The BEST Moving Average Trading Strategies Explained

Trending updated videos top searched Best Forex Technical Analysis, Forex Education, and Sma Trading Strategy, The BEST Moving Average Trading Strategies Explained.

Tuesday is Tradeciety day!

Every Tuesday, we release a new podcast episode, share a new trading video on YouTube and also host a live stream.

You can find all new and previous podcast episodes here:

► https://tradeciety.com/podcast

Risk Disclaimer:

https://www.tradeciety.com/risk-disclaimer/

Any and all liability for risks resulting from investment transactions or other asset dispositions carried out by the customer based on information received or market analysis is expressly excluded by Quantum Trade Solutions GmbH. All the information made available here is generally provided to serve as an example only, without obligation and without specific recommendations for action. It does not constitute and cannot replace investment advice. We, therefore, recommend that you contact your personal financial advisor before carrying out specific transactions and investments.

In view of the high risks, you should only carry out such transactions if you understand the nature of the contracts (and contractual relationships) you are entering into and if you are able to fully assess the extent of your risk potential. Trading with futures, options, forex, CFDs, stocks, cryptocurrencies and similar financial instruments is not suitable for many people. You should carefully consider whether trading is appropriate for you based on your experience, your objectives, your financial situation and other relevant circumstances.

Information and Opinions: Information on this site is provided solely for informational or general educational purposes and should not be construed as an offer to sell or the solicitation of an offer to buy securities or to provide investment advice. The opinions and analyses included herein are based on sources believed to be reliable, but no representation or warranty, express or implied is made as to their accuracy, completeness, timeliness, or correctness. All information contained herein should be verified independently.

Results: Past performance is not necessarily indicative of future results. Investment information may not be appropriate for all investors. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

#forex #forextrading #technicalanalysis

► Risk Disclaimer:

https://www.tradeciety.com/risk-disclaimer/

#forex #forextrading #technicalanalysis

Sma Trading Strategy, The BEST Moving Average Trading Strategies Explained.

Trading Strategies Of The Professionals

It’s unclear which companies will be impacted by this decree but Goldcorp and DeBeers have mining jobs there. What does the stock action require to appear like for your technique? Likewise active trading can affect your tax rates.

The BEST Moving Average Trading Strategies Explained, Explore top complete videos related to Sma Trading Strategy.

Forex Moving Average Pointers And Strategies

A typical forex rate chart can look extremely erratic and forex candlesticks can obscure the pattern even more. Now, another thing that you need to have observed is that all these MAs are the average of previous rates.

The Bollinger Bands were developed by John Bollinger in the late 1980s. Bollinger studied moving averages and explored with a new envelope (channel) indicator. This study was among the first to measure volatility as a vibrant movement. This tool provides a relative meaning of price highs/lows in terms of upper and lower bands.

Nasdaq has rallied 310 points in three months, and hit a brand-new four-year high at 2,201 Fri Moving Average Trader early morning. The economic information suggest market pullbacks will be limited, although we have actually gone into the seasonally weak duration of Jul-Aug-Sep after a huge run-up. Consequently, there might be a consolidation duration rather than a correction over the next few months.

The reality that the BI is evaluating such an useful period suggests that it can frequently figure out the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their initial positions for the day. A relocation far from the BI shows that one side is more powerful than the other. A stock moving above the BI suggests the prevailing belief in the stock is bullish. The way in which the stock breaks above and trades above the BI will show the strength of the bullish belief. The opposite however same analysis uses when a stock moves below its BI.

There is a plethora of financial investment idea sheets and newsletters on the web. Sadly, numerous if not the majority of them are paid to promote the stocks they recommend. Instead of blindly following the recommendations of others you require to establish swing trading rules that will trigger you to enter a trade. This Forex MA Trading be the stock moving throughout a moving average; it may be a divergence between the stock rate and an indication that you are following or it may be as basic as trying to find support and resistance levels on the chart.

This means that you need to know how to manage the trade before you take an entry. In a trade management technique, you should have drawn up exactly how you will manage the trade after it is gotten in into the Stocks MA Trading so you know what to do when things turn up. Conquering trade management is extremely crucial for success in trading. This part of the system need to consist of details about how you will react to all type of conditions one you enter the trade.

You will be able to see the pattern amongst traders of forex if you use information offered by FXCM. Day-to-day earnings and loss modifications show there is a large loss and this implies traders do not end and benefit up losing cash rather. The gain daily was just 130 pips and the highest loss was a drop of over 170 points.

Stochastics indication has got 2 lines understood as %K and %D. Both these lines are plotted on the horizontal axis for a provided time duration. The vertical axis is plotted on a scale from 0% to 100%.

Five circulation days throughout March of 2000 signaled the NASDAQ top. Likewise important is the truth that lots of leading stocks were revealing top signals at the very same time. The best stock exchange operators went primarily, or all in cash at this time, and retained their amazing gains from the previous 4 or 5 years. They did this by effectively evaluating the day-to-day cost and volume action of the NASDAQ. It makes no sense at all to watch significant revenues vanish. Once you discover to recognize market tops, and take suitable action, your general trading outcomes will enhance significantly.

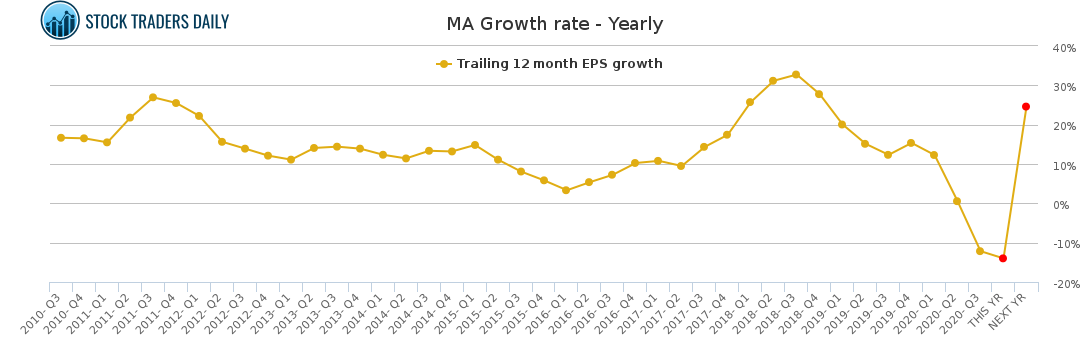

Moving averages are simply the average of previous costs. Now that I got that out of the method, its time for the technique. The most typical method is to measure the slope of a MA against an otherwise longer term trend.

If you are searching instant entertaining videos related to Sma Trading Strategy, and Learn About Stock Market, Strong Trend, Stock Market Works, Trading Channel dont forget to join for a valuable complementary news alert service totally free.