Simple Moving Average (SMA) Trading Indicator | How to Trade Simple Moving Average Crossovers

Best guide related to Stock Trading Tips, Most Advanced Live Trading Forex Robot Capable of Doubling Your Money, Complex Indicators, Swing Trading for Beginners, and What Is Sma In Trading, Simple Moving Average (SMA) Trading Indicator | How to Trade Simple Moving Average Crossovers.

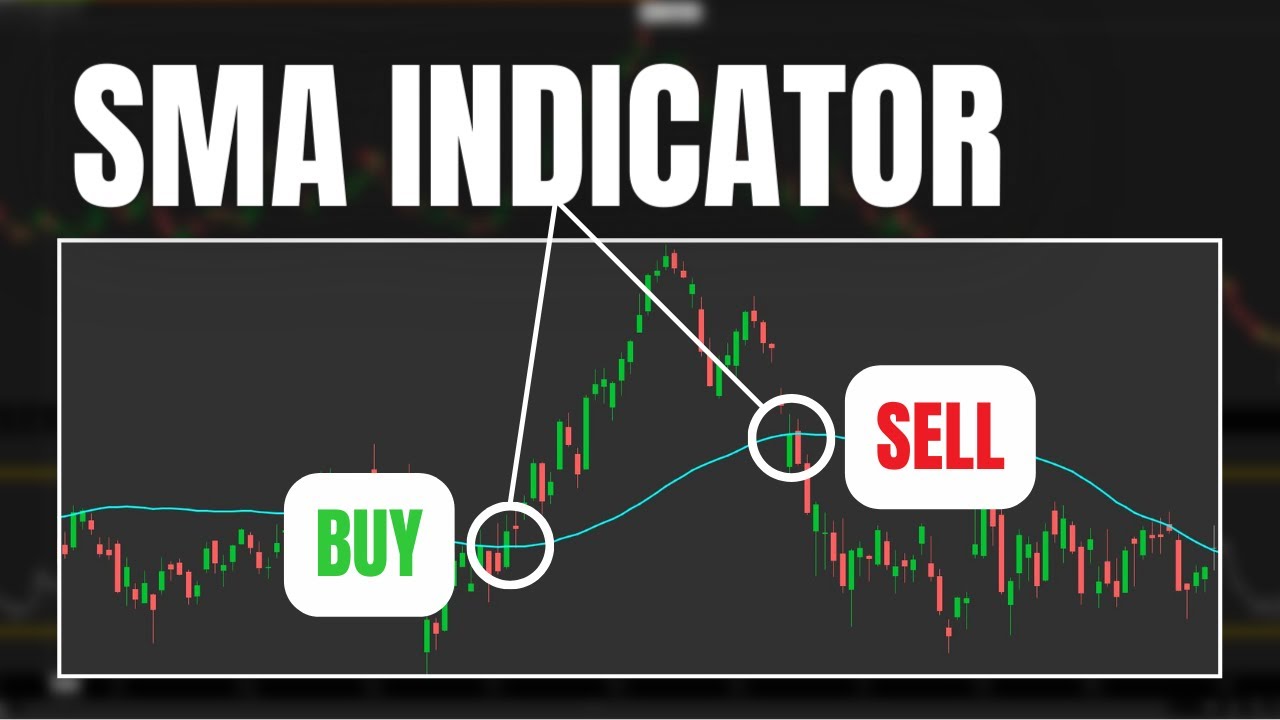

The Simple Moving Average, or SMA, is a popular technical indicator that can be used to find potential trend reversals.

Throughout this video we’ll go over how the Simple Moving Average (SMA) is calculated, how it in can be used to find buy and sell signals, and how to create custom scans to find those stocks that meet our criteria. There are several different methods traders use to find potential buy or sell opportunities. This includes both SMA price crossovers and moving average crossovers.

The most popular of the two crossovers being the death cross or the golden cross. The death cross is seen when the 50 day simple moving average crosses below the 200 day simple moving average. The golden cross being when the 50 day simple moving average crosses above the 200 day simple moving average.

