The Ultimate VWAP Day Trading Strategy – VWAP + 600 EMA + MACD

New reviews related to Forex Investors, Moving Average, and Sma Vs Ema Swing Trading, The Ultimate VWAP Day Trading Strategy – VWAP + 600 EMA + MACD.

Here is an awesome VWAP trading strategy you can use to get much better consistent trade entries in Forex, Crypto, and Stocks.

Sma Vs Ema Swing Trading, The Ultimate VWAP Day Trading Strategy – VWAP + 600 EMA + MACD.

Forex Leading Signs: Exists A Real Leading Sign?

What is proper for the trending market might not be appropriate for a variety bound or a consolidating market. Trading in the Forex market has actually ended up being simpler during the last couple of years.

The Ultimate VWAP Day Trading Strategy – VWAP + 600 EMA + MACD, Find most searched reviews related to Sma Vs Ema Swing Trading.

Forex Trading Tricks To Help The Average Forex Trader Really Make Some Money

Another forex trader does care excessive about getting a roi and experiences a loss. All over the web there are conversations about trading methods – what truly works and what doesn’t.

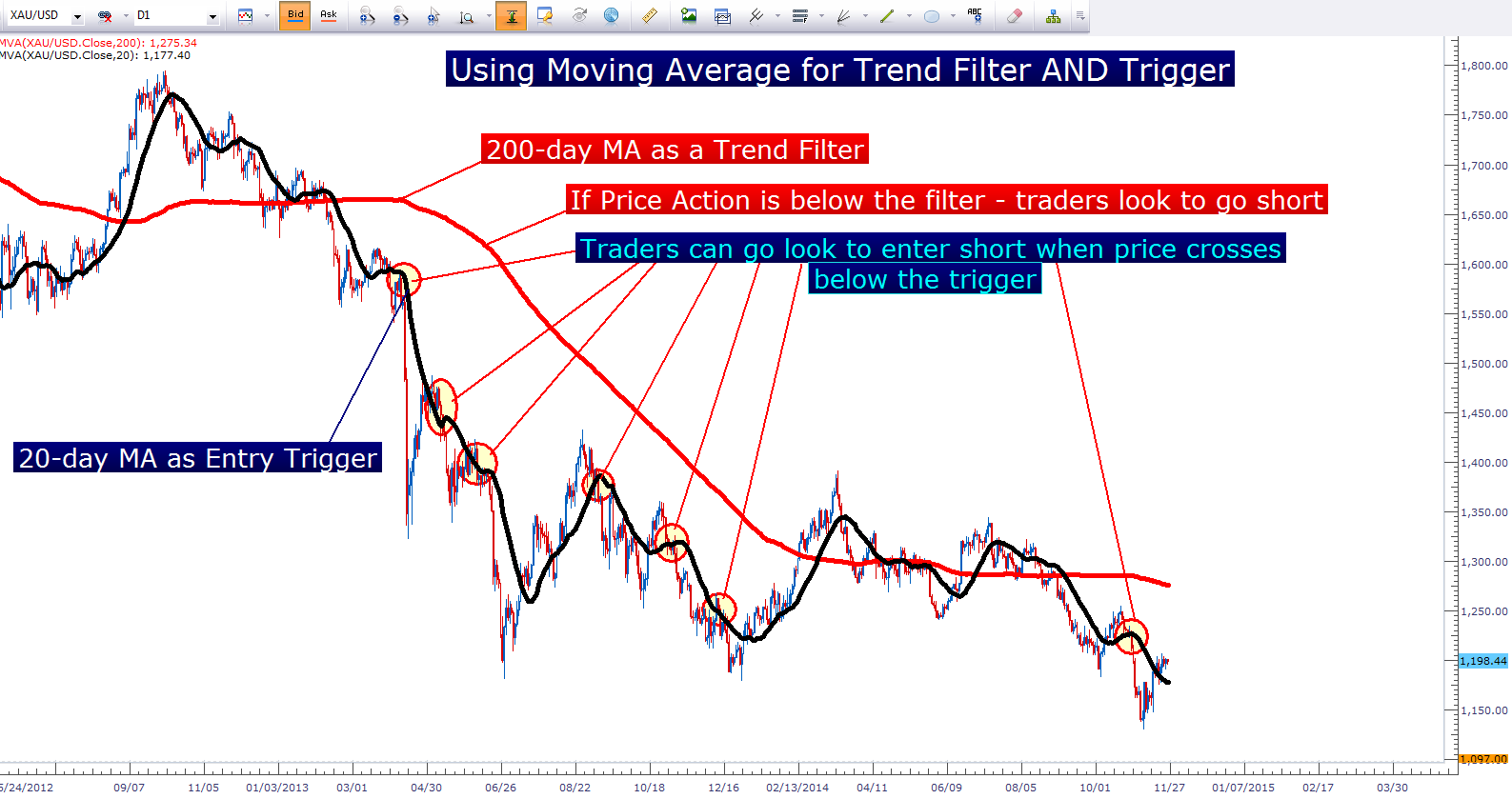

After the last couple of years of wide swings in the stock exchange, oil, gold, etc, a simple investment strategy that works is at the top of many investors’ desire list. Numerous retired individuals have seen 20 to 40 percent losses in their retirement funds. The ideal financial investment strategy would keep portfolios invested throughout all major up market moves and be on the sidelines throughout significant down relocations. Any strategy used ought to also prevent over trading. Too much in and out trading can be both psychologically and financially damaging. The understanding and usage of easy moving averages will achieve this.

Nevertheless, if there is a breakout through one of the external bands, the price will tend to continue in the same instructions for a while and robustly so if there is a boost Moving Average Trader in volume.

