Only 3 Indicators you need for Swing Trading | Trading Geeks

Top updated videos about Swing Trading Strategy, Fading Market, and Which Chart Is Best For Swing Trading, Only 3 Indicators you need for Swing Trading | Trading Geeks.

If you are a swing trader & you use every other indicator then this video is for you. In this video, I have shared 3 Indicators that are more than sufficient for swing trading once you master how to use them.

►Join Telegram Channel For Charts & Analysis

Link: https://telegram.me/Trading_Geeks_Official

OR

[ Search ‘Trading Geeks’ On Telegram To Join.]

______________________________________

►ANGEL BROKING (Free Account):

Link: https://tinyurl.com/y6lg5qks

►ZERODHA (Free Account):

Link: https://zerodha.com/open-account?c=YMR013

►FYERS (Free Account):

Link: https://open-account.fyers.in/?utm-source=AP-Leads&utm-medium=AP1521

►UPSTOX (FREE ACCOUNT):

Link: https://upstox.com/open-account/?f=00AQ

Open Trading Account With Above Link And Send Client ID On Whatsapp To Join Premium Telegram Channe!!

Whatsapp: 9170898928 |OR| Click On The Below Link.

Link: https://wa.me/message/CYGSZIVBQOEVJ1

______________________________________

DISCLAIMER

This video expresses my personal opinion only. Trading financial markets involve risk and are not suitable for all investors. I am not responsible for any losses incurred due to your trading or anything else. I do not recommend any specific trade or action, and any trades you decide to take are your own.

Tag: swing trading,swing trading strategies,swing trading indicators,swing trading for beginners,swing trading strategy,swing trading stocks,forex trading,swing trading strategies that work,tradingview best indicators,best swing trading indicators,trading,swing trading basics,day trading,swing trading indicator tradingview,best swing trading strategy,indicators for swing trading,swing trading indicator

Which Chart Is Best For Swing Trading, Only 3 Indicators you need for Swing Trading | Trading Geeks.

Trend Trading – Trading Stocks Using Technical Analysis And Swing Trading Strategies