Like all indicators, the Simple Moving Average (SMA) lines are not perfect. However, they may give be able to give you some insight as to the overall trend in stock and be made aware of potential trend reversals.

Timestamps

0:00 Intro

0:28 SMA Calculation

1:32 Adding SMA to Charts

3:12 Trading Using SMA

6:19 Scanner Intro

6:50 SMA Price Crossover Scan

10:30 Golden Cross / Death Cross Scan

13:24 Outro

➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J

➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm

Disclaimer: Some of these links go to one of my websites and some are affiliate links where I’ll earn a small commission if you make a purchase at no additional cost to you.

What Is Sma In Trading, Simple Moving Average (SMA) Trading Indicator | How to Trade Simple Moving Average Crossovers.

Improving Your Outcomes In The Stock Market

In a stock day-to-day cost chart, if 50SMA moves up and crosses 200SMA, then the trend is up. You would have purchased in June 2003 and stayed with the up move until January 2008. A drop is shown by lower highs and lower lows.

Simple Moving Average (SMA) Trading Indicator | How to Trade Simple Moving Average Crossovers, Search most shared explained videos relevant with What Is Sma In Trading.

Support And Resistance In Cfd Trading

Rapid MAs weigh more recent prices heavier. A 50-day moving typical line takes 10 weeks of closing rate information, and after that plots the average. This trader loses and his wins are on average, much larger than losing.

I have been trading futures, alternatives and equities for around 23 years. Along with trading my own money I have traded cash for banks and I have actually been a broker for private clients. For many years I have actually been amazed to discover the difference between winners and losers in this service.

But if you have a couple of bad trades, it can truly sour you on the whole trading video game Moving Average Trader .When you simply have to step back and take a look at it, this is. Possibly, you simply require to escape for a day or 2. Unwind, do something different. Your unconscious mind will deal with the issue and when you return, you will have a much better outlook and can find the trading opportunities quicker than they can come at you.

Accomplishing success in currency trading includes a high level of discipline. It can not be treated as a side service. It not only needs knowledge about the patterns but likewise about the direction the trends will move. There are lots of software offered to understand the pattern and follow a system however in truth to achieve success in currency trading a trader ought to build their own system for trading and above all to follow it consistently.

While there is no chance to forecast what will happen, it does suggest that you ought to be prepared in your investments to act if the Forex MA Trading begins to head south.

The founders of technical analysis regarded it as a tool for an elite minority in a world in which essential analysis reined supreme. They regarded themselves as savvy Stocks MA Trading predators who would conceal in the weeds and knock off the huge video game fundamentalists as they came roaring by with their high powered technical rifles.

While the year-end rally tends to be quite trusted, it doesn’t occur every year. And this is something stock exchange investors and traders may desire to take note of. In the years when the markets registered a loss in the last days of trading, we have actually often experienced a bear market the next year.

As you can see, defining the BI is easy. The 30-minute BI is strictly the high and the low of the first 30 minutes of trading. I discover that the BI often exposes the predisposition of a stock for the day.

Five distribution days throughout March of 2000 signaled the NASDAQ top. Also essential is the fact that lots of leading stocks were showing top signals at the exact same time. The extremely best stock exchange operators went primarily, or all in money at this time, and kept their incredible gains from the previous 4 or 5 years. They did this by properly analyzing the day-to-day cost and volume action of the NASDAQ. It makes no sense at all to watch major earnings vanish. Once you learn to acknowledge market tops, and take proper action, your overall trading results will improve dramatically.

But as quickly as the 9 day crosses over the 4 day it is a sell signal. To help you identify trends you need to also study ‘moving averages’ and ‘swing trading’. At least as far as the retail financier is worried.

If you are looking most engaging reviews relevant with What Is Sma In Trading, and Option Trading, Swing Trading, Stock Trading, Momentum Forex Strategy dont forget to join for email list for free.