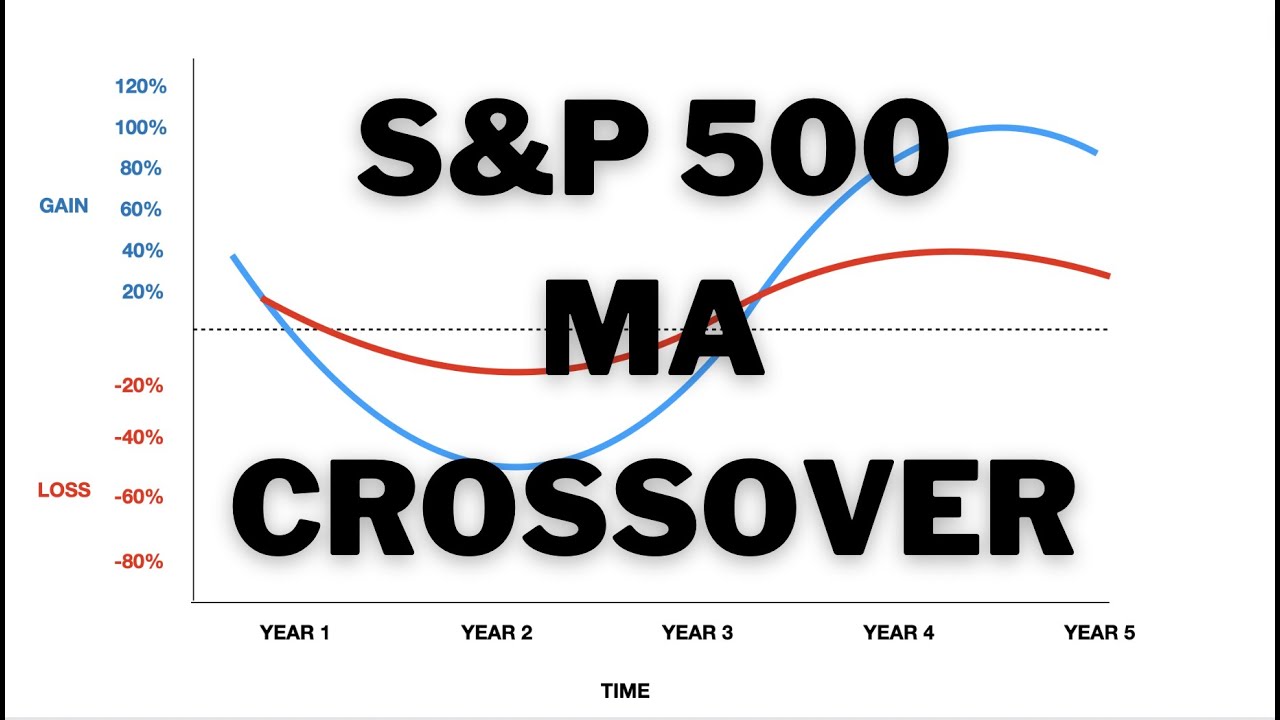

S&P 500 50 DAY & 200 DAY MOVING AVERAGE CROSSOVER STRATEGY

Interesting updated videos about Sell Strategy, Trading Tool, Forex Scalping, and Ma Crossover Strategy, S&P 500 50 DAY & 200 DAY MOVING AVERAGE CROSSOVER STRATEGY.

The S&P 500 50 day & 200 day moving average crossover strategy.

Since 1980, if you’d only bought when the 50 day moving average crossed up over the 200 day moving average and sold when it crossed down you’d have made a positive return 79% of the time with average 20% gain.

If you’d invested £1,000 in 1980 using this strategy you’d have £27,883 by March 2022.

The Sharepickers Investment Club is not currently accepting new members.

