Moving Average Strategy With Setting | Moving Average Crossover | Best Trading Strategy | Mark Blake

Top un-edited videos related to Exit Strategy, Timing the Market, Forex Moving Average Tips and Strategies, and Best Ma Crossover Settings, Moving Average Strategy With Setting | Moving Average Crossover | Best Trading Strategy | Mark Blake.

Moving Average Strategy With Setting | Moving Average Crossover | Best Trading Strategy | Mark Blake

#bestmovingaveragestrategy

#movingaveragecrossoverbacktest

#Movingaveragestrategy

#movingaveragetradingstrategy

#movingaverageindicator

#simpletradingstrategy

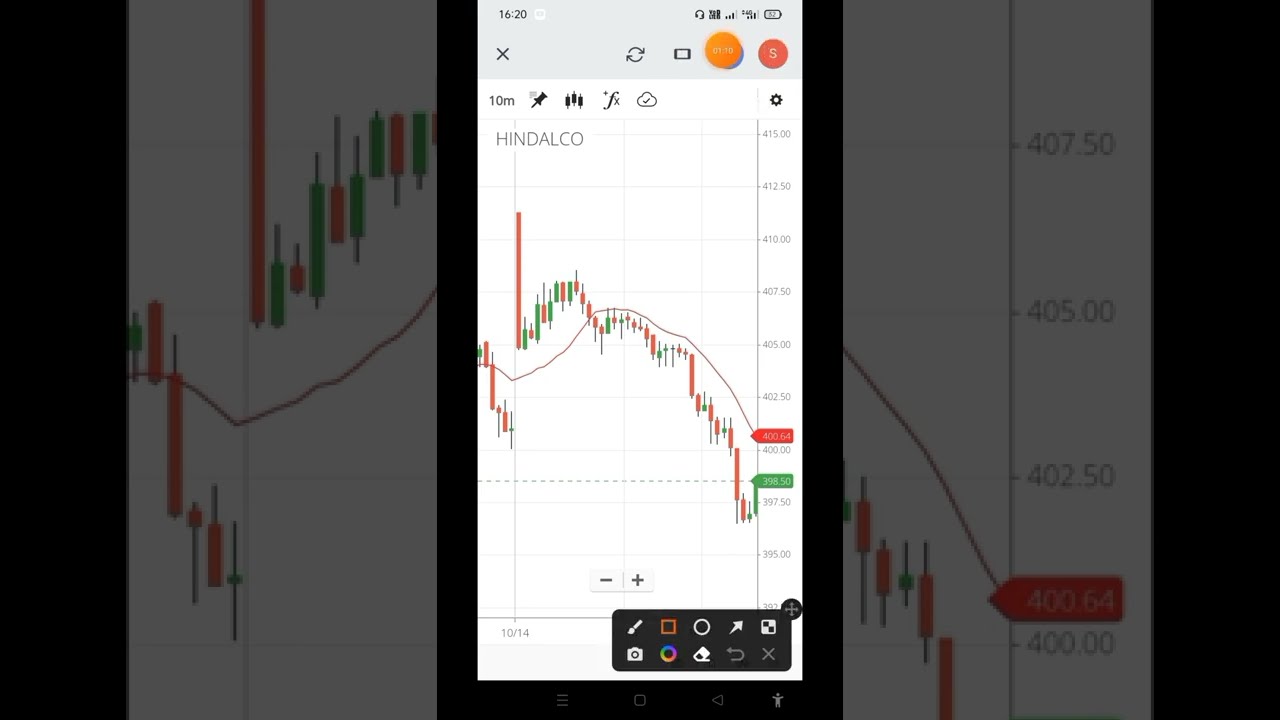

In this video – Best Moving Average Strategy, Moving Average Crossover Strategy

🔥🔥 👇👇👇👇👇👇👇👇

Telegram 👉 https://t.me/MarkBlake7

free open demat account

Groww 👉https://app.groww.in/v3cO/u64h1yko

Zerodha👉 https://zerodha.com/open-account?c=MUA555

Cover Topic

best moving average strategy

moving average crossover backtest

Moving average strategy

moving average trading strategy

moving average indicator

breakout trading strategy

trading strategies

no loss strategy

DISCLAIMER- This channel / owner is not SEBI registered financial advisor . This channel / owner is not responsible for your profit and loss . Given Charts and Levels only for Education purpo Do your own analysis before taking trade . Invest in any stocks without knowledge is very Risky .

