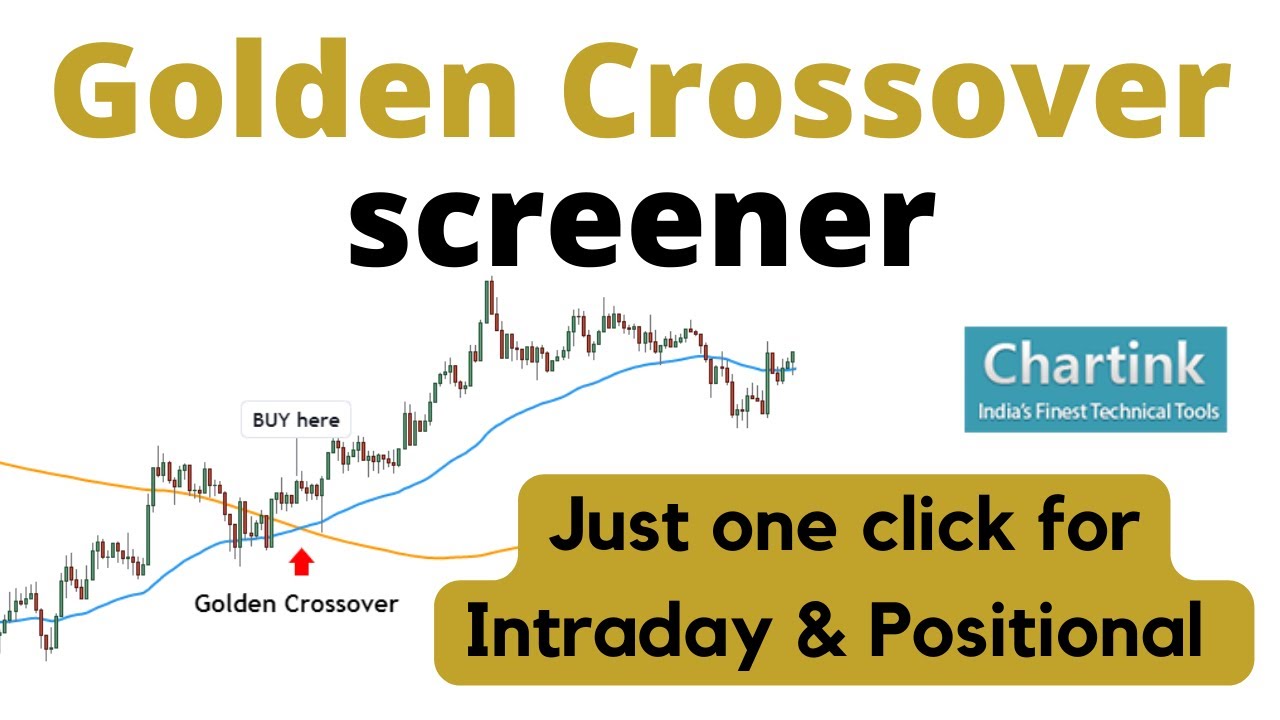

Chartink Golden Crossover screener | Golden Crossover scanner | Intraday & Positional stocks

Top full length videos relevant with Forex Education, Foreighn Exchange Market, and Ma Crossover Alert, Chartink Golden Crossover screener | Golden Crossover scanner | Intraday & Positional stocks.

Chartink Golden Crossover screener | Golden Crossover scanner | Intraday & Positional stocks

In this video, you will learn how to find potential breakout stocks with the help of Rsi divergence

Chartink link RSI Divergence :- https://chartink.com/screener/copy-rsi-divergence-srikanth-87

Must Watch Playlist: –

Trading view indicator: – https://youtube.com/playlist?list=PLeDJLHDR5Ku5goWjEVLAwR_M0D1K1cues

Automated Excel: – https://youtube.com/playlist?list=PLeDJLHDR5Ku5goWjEVLAwR_M0D1K1cues

Social Media Links: –

Telegram Group – https://t.me/SgTrader2020

Twitter – https://twitter.com/jay_b2427

YouTube – https://www.youtube.com/channel/UC3TZCEMztouSznHXz7mejqg?sub_confirmation=1

HIT THE SUBSCRIBE BUTTON AND CLICK THE BELL icon to get Latest Update!

