The Best ADVANCED 2-MA Crossover Forex Expert Advisor/BOT With TP & Trailing Stop & NO SL – PART 147

Interesting replays about Current Sector Trends, How to Read Stock Charts, and Ma Crossover EA, The Best ADVANCED 2-MA Crossover Forex Expert Advisor/BOT With TP & Trailing Stop & NO SL – PART 147.

#howto

#forextrading

#algotrading

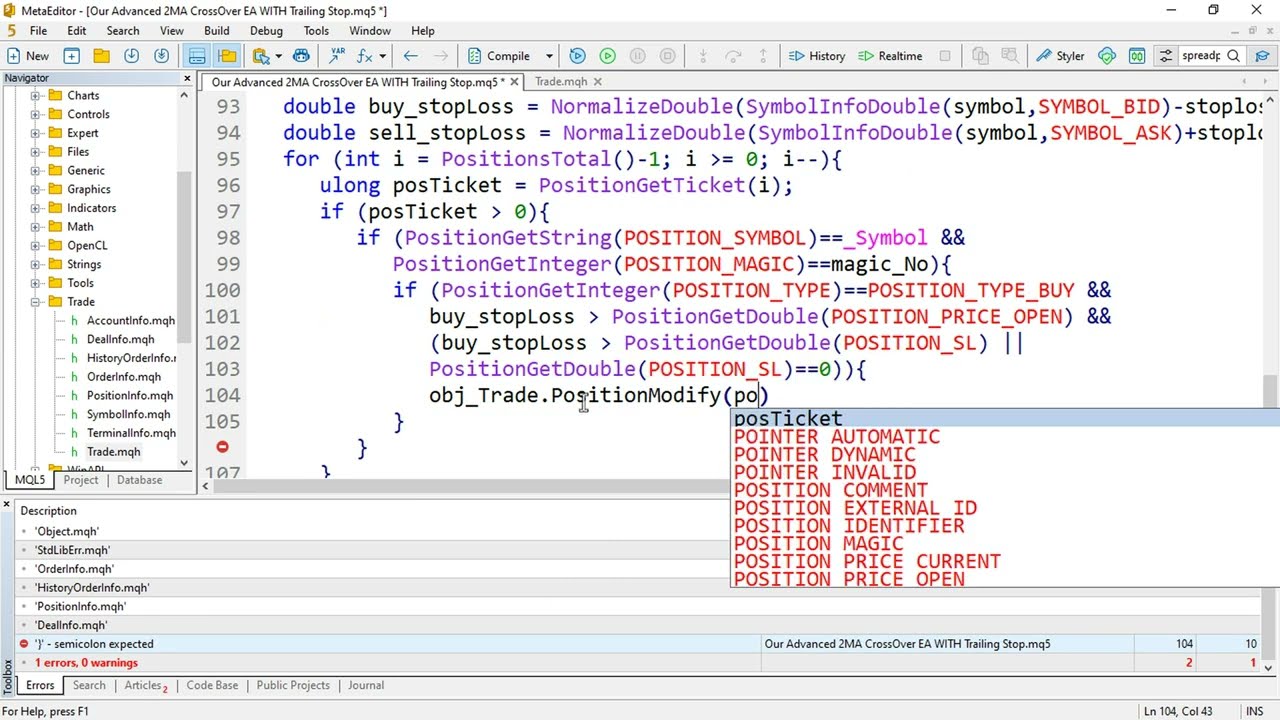

In this video, you will learn and understand how to CREATE A 2-MA CROSSOVER EXPERT ADVISOR WITH TP AND TRAILING STOP WITH NO SL IN MQL5. Thank you.

