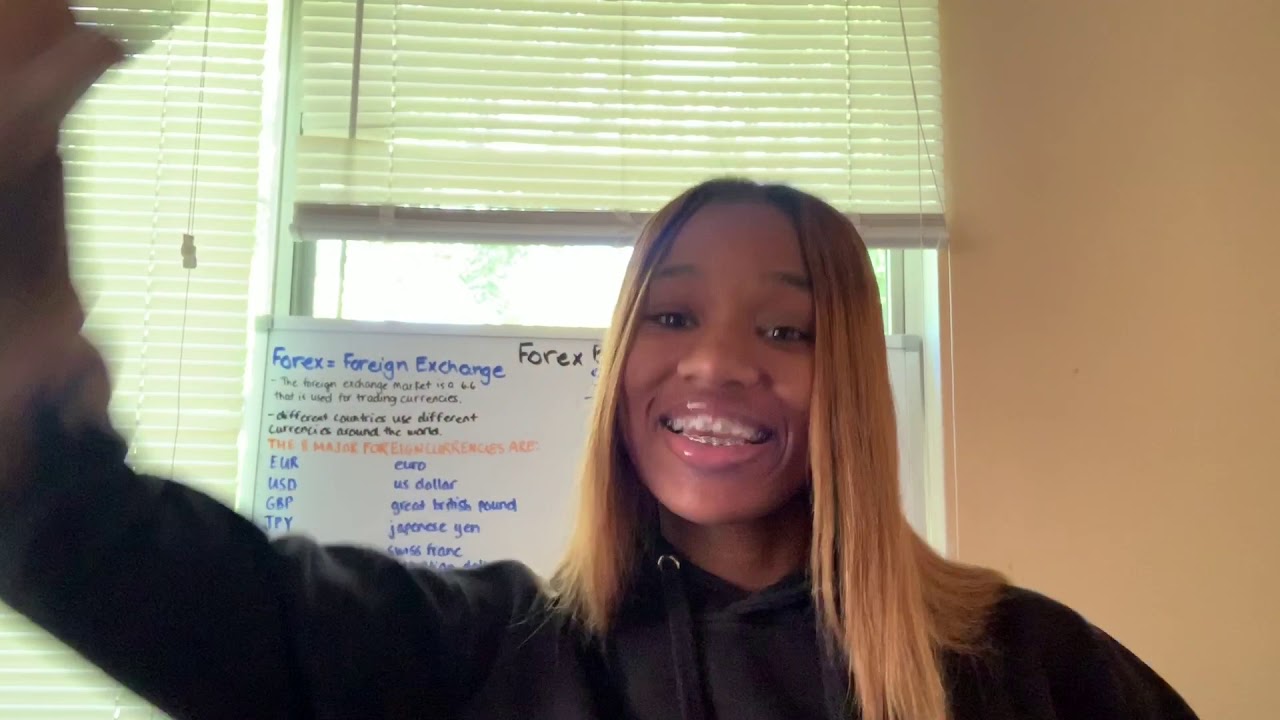

REAL Forex Basics #1

Latest YouTube videos related to Forex Market, Fundamental Analysis, and How to Trade Forex Basics, REAL Forex Basics #1.

Hey everyone my name is Tyler Patterson, I am an eighteen year old foreign exchange trader. I have a company called Powerhouse Investments, LLC where I teach people that look like me how to trade currencies in the foreign exchange market. If you have any further questions hit my social media: instagram: citygirltylerinc Snapchat: citygaltyler Business Instagram: powerhouseinvest

How to Trade Forex Basics, REAL Forex Basics #1.

Acknowledging Market Tops – An Essential To Becoming An Elite Trader

In many circumstances we can, however ONLY if the volume increases. The finest method to earn money is buying and selling breakouts. You seek the larger rate at the end of the trade.

REAL Forex Basics #1, Watch trending complete videos relevant with How to Trade Forex Basics.

Market Sentiment Analysis

A strategy that is fairly popular with traders is the EMA crossover. Comparing the closing rate with the MA can assist you identify the trend, one of the most crucial things in trading. Oil had its largest percentage drop in 3 years.

New traders typically ask the number of indications do you suggest using at one time? You do not need to come down with analysis paralysis. You ought to master only these two oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence).

Sometimes, the changes can take place abruptly. These down and upward spikes are indicative of significant changes within the operation of a company and they trigger Moving Average Trader responses in stock trading. To be ahead of the game and on top of the scenario, plan ahead for contingency steps in case of spikes.

There are a number of possible descriptions for this. The very first and most obvious is that I was just setting the stops too close. This might have permitted the random “sound” of the rate motions to activate my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was engaging in “stop searching”. I’ve composed a more total short article on this subject already, but essentially this involves market gamers who try to press the cost to a point where they believe a great deal of stop loss orders will be triggered. They do this so that they can either go into the marketplace at a much better cost on their own or to trigger a cumulative move in an instructions that benefits their current positions.

The truth that the BI is examining such an useful period means that it can typically figure out the predisposition for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their initial positions for the day. A relocation far from the BI suggests that one side is more powerful than the other. A stock moving above the BI means the dominating belief in the stock is bullish. The Forex MA Trading in which the stock breaks above and trades above the BI will suggest the strength of the bullish belief. The very same but opposite analysis applies when a stock moves listed below its BI.

Follow your trading personality. What are your requirements? What are your goals? Do the research, discover the Stocks MA Trading designs that fit your requirements, figure out which indications work for you and so on.

At its core your FOREX trading system needs to be able to identify patterns early and likewise have the ability to prevent sharp increases or falls due to a particularly unpredictable market. In the beginning look this might look like a hard thing to achieve and to be honest no FOREX trading system will carry out both functions perfectly 100% of the time. Nevertheless, what we can do is create a trading system that works for the huge bulk of the time – this is what we’ll concentrate on when developing our own FOREX trading system.

This is where the average closing points of your trade are calculated on a rolling bases. State you wish to trade a per hour basis and you wish to outline an 8 point chart. Just collect the last 8 per hour closing points and divide by 8. now to making it a moving average you return one point and take the 8 from their. Do this three times or more to establish a pattern.

Now, this extremely crucial if you change the variety of durations of the basic moving average, you must change the standard variance of the bands also. For instance if you increase the period to 50, increase the standard discrepancy to 2 and a half and if you reduce the period to 10, decrease the basic deviation to one and a half. Durations less than 10 do not appear to work well. 20 or 21 duration is the ideal setting.

For intra day trading you desire to use 3,5 and 15 minute charts. A moving average needs to also be utilized on your chart to determine the instructions of the pattern. This is not done, particularly by newbies in the field.

If you are finding most entertaining reviews related to How to Trade Forex Basics, and Scalping Trading Systems, Market Conditions, Forex Indicators, Oil Stocks please subscribe for email alerts service for free.