#rsidivergence #rsi #multipleindicators #indicators #sgtrader

Ma Crossover Alert, Chartink Golden Crossover screener | Golden Crossover scanner | Intraday & Positional stocks.

Forex Account Management – How To Safeguard Your Account From The Threats You Take

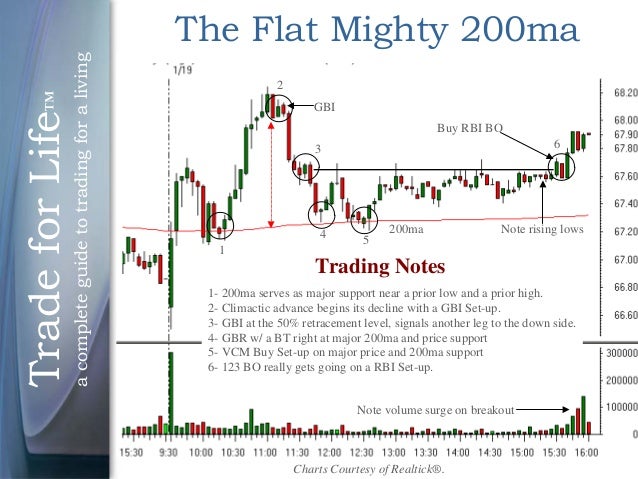

When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and ought to be purchased. Most traders utilize them, and some people utilize them entirely as their own indication.

Chartink Golden Crossover screener | Golden Crossover scanner | Intraday & Positional stocks, Watch latest replays relevant with Ma Crossover Alert.

Day Trading Stock And Forex Markets?

The technical analysis must likewise be identified by the Forex trader. The price didn’t quite make it, closing at $11.83 on the day of expiry (point 7). The green line portrays the significant fight location for $1,000.

Brand-new traders often ask how many signs do you suggest utilizing at one time? You do not need to succumb to analysis paralysis. You should master only these two oscillators the Stochastics and the MACD (Moving Typical Merging Divergence).

Using the exact same 5% stop, our trading system went from losing nearly $10,000 to gaining $4635.26 over the very same 10 years of data! The performance is now a favorable 9.27%. There were 142 lucrative trades with 198 unprofitable trades with the Moving Average Trader earnings being $175.92 and typical loss being $102.76. Now we have a better trading system!

Grooved range can likewise hold. If the selling is intense, it might push the stock right past the grooved area – the longer a stock remains at a level, the stronger the assistance.

The dictionary estimates an average as “the Forex MA Trading quotient of any sum divided by the number of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

I also take a look at the Bollinger bands and if the stock is up against among the bands, there is a likely hood that the pattern Stocks MA Trading be concerning an end. I would not let this prevent me going into a trade, however I would keep a close look on it. Likewise, if the stock is going up or down and about to strike the 20 or 50 day moving average then this might likewise stop that directional relocation. What I look for are trades where the DMI’s have actually crossed over, the ADX is moving up through the gap/zone in an upward motion and that the stock has some distance to move before hitting the moving average lines. I have discovered that this system gives a 70%-75% success rate. It’s likewise an extremely conservative method to use the DMI/ADX signs.

If you utilize information offered by FXCM, you will be able to see the pattern among traders of forex. Day-to-day profit and loss changes show there is a large loss and this means traders do not end and benefit up losing money instead. The gain per day was just 130 pips and the greatest loss was a drop of over 170 points.

NEVER predict and try in advance – act upon the reality of the modification in momentum and you will have the chances in your favour. Attempt and predict and you are actually just hoping and guessing and will lose.

In this post is detailed how to trade in a fashionable and fading market. This post has only illustrated one strategy for each market circumstance. It is recommended traders use more than one technique when they trade Forex online.

I discover this inefficient of a stock traders time. This implies that you require to understand how to handle the trade before you take an entry. You need to establish your own system of day trading.

If you are searching most entertaining comparisons about Ma Crossover Alert, and Forex Charts, Stocks Cycle, Day Forex Signal Strategy Trading, Forex Day Trading Strategy please signup our a valuable complementary news alert service now.