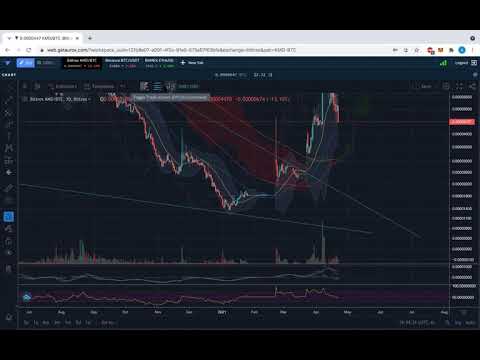

Technical Analysis – KMD/BTC long term structure & daily cross 100 & 200 moving average 04/22/21

Best high defination online streaming top searched Investment Strategy, Trading Tips, Bollinger Band Trading, and What Happens When 50 Sma Crosses 200 Sma, Technical Analysis – KMD/BTC long term structure & daily cross 100 & 200 moving average 04/22/21.

This video is about KMD chart structure, long term, and the recent bullish cross of 100-day & 200-day moving averages. I said 50 cross with 200 instead of 100… what a thing to say at the wrong time. (error correction)

NONE OF THIS IS FINANCIAL ADVICE

Use this referral link to sign up with Aurox:

https://aurox.app/5211

What Happens When 50 Sma Crosses 200 Sma, Technical Analysis – KMD/BTC long term structure & daily cross 100 & 200 moving average 04/22/21.

Journey, Illusions And Discoveries As A Forex Trader

He understood it would not be simple, however he was going to do whatever it required to prosper as a trader. You can and need to chart all types of stocks consisting of cent stocks. Make sure you turn into one of that minority.

Technical Analysis – KMD/BTC long term structure & daily cross 100 & 200 moving average 04/22/21, Explore interesting explained videos about What Happens When 50 Sma Crosses 200 Sma.

Forex Account Management – How To Secure Your Account From The Risks You Take

Currently, SPX is oversold enough to bounce into the Labor Day holiday. Nasdaq has actually rallied 310 points in 3 months, and struck a new four-year high at 2,201 Fri morning. Likewise active trading can impact your tax rates.

A ‘moving’ average (MA) is the average closing price of a particular stock (or index) over the last ‘X’ days. For instance, if a stock closed at $21 on Tuesday, at $25 on Wednesday, and at $28 on Thursday, its 3-day MA would be $24.66 (the sum of $21, $25, and $28, divided by 3 days).

The best method to make money is purchasing and selling Moving Average Trader breakouts., if you incorporate them in your forex trading technique you can utilize them to pile up big gains..

Likewise getting in and out of markets although more affordable than in the past still costs money. Not simply commission however the spread (distinction in between trading price). Also active trading can impact your tax rates.

The near-term signs on the market have actually damaged on the Dow Jones. The DJIA remained in a bullish pattern however it fell listed below its 20-day average of 11,156. If the average can not hold, this indicates that the market might fall. In addition, the Relative Strength is showing a loss while the Forex MA Trading is at a moderate sell.

Can we purchase prior to the share rate reaches the breakout point? In numerous circumstances we can, however ONLY if the volume boosts. Often you will have a high opening rate, followed by a fast retracement. This will often be followed by a fast upsurge with high volume. This can be a buy signal, but when again, we must Stocks MA Trading sure that the volume is strong.

As bad as things can feel in the rare-earth elements markets these days, the fact that they can’t get excessive even worse needs to console some. Gold specifically and silver are looking great technically with gold bouncing around strong support after its second run at the venerable $1,000. Palladium looks to be holding while platinum is anyone’s guess at this point.

Once the buzz settles down and the CME finishes its margin boost on Monday, we must see silver rates support. From my point of view, I see $33 as a level I may carefully start to purchase. I believe assistance will be around $29 up until the Fed decides it’s time to cool inflation if silver breaks below that level.

Now, this thesis is to assist individual traders with criteria that have actually proven to be quite efficient. Most skilled traders would choose not to thicken up their charts, with a lot of indicators. While some may not mind, up until now as what they see on their charts, is clear to them. Now this would depend upon what works best for you so as not to get confused.

Those are the moving averages of that specific security. With each brand-new day it drops the very first cost used in the previous day’s calculation. Others are more aggressive and switch between long and short rather frequently.

If you are finding best ever engaging reviews about What Happens When 50 Sma Crosses 200 Sma, and Foreign Currency Trading, Exit Strategy, Global Market Divergences, Trading Part Time please list your email address our email list totally free.