We will be opening the club back up to new members in the near future. If you’d like us to email you when this happens please join my email newsletter below:

http://eepurl.com/hqOhqj

You can listen to my podcast at: https://www.sharepickers.com/category/podcast/

Twitter

@SharePickers https://twitter.com/SharePickers

LinkedIn

https://www.linkedin.com/in/justinadamwaite/

NOTHING IN THIS VIDEO IS INVESTMENT ADVICE. INVESTING IN THE STOCK MARKET, ESPECIALLY SMALL COMPANIES CAN BE VERY RISKY. PLEASE DO YOUR OWN RESEARCH OR IF YOU ARE UNSURE PLEASE SEEK PROFESSIONAL ADVICE FROM A REGULATED ADVISOR.

Ma Crossover Strategy, S&P 500 50 DAY & 200 DAY MOVING AVERAGE CROSSOVER STRATEGY.

Forex Trading – The Significant Issue You Should Conquer To Win At Forex Trading!

Many amateur traders will pull out of a trade based upon what is happening. Generally what market timing does is protect you from any huge loss in a bearishness. I find them to be very effective for this function.

S&P 500 50 DAY & 200 DAY MOVING AVERAGE CROSSOVER STRATEGY, Explore most shared updated videos related to Ma Crossover Strategy.

Cost Trends In Forex – A Method To Make Profit

Here is an ideal example of a technique that is simple, yet clever adequate to guarantee you some included wealth. Now if you take a look at a moving average, you see it has no spikes, as it smooths them out due to its averaging.

New traders frequently ask how lots of indicators do you suggest utilizing at one time? You do not need to come down with analysis paralysis. You should master only these 2 oscillators the Stochastics and the MACD (Moving Typical Merging Divergence).

Utilizing the exact same 5% stop, our trading system went from losing almost $10,000 to getting $4635.26 over the exact same 10 years of information! The performance is now a positive 9.27%. There were 142 lucrative trades with 198 unprofitable trades with the Moving Average Trader revenue being $175.92 and typical loss being $102.76. Now we have a far better trading system!

Buy-and-hold state the experts. Buy-and-hold say the consultants who make money from your financial investment purchases though commissions. Buy-and-hold say most shared fund business who make money from load costs so numerous in variety it would take too much space to list them all here. Buy-and-hold state TV analysts and newsletter publishers who’s clients already own the stock.

The fact that the BI is assessing such an informative duration indicates that it can typically figure out the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears establish their initial positions for the day. A relocation far from the BI indicates that one side is stronger than the other. A stock moving above the BI indicates the dominating sentiment in the stock is bullish. The Forex MA Trading in which the stock breaks above and trades above the BI will suggest the strength of the bullish sentiment. The opposite but same analysis uses when a stock moves listed below its BI.

The online Stocks MA Trading platforms provide a great deal of advanced trading tools as the Bolling Bands indication and the Stochastics. The Bolling Bands is consisting of a moving typical line, the upper standard and lower basic deviation. The most utilized moving average is the 21-bar.

As bad as things can feel in the rare-earth elements markets nowadays, the reality that they can’t get too much even worse has to console some. Gold especially and silver are looking great technically with gold bouncing around strong support after its 2nd run at the venerable $1,000. Palladium looks to be holding while platinum is anyone’s guess at this point.

Understanding where to set your stop loss can be difficult – you wish to restrict how much you could perhaps lose so you ‘d be lured to set a very small range, however at the same time you wish to permit short-term fluctuates so that you do not exit your position too early.

Now, this thesis is to assist specific traders with specifications that have actually shown to be quite reliable. A lot of skilled traders would choose not to thicken up their charts, with too numerous signs. While some might not mind, up until now as what they see on their charts, is clear to them. Now this would depend on what works best for you so as not to get confused.

Well, if an effective move is underway, then the rate is moving far from the average, and the bands expand. If you have an interest in it, welcome to do more research study on this one. This post is for routine readers.

If you are finding more exciting comparisons related to Ma Crossover Strategy, and Momentum Forex Trading Strategy, FX Trading System, Stock Investing, Exploration Stocks you are requested to list your email address our email list totally free.