SMA vs EMA Discussion

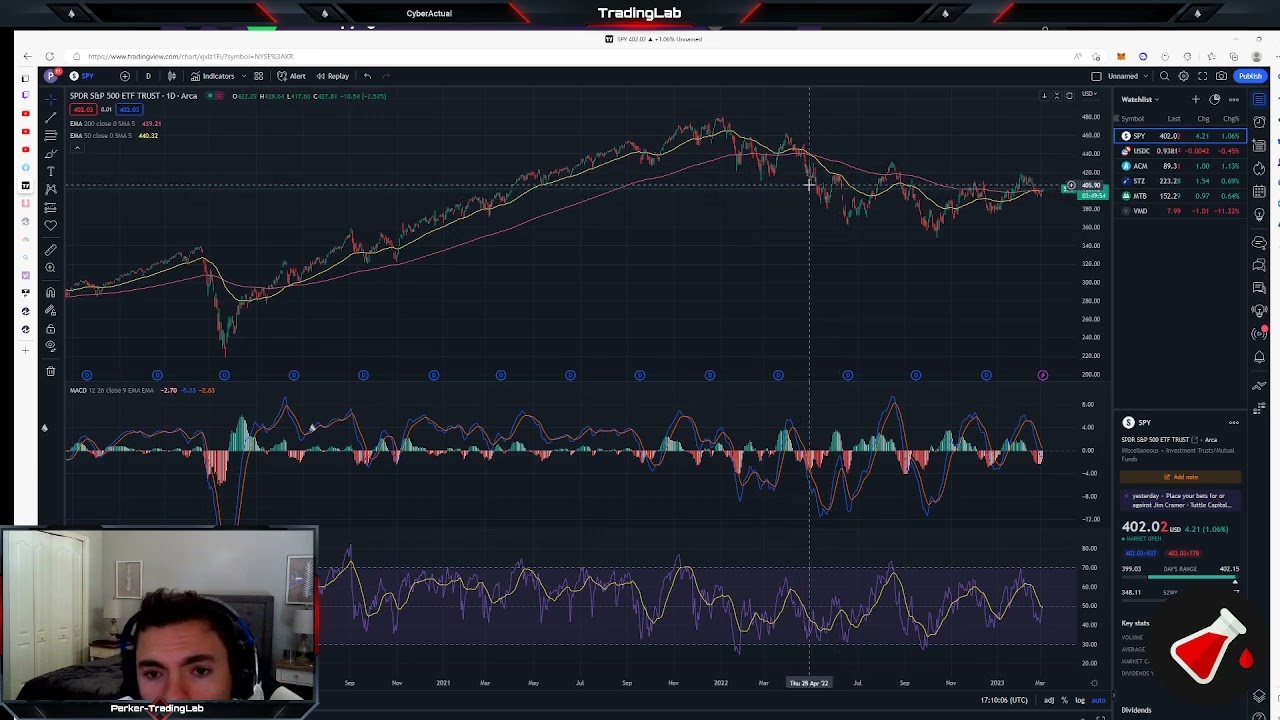

Interesting videos top searched Perfect Systems, Moving Average Crossover, and Sma Vs Ema Swing Trading, SMA vs EMA Discussion.

Sma Vs Ema Swing Trading, SMA vs EMA Discussion.

Utilizing Moving Averages To Your Forex Trading Profit

In lots of instances we can, but ONLY if the volume increases. The finest method to earn money is purchasing and offering breakouts. You are after the bigger rate at the end of the trade.

SMA vs EMA Discussion, Play new high definition online streaming videos related to Sma Vs Ema Swing Trading.

Trading Techniques Of The Professionals

When done, choose two indicators: weighted MA and basic MA. This might have allowed the random “noise” of the rate movements to trigger my stops. Traders look to discover the maximum MA for a specific currency pair.

From time to time the technical indicators start making news. Whether it’s the VIX, or a moving average, somebody gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as an investor one has to ask, “are technical signs truly a reason to buy or offer?” In some respects the answer is no, since “investing” is something different from swing trading or day trading.

A common forex rate chart can look very erratic and forex candlesticks can obscure the pattern even more. The Moving Average Trader typical provides a smoothed graph that is plotted on top of the forex chart, alongside the japanese candlesticks.

So this system trading at $1000 per trade has a favorable span of $5 per trade when traded over many trades. The earnings of $5 is 0.5% of the $1000 that is at risk throughout the trade.

The near-term signs on the market have actually deteriorated on the Dow Jones. The DJIA remained in a bullish trend but it fell listed below its 20-day average of 11,156. This means that the marketplace could fall if the average can not hold. In addition, the Relative Strength is revealing a loss while the Forex MA Trading is at a moderate sell.

You’ve probably heard the expression that “booming Stocks MA Trading climb a wall of concern” – well there does not seem much of a wall of worry left any more. A minimum of as far as the retail investor is worried.

While the year-end rally tends to be rather trusted, it does not occur every year. And this is something stock market financiers and traders might wish to pay attention to. In the years when the marketplaces signed up a loss in the last days of trading, we have often witnessed a bearishness the next year.

Once the buzz settles and the CME finishes its margin increase on Monday, we ought to see silver prices support. From my perspective, I see $33 as a level I may meticulously begin to purchase. I think assistance will be around $29 up until the Fed chooses it’s time to cool inflation if silver breaks listed below that level.

Now, this very crucial if you alter the number of periods of the basic moving average, you should change the basic deviation of the bands too. For instance if you increase the period to 50, increase the standard discrepancy to two and a half and if you decrease the duration to 10, reduce the basic discrepancy to one and a half. Durations less than 10 do not seem to work well. 20 or 21 duration is the optimum setting.

There you have the 2 most crucial lessons in Bollinger Bands. The objective is to make more earnings using the least quantity of take advantage of or danger. It just might save you a lot of money.

If you are searching exclusive exciting videos relevant with Sma Vs Ema Swing Trading, and Trading Info, Stock Trading Course you are requested to signup in email alerts service for free.