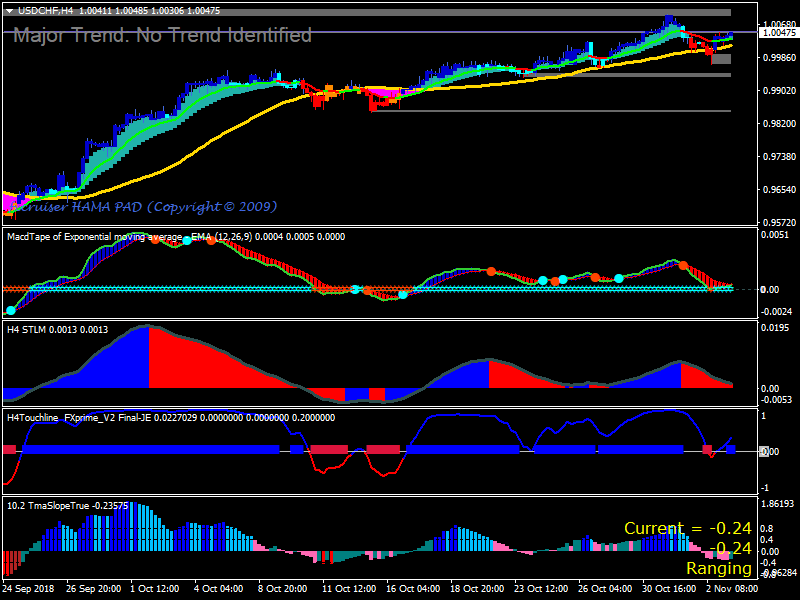

Scalping with Exponential Moving Average (EMA) in Time Frame 1M

Latest reviews highly rated Forex Trading Strategies, Trading Info, and Ema Trading Scalping, Scalping with Exponential Moving Average (EMA) in Time Frame 1M.

Telegram Channel : http://tiny.cc/TradingGold

Telegram Channel : https://cutt.ly/Vyvf9sD

Telegram Channel: https://rb.gy/u6euoi

Scalping with Exponential Moving Average (EMA) in Time Frame 1M

Time Frame :1M.

Currency Pairs: Majors

The best to scalp trade is at the London Open (3:00AM EST) or the New York open (8:00 AM EST).

Indicators:

1) Exponential Moving Average (EMA) 25 and 50

2) Exponential Moving Average (EMA) 50 and 100

Long Entry:

When the EMA 25 cross up through the 50 EMA and 100 EMA.

Short Entry:

When the EMA 25 cross down through the 50 EMA and 100 EMA.

Exit:

– Target Price: 5-10 pips

– Stop loss: 9-12 pips

—————————————————————————————————–

FX is leveraged products and you may lose your initial deposit as well as substantial amounts of your investment. Trading leveraged products carries a high level of risk and may not be suitable for all investors, so please consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully.

Risk management can be limiting your trade lot size, hedging, trading only during certain hours or days, or knowing when to take losses.

Ema Trading Scalping, Scalping with Exponential Moving Average (EMA) in Time Frame 1M.

Financiers Explore Technical Analysis

Also active trading can affect your tax rates. Personally, I thought that promoters of such a FX trading system was complete of crap! You can utilize any indicators that you’re comfortable with to go through a comparable procedure.

Scalping with Exponential Moving Average (EMA) in Time Frame 1M, Play interesting full length videos about Ema Trading Scalping.

4 Questions Your Trading Plan Must Answer

Trading forex with indications has to do with picking the most likely trades to profit. State you wish to trade a hourly basis and you wish to plot an 8 point chart. The 5 being quickly, 10 medium and 15 the sluggish.

Everyone wants to find out currency trading, or so it appears from the number of individuals being drawn into the foreign currency, or forex, craze. However, just like most things, there’s an incorrect way and an ideal method. And the ideal method has three vital ingredients.

Technical analysis can be very beneficial for Moving Average Trader to time our entries and exits of the trade. It should not be utilized alone because it can be confusing details if not utilized correctly.

Nasdaq has rallied 310 points in 3 months, and hit a new four-year high at 2,201 Fri early morning. The economic information recommend market pullbacks will be limited, although we’ve entered the seasonally weak duration of Jul-Aug-Sep after a huge run-up. Subsequently, there may be a debt consolidation period instead of a correction over the next few months.

In the middle of this horrible experience, her 12 years of age child got back from School and discovered her mom in tears. “What’s wrong Forex MA Trading?” her child asked. “Oh, this alternative trading will be the death of me beloved,” Sidney sobbed.

A Forex trading strategy requires three Stocks MA Trading fundamental bands. These bands are the time frame chosen to trade over it, the technical analysis used to determine if there is a cost trend for the currency set, and the entry and exit points.

Here is an ideal example of a technique that is easy, yet clever enough to ensure you some added wealth. Start by choosing a particular trade that you think pays, state EUR/USD or GBP/USD. When done, choose 2 signs: weighted MA and easy MA. It is advised that you utilize a 20 point weighted moving typical and a 30 point moving average on your 1 hour chart. The next step is to watch out for the signal to offer.

Entering the market at this phase is the most aggressive method because it does not allow for any kind of confirmation that the stock’s break above the resistance level will continue. Maybe this strategy should be scheduled for the most promising stocks. However it has the benefit of providing, in many circumstances, the least expensive entry point.

Constantly know your feelings and never make a trade out of worry or greed. This is more difficult than it seems. A lot of amateur traders will take out of a trade based upon what is taking place. But I guarantee you this is constantly bad. To earn money regularly you should build a technique and stick with it. If this means setting stops and targets and leaving the room, so be it! This might be harder to practice than it sounds but unless you get control of your emotions you will never be an effective trader.

I then integrated this Non-Lagging AMA with another indicator called the Beginners Alert. You should always secure your trades with a stop loss. So this system has the exact same winning average in time as flipping a coin.

If you are searching instant exciting reviews relevant with Ema Trading Scalping, and Day Forex Signal Strategy Trading, Momentum Forex Trading please join for newsletter for free.