Technical Analysis uses historic rates and volume patterns to forecast future behavior. From Wikipedia:”Technical analysis is frequently contrasted with essential Analysis, the research study of economic elements that some experts say can affect prices in financial markets. Technical analysis holds that rates currently reflect all such impacts prior to investors understand them, for this reason the study of cost action alone”. Technical Analysts highly believe that by studying historic rates and other essential variables you can forecast the future rate of a stock. Nothing is outright in the stock market, however increasing your likelihoods that a stock will go the instructions you expect it to based on mindful technical analysis is more accurate.

There are Forex MA Trading theories on why this sell-off is happening. Certainly, any real strength or even support in the U.S. dollar will normally be bearish for precious metals like gold and silver. This is mostly due to the fact that the U.S. holds the largest stockpiles of these metals and they are sold U.S. dollars globally. Although gold is more of an acknowledged currency, they both have level of sensitivity to changes in the U.S. dollar’s worth.

A Forex trading technique requires three Stocks MA Trading fundamental bands. These bands are the time frame selected to trade over it, the technical analysis utilized to identify if there is a cost trend for the currency pair, and the entry and exit points.

A 50-day moving average line takes 10 weeks of closing cost information, and after that plots the average. The line is recalculated daily. This will show a stock’s price pattern. It can be up, down, or sideways.

Stochastics is utilized to determine whether the market is overbought or oversold. The marketplace is overbought when it reaches the resistance and it is oversold when it reaches the assistance. So when you are trading a variety, stochastics is the best indication to inform you when it is overbought or oversold. It is likewise called a Momentum Sign!

Do not simply buy and hold shares, at the exact same time active trading is not for everyone. When to be in or out of the S&P 500, utilize the 420 day SMA as a line to choose. When the market falls below the 420 day SMA, traders can likewise look to trade brief.

With each brand-new day it drops the very first price used in the previous day’s calculation. When trading Forex, one should beware since wrong expectation of price can happen.

If you are looking updated and engaging reviews about Sma Vs Ema Swing Trading, and Commitment of Traders, Disciplined Trader, Stock Tips you should join in email subscription DB now.