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & energy stocks. The two charts below show SPX started the current rally about a month before OIH. Likewise, the charts indicate, non-energy & energy stocks tipped over the past week or so, while energy & utility stocks stayed high or increased even more.

Now when we utilize 3 MAs, the moving average with the least number of periods is identified as fast while the other two are identified as medium and slow. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being quick, 10 medium and 15 the slow.

During these times, the Stocks MA Trading regularly breaks assistance and resistance. Obviously, after the break, the rates will normally pullback before advancing its way.

You will be able to see the trend amongst traders of forex if you utilize information given by FXCM. Daily earnings and loss modifications show there is a big loss and this suggests traders do not end and profit up losing cash instead. The gain per day was just 130 pips and the greatest loss was a drop of over 170 points.

Stochastics is utilized to figure out whether the marketplace is overbought or oversold. When it reaches the resistance and it is oversold when it reaches the assistance, the market is overbought. So when you are trading a range, stochastics is the very best indication to tell you when it is overbought or oversold. It is likewise called a Momentum Sign!

To assist you determine trends you ought to also study ‘moving averages’ and ‘swing trading’. For instance 2 standard rules are ‘do not purchase a stock that is below its 200-day moving average’ and ‘do not purchase a stock if its 5-day moving average is pointing down’. If you don’t comprehend what these quotes suggest then you require to research ‘moving averages’. Best of luck with your trading.

Nasdaq has been developing a rising wedge for about two years. I would not let this prevent me going into a trade, but I would keep a close search it. This trader loses and his wins are on average, much bigger than losing.

If you are looking more exciting comparisons relevant with How To Use Sma In Trading, and Forex Chart, Forex Trading Strategy, Currency Trading Charts you are requested to subscribe in newsletter for free.