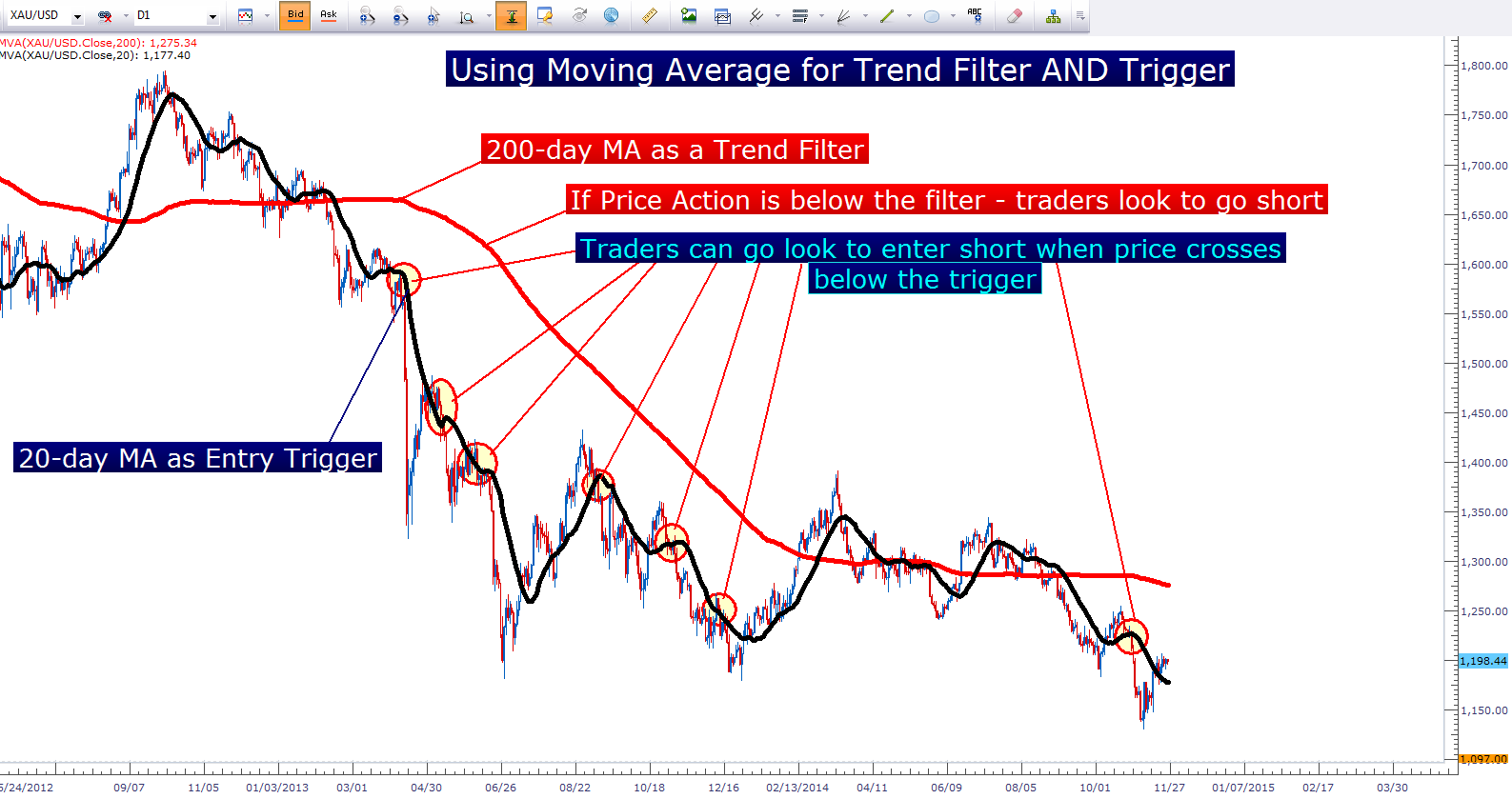

Many argue that moving averages are the very best indicators for forex. This may be quite various from somebody else who looked at a roll over as a reason to offer out. Let’s begin with a system that has a 50% chance of winning.

Only 3 Indicators you need for Swing Trading | Trading Geeks, Find popular explained videos about Which Chart Is Best For Swing Trading.

5 Steps To Trading Success Utilizing Technical Analysis

Complex signs will likely stop working to work in the long-term. Moving averages are incredibly popular signs in the forex. Pleased trading and never ever stop discovering! You should establish your own system of day trading.

There are a terrific range of forex indications based upon the moving average (MA). This is a review on the simple moving average (SMA). The easy moving average is line produced by computing the average of a set number of duration points.

Always use stop losses. You should constantly safeguard your trades with a stop loss. If you are trading part time and you do not monitor the market all day long, this is absolutely needed Moving Average Trader . If the trade does not go in your favour, it likewise assists to reduce your stress levels as you know ahead how much you are likely to loss.

The reality that the BI is examining such an informative duration suggests that it can typically figure out the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears establish their initial positions for the day. A relocation away from the BI shows that a person side is more powerful than the other. A stock moving above the BI indicates the prevailing sentiment in the stock is bullish. The way in which the stock breaks above and trades above the BI will indicate the strength of the bullish belief. When a stock moves listed below its BI, the opposite but same analysis uses.

Market timing is based on the “truth” that 80% of stocks will follow the instructions of the broad market. It is based on the “truth” that the Forex MA Trading pattern over time, have been doing so given that the beginning of freely traded markets.

There are numerous strategies and indications to identify the trend. My preferred ones are the most simple ones. I like to use a moving typical sign with the big number of averaging periods. Increasing Stocks MA Trading indicates the uptrend, falling MA indicates the drop.

Here is a best example of a technique that is basic, yet smart sufficient to assure you some added wealth. Start by picking a particular trade that you think is successful, say EUR/USD or GBP/USD. When done, choose two indicators: weighted MA and easy MA. It is advised that you use a 20 point weighted moving typical and a 30 point moving average on your 1 hour chart. The next step is to keep an eye out for the signal to sell.

The second action is the “Get Set” step. In this step, you might increase your cash and gold allotments further. You may also begin to move money into bear ETFs. These funds go up when the marketplace decreases. Funds to consider consist of SH, the inverse of the S&P 500, DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

Now, this very crucial if you alter the variety of durations of the basic moving average, you should change the basic deviation of the bands also. For instance if you increase the duration to 50, increase the basic discrepancy to 2 and a half and if you reduce the period to 10, reduce the standard deviation to one and a half. Periods less than 10 do not appear to work well. 20 or 21 period is the optimum setting.

We do not even put our hopes in the stock we just sold. But as quickly as the 9 day crosses over the 4 day it is a sell signal. Buy-and-hold state the advisors who profit from your financial investment purchases though commissions.

If you are looking unique and engaging videos related to Which Chart Is Best For Swing Trading, and Online Day Trading, Stock Trading Tips, Successful Forex Trading please join for a valuable complementary news alert service for free.