Simple moving average crossover day trading strategy. // Intraday Stocks indicator RSI MACD options

Top videos top searched How to Read Stock Charts, Spread Trading, and What Is Ema Crossover Indicator, Simple moving average crossover day trading strategy. // Intraday Stocks indicator RSI MACD options.

Simple moving average crossover day trading strategy. / Intraday stocks indicator method best moving averages tutorial alert cross explained RSI MACD make money options

Want more help from David Moadel? Contact me at davidmoadel @ gmail . com

Subscribe to my YouTube channel: https://www.youtube.com/channel/UCUoWjpemcumDyh95Z9KPEdA?sub_confirmation=1

Plenty of stock / options / finance education videos here: https://davidmoadel.blogspot.com/

Disclaimer: I am not licensed or registered to provide financial or investment advice. My videos, presentations, and writing are only for entertainment purposes, and are not intended as investment advice. I cannot guarantee the accuracy of any information provided.

hedge fund investing, financial advisor, financial adviser, day trading, day trader, day trading strategies, day trading for beginners, day trading stocks, day trading penny stocks, day tading live, day trading setup, day trading academy, day trading options, day trading for dummies, day trading for a living, day trading basics, day trading 101, how to day trade, how to day trade for beginners, how to day trade stocks, how to day trade penny stocks, how to day trade options, how to day trade for beginners, day trader interview, options trading for beginners stock market for beginners stocks for beginners stock investing stock market investing options trading strategies stock trading strategies stock investing penny stocks penny stock trading nasdaq apple twitter education rsi bollinger bands $SPY $QQQ $AAPL $TWTR SPY QQQ AAPL TWTR forex david moadel trading traders investing investors stock charts, volatility investing, retail sector trading, stock market experts, stock market interview, Stock market volatility lessons for better trading, UVXY VXX TVIX trading options 101, vix trading, vix index, vix volatility, uvxy trading, uvxy stock, uvxy options, uvxy explained, uvxy technical analysis, market volatility, stock market volatility, stock volatility, vix trading strategies, trading vix options, trading vix futures, trading the vix, tvix stock, tvix explained, vxx trading, vxx stock, vxx etf, vxx options, vxx explained, xiv stock, options volatility, options volatility trading, options implied volatility, market volatility explained, shorting the vix

What Is Ema Crossover Indicator, Simple moving average crossover day trading strategy. // Intraday Stocks indicator RSI MACD options.

Cost Trends In Forex – A Way To Make Profit

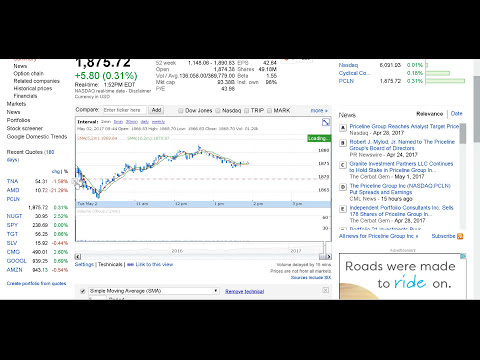

Chart: A chart is a chart of cost over a period of time. Now, this thesis is to help individual traders with parameters that have shown to be quite effective. A duration of 5 in addition to 13 EMA is normally utilized.

Simple moving average crossover day trading strategy. // Intraday Stocks indicator RSI MACD options, Get most shared updated videos about What Is Ema Crossover Indicator.

Journey, Impressions And Discoveries As A Forex Trader

What were these essential experts missing out on? As soon as a trend remains in motion, we like to track stops behind the 40 day ma. An uptrend is shown by greater highs and higher lows. Since they are lagging indications.

In less than four years, the cost of oil has increased about 300%, or over $50 a barrel. The Light Crude Continuous Contract (of oil futures) struck an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Constantly high oil rates will ultimately slow financial growth, which in turn will cause oil costs to fall, ceritus paribus.

The down trend in sugar futures is well established due to the expectations of a substantial 2013 harvest that should be led by a record Brazilian harvest. This is news that everybody understands and this basic details has actually drawn in good traders to the sell side of the market. Technical traders have likewise had a simple go of it considering that what rallies there have actually been have actually been capped perfectly by the 90 day moving average. In fact, the last time the 30-day Moving Average Trader average crossed under the 90-day moving average remained in August of in 2015. Finally, technical traders on the short side have actually collected profits due to the orderly decline of the market so far rather than getting stopped out on any spikes in volatility.

The most basic application of the BI concept is that when a stock is trading above its Bias Sign you need to have a bullish predisposition, and when it is trading below its Bias Indication you should have a bearish bias.

Market timing is based upon the “fact” that 80% of stocks will follow the direction of the broad market. It is based on the “fact” that the Forex MA Trading pattern gradually, have actually been doing so since the beginning of freely traded markets.

This means that you need to understand how to handle the trade prior to you take an entry. In a trade management strategy, you ought to have composed out exactly how you will manage the trade after it is participated in the Stocks MA Trading so you know what to do when things show up. Dominating trade management is extremely crucial for success in trading. This part of the system need to include information about how you will react to all kinds of conditions one you enter the trade.

For every time a short article has actually been e-mailed, award it three points. An e-mailed post suggests you have at least strike the interest nerve of some member of your target market. It may not have been a publisher so the category isn’t as important as the EzinePublisher link, however it is more important than a basic page view, which does not necessarily mean that someone checked out the whole short article.

As you can see, specifying the BI is simple. The 30-minute BI is strictly the high and the low of the first thirty minutes of trading. I find that the BI frequently reveals the predisposition of a stock for the day.

Combining these two moving averages gives you a great foundation for any trading plan. Possibilities are good that you will be able to make cash if you wait for the 10-day EMA to agree with the 200-day SMA. Simply use good finance, do not run the risk of excessive on each trade, and you must be great.

It is the setup, not the name of the stock that counts. Start by picking a particular trade that you think pays, state EUR/USD or GBP/USD. The first point is the strategy to be followed while the second pint is the trading time.

If you are finding rare and entertaining videos about What Is Ema Crossover Indicator, and Stock Trading, Beginner Trading, Forex Market you are requested to signup our email subscription DB now.