Technical Analysis Course – Module 6: Moving Averages

Latest un-edited videos relevant with Forex for Beginners – a Simple 1-2-3 Step Strategy for Making Money, Forex Moving Averages, Pivot Point Trading, and 50 Day Ema Trading Rule, Technical Analysis Course – Module 6: Moving Averages.

Moving Averages http://www.financial-spread-betting.com/course/simple-moving-average.html Let’s first talk about the types of moving averages. First off we have the simple moving average, this is the basic moving average. An average is simply is just a group of numbers added to one another and then divided by the total there are.

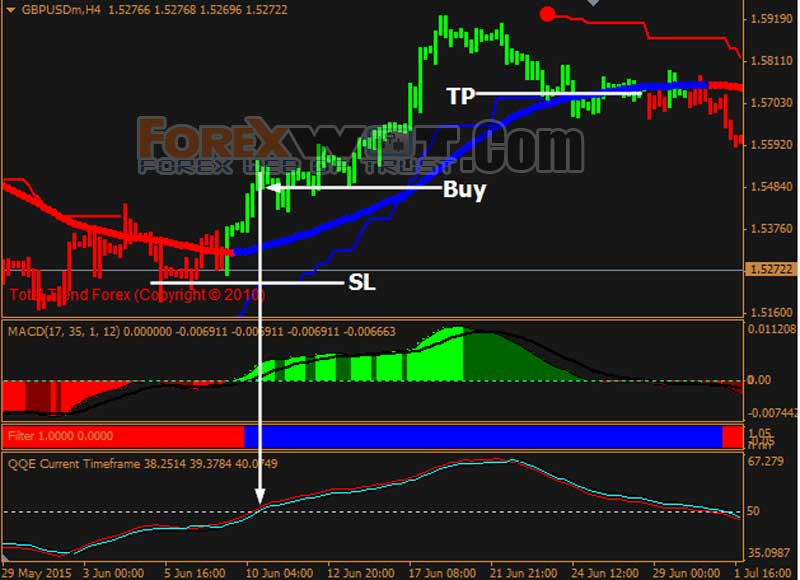

There are different types of moving average, and each type can be constructed as a whole set with different periods. Some types of moving average are better in certain tasks than others, and you are free to experiment and find the type and values which work best for your trading.

50 Day Ema Trading Rule, Technical Analysis Course – Module 6: Moving Averages.

Forex Trading Guide – The Importance Of Your Own Forex Trading System

Very first appearance at the last couple of days, then the last few weeks, months and after that year.

The most typical method is to measure the slope of a MA versus an otherwise longer term trend.

Technical Analysis Course – Module 6: Moving Averages, Enjoy new reviews relevant with 50 Day Ema Trading Rule.

Do You Trade Es Emini Market Sound Or The Trend

What were these fundamental experts missing? As soon as a pattern is in motion, we like to track stops behind the 40 day ma. An uptrend is shown by higher highs and greater lows. Because they are lagging indicators.

Would not it be good if you were only in the stock market when it was increasing and have whatever transferred to money while it is decreasing? It is called ‘market timing’ and your broker or monetary planner will inform you “it can’t be done”. What that individual simply informed you is he does not know how to do it. He doesn’t understand his task.

If that ratio gets extremely high, like 100, that suggests that silver is low-cost relative to gold and may be a good value. Silver might be getting overly Moving Average Trader costly if the number is low.

Grooved variety can also hold. If the selling is intense, it may push the stock right past the grooved area – the longer a stock stays at a level, the more powerful the support.

What does that Forex MA Trading tell you about the direction it is heading? Is it in an upward or a down pattern? Charts of the primary index can tell you this by a quick look. If the line is heading downward then it remains in a downward trend, however with the disorderly nature of the index rate, how do you understand if today’s down is not simply a problem and tomorrow it will return up again?

The founders of technical analysis regarded it as a tool for an elite minority in a world in which basic analysis reined supreme. They concerned themselves as smart Stocks MA Trading predators who would hide in the weeds and knock off the huge video game fundamentalists as they came thundering by with their high powered technical rifles.

Here is a perfect example of a method that is easy, yet clever sufficient to assure you some included wealth. Start by selecting a specific trade that you believe is lucrative, say EUR/USD or GBP/USD. When done, select two signs: weighted MA and easy MA. It is recommended that you use a 20 point weighted moving average and a 30 point moving average on your 1 hour chart. The next action is to watch out for the signal to offer.

As you can see, specifying the BI is easy. The 30-minute BI is strictly the high and the low of the very first thirty minutes of trading. I find that the BI frequently exposes the predisposition of a stock for the day.

At the day level there are durations likewise that the cost doesn’t mainly and durations that the price change mainly. The dangerous time durations are when London stock opens advertisement when U.S.A. stock opens. Also there are big changes when Berlin stock opens. After each one opens, there are frequently big changes in the costs for a man hours. The most dangerous time periods is the time at which 2 stocks are overlapped in time.

This is an evaluation on the basic moving average (SMA). As your stock moves up in price, there is an essential line you wish to view. They instantly desert such a trade without waiting on a couple of hours for it to turn successful.

If you are looking most entertaining comparisons about 50 Day Ema Trading Rule, and Stock Trading Tip, Forex Profits, Forex Online please list your email address in newsletter for free.