Best Ma Crossover Settings, Moving Average Strategy With Setting | Moving Average Crossover | Best Trading Strategy | Mark Blake.

Currency Trading – Intraday Positions

It is provided in a chart where all you need to do is to keep an eager eye on the very best entrance and exit points. The strongest signal is where the present cost goes through both the SMAs at a high angle.

Moving Average Strategy With Setting | Moving Average Crossover | Best Trading Strategy | Mark Blake, Explore new reviews about Best Ma Crossover Settings.

Forex Moving Average Suggestions And Strategies

Complex indications will likely stop working to work in the long-term. Moving averages are popular signs in the forex. Delighted trading and never ever stop learning! You must establish your own system of day trading.

Brand-new traders often ask how many indicators do you suggest using at one time? You don’t need to fall victim to analysis paralysis. You should master only these two oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence).

But if you have a couple of bad trades, it can truly sour you on the entire trading game Moving Average Trader .This is when you simply have to step back and have a look at it. Possibly, you just need to escape for a day or 2. Unwind, do something various. Your unconscious mind will work on the issue and when you return, you will have a better outlook and can spot the trading opportunities quicker than they can come at you.

Technical Analysis utilizes historical rates and volume patterns to forecast future behavior. From Wikipedia:”Technical analysis is often contrasted with basic Analysis, the research study of economic elements that some experts say can affect prices in monetary markets. Technical analysis holds that costs currently reflect all such influences prior to investors know them, hence the research study of cost action alone”. Technical Experts strongly think that by studying historic costs and other key variables you can predict the future rate of a stock. Nothing is absolute in the stock exchange, however increasing your probabilities that a stock will go the direction you anticipate it to based upon cautious technical analysis is more precise.

The near-term indications on the marketplace have actually weakened on the Dow Jones. The DJIA remained in a bullish trend but it fell below its 20-day average of 11,156. If the average can not hold, this indicates that the market might fall. In addition, the Relative Strength is showing a loss while the Forex MA Trading is at a moderate sell.

The frequency is essential in choice. For example, provided 2 trading systems, the first with a greater revenue aspect but a low frequency, and the second a greater frequency in trades however with a lower earnings aspect. The 2nd system Stocks MA Trading have a lower profit factor, however due to the fact that of its higher frequency in trading and taking little revenues, it can have a greater overall earnings, than the system with the lower frequency and higher revenue aspect on each specific trade.

The very best method to generate income is purchasing and selling breakouts. , if you include them in your forex trading method you can utilize them to pile up substantial gains..

Once the buzz settles and the CME completes its margin boost on Monday, we should see silver prices support. From my viewpoint, I see $33 as a level I might meticulously start to purchase. If silver breaks listed below that level, I think support will be around $29 until the Fed decides it’s time to cool inflation.

Daily Moving Averages: There are lots of moving averages which is simply the average price of a stock over an extended period of time, on an annual chart I like to use 50, 100 and 200 day-to-day moving averages. They provide a long ravelled curve of the average cost. These lines will also end up being support and resistance points as a stock trades above or below its moving averages.

Another example of a basic timing system may be revealed as follows. Draw the line to acknowledge the support and resistance levels. The first and most apparent is that I was simply setting the stops too close.

If you are looking exclusive engaging videos about Best Ma Crossover Settings, and Commitment of Traders, Disciplined Trader, Stock Tips you should signup in newsletter totally free.