You can join our WhatsApp Group via the link below:

https://chat.whatsapp.com/CDYI6MSzS9v8tPpSTtTF36

You can join our Telegram Group via the link below:

https://t.me/forexalgo_trading

Find our MQL5 for MT5 products via the link below:

https://www.mql5.com/en/market/product/98238?source=Unknown

Follow us on TikTok via the link below:

@_forexalgo_trader

You can join our Facebook Group via the link below:

https://www.facebook.com/groups/1548218636000591/?__cft__[0]=AZVbQLPtVPdV1-X7A9GtJebruMknnpGVmCcEFzqpLWgsYyxsEQGByXPdWlYBufFottlC8ATOpqrS0rt3yKVeIgfbQm_3ZGbTF8ZQLf7VFSuDNVFh2GbSl__-38-Q-QhH8_3MTa6KMYVbzvsKRAh1yhvhUU3O3oal17GU1YO6L0xGLeVm6EjlP193ZE7I3jasaRG5xNVzHBC-8iB6c8LeTrl8&__tn__=-UK-R

#howto

#forextrading

#algorithmictrading

#algotrading

Ma Crossover EA, The Best ADVANCED 2-MA Crossover Forex Expert Advisor/BOT With TP & Trailing Stop & NO SL – PART 147.

Assistance And Resistance In Cfd Trading

In lots of instances we can, however ONLY if the volume boosts. The best way to earn money is purchasing and offering breakouts. You seek the larger cost at the end of the trade.

The Best ADVANCED 2-MA Crossover Forex Expert Advisor/BOT With TP & Trailing Stop & NO SL – PART 147, Enjoy top full length videos relevant with Ma Crossover EA.

Management Stocks And Lagging Stocks

Paul agreed to study tough and to attempt to conquer his feelings of fear and greed. Another excellent method to use the sideways market is to take scalping trades. Also active trading can affect your tax rates.

I have actually been trading futures, alternatives and equities for around 23 years. Along with trading my own money I have traded cash for banks and I have actually been a broker for private customers. Over the years I have been interested to find the distinction in between winners and losers in this company.

Every trade you open should be opened in the direction of the daily trend. No matter the timeframe you utilize (as long as it is less than the day-to-day timeframe), you should trade with the total direction of the market. And the excellent news is that finding the daily pattern Moving Average Trader is not difficult at all.

This is a great question. The response is rather fascinating though. It is simply since everybody is using it, especially those big banks and organizations. They all utilize it that method, so it works that method. Really, there are mathematic and figure theories behind it. If you are interested in it, welcome to do more research on this one. This short article is for regular readers. So I don’t wish to get too deep into this.

In the middle of this terrible experience, her 12 years of age daughter got home from School and discovered her mom in tears. “What’s wrong Forex MA Trading?” her child asked. “Oh, this option trading will be the death of me darling,” Sidney sobbed.

A Forex trading strategy needs three Stocks MA Trading basic bands. These bands are the time frame picked to trade over it, the technical analysis used to figure out if there is a price pattern for the currency pair, and the entry and exit points.

You will be thought about a pattern day trader no matter you have $25,000 or not if you make 4 or more day trades in a rolling five-trading-day period. If your account equity falls listed below $25,000, a day trading minimum equity call will be issued on your account requiring you to deposit additional funds or securities.

If the rate of my stock or ETF is up to the 20-day SMA and closes listed below it, I like to add a few Put choices– perhaps a 3rd of my position. I’ll add another third if the stock then continues down and heads towards the 50-day SMA. If the price closes listed below the 50-day SMA, I’ll include another third.

The basic guideline in trading with the Stochastics is that when the reading is above 80%, it indicates that the marketplace is overbought and is ripe for a down correction. Likewise when the reading is below 20%, it indicates that the market is oversold and is going to bounce down soon!

As the most traded index worldwide, let’s look at the S&P 500. Any method utilized must likewise avoid over trading. They right away abandon such a trade without waiting for a few hours for it to turn lucrative.

If you are searching rare and entertaining reviews relevant with Ma Crossover EA, and What Are the Best Indicators to Use, Demarker Indicator you are requested to list your email address for email alerts service for free.