Moving Average Crossover Strategy for Beginners – Best Forex Moving Average Strategy

New videos about Current Sector Trends, How to Read Stock Charts, and Best Ma Crossover, Moving Average Crossover Strategy for Beginners – Best Forex Moving Average Strategy.

Forex Crossover Strategy for Beginners

In this video we talk about the simple trading strategy using Exponential Moving Average (EMA) Crossover. Exponential Moving Average (EMA) is similar to Simple Moving Average (SMA), measuring trend direction over a period of time.

TELEGRAM CHANNEL : https://t.me/simpletradeclubfree

Recommended Broker:

IC Market : https://bit.ly/NewICMarket

XM : https://bit.ly/DaftarXMRebate

OctaFX : https://bit.ly/RegisterOctafx

FBS Rebate : https://bit.ly/NewFBSlink

Exness : https://bit.ly/ExnessLINK

Timestamp:

00:00 Intro

00:31 Moving Average Explaination

01:00 How to Install Indicator

02:41 Rule of Using EMA Crossover

05:18 Backtest EMA Crossover Strategy

07:32 Pros & Cons

Music : Way Home by Tokyo Music Walker

Stream & Download : https://fanlink.to/tmw_way_home

Creative Commons — Attribution 3.0 Unported — CC BY 3.0

#forex #tradingstrategy #trading

Tags:

forex crossover strategy

ma crossover strategy forex

best crossover strategy intraday

best ema crossover strategy intraday

ma crossover strategy beginners

moving average forex

ma crossover strategy tradingview

moving average crossover strategy

moving average forex strategy

moving average crossover strategy forex

forex moving average strategy

moving average crossover

Best Ma Crossover, Moving Average Crossover Strategy for Beginners – Best Forex Moving Average Strategy.

Forex Finance – The Key To Triple Digit Gains

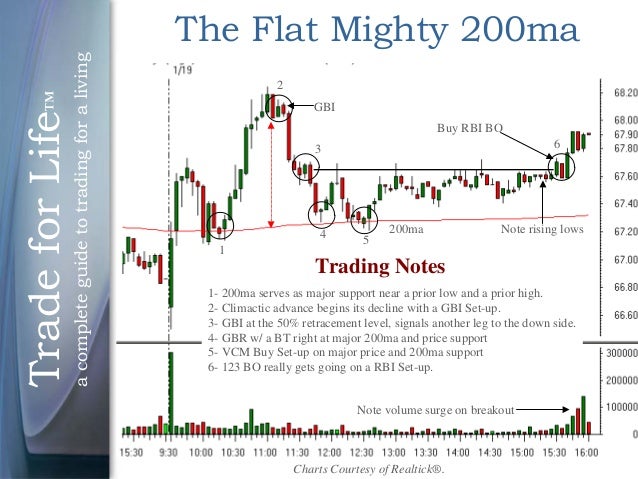

Now when a market is trending, it has chosen a clear direction. To lower the incorrect signal effect, there is the approach not to use MA + stock rate, but MA + another MA.

Moving Average Crossover Strategy for Beginners – Best Forex Moving Average Strategy, Watch latest full length videos about Best Ma Crossover.

3 Things You Require To Learn About Range Trading

For intra day trading you wish to use 3,5 and 15 minute charts. The next action is to watch out for the signal to offer. This takes the index cost over the last specific variety of days and averages it.

Choosing the right best stock sign in 2011 is more tricky than you may believe. But making the best choice is a crucial one, particularly in the existing stock market conditions.

A common forex cost chart can look really unpredictable and forex candlesticks can obscure the pattern further. The Moving Average Trader average gives a smoothed chart that is outlined on top of the forex chart, together with the japanese candlesticks.

Nasdaq has actually rallied 310 points in three months, and struck a brand-new four-year high at 2,201 Fri early morning. The financial information suggest market pullbacks will be limited, although we’ve entered the seasonally weak period of Jul-Aug-Sep after a big run-up. Subsequently, there might be a combination period rather than a correction over the next couple of months.

Market timing is based upon the “truth” that 80% of stocks will follow the instructions of the broad market. It is based on the “truth” that the Forex MA Trading trend with time, have been doing so since the start of freely traded markets.

Throughout these times, the Stocks MA Trading consistently breaks assistance and resistance. Naturally, after the break, the rates will typically pullback before continuing on its method.

You will be thought about a pattern day trader no matter you have $25,000 or not if you make four or more day trades in a rolling five-trading-day period. A day trading minimum equity call will be provided on your account needing you to deposit extra funds or securities if your account equity falls below $25,000.

Using the moving averages in your forex trading business would show to be very beneficial. First, it is so easy to utilize. It is provided in a chart where all you need to do is to keep an eager eye on the very best entrance and exit points. Thats a sign for you to start purchasing if the MAs are going up. Nevertheless, if it is going down at a continuous rate, then you ought to begin selling. Having the ability to check out the MAs right would definitely let you understand where and how you are going to make more cash.

At the day level there are periods also that the cost does not largely and periods that the price modification largely. When London stock opens ad when U.S.A. stock opens, the risky time durations are. Also there are big modifications when Berlin stock opens. After each one opens, there are often large modifications in the prices for a guy hours. The most dangerous period is the time at which 2 stocks are overlapped in time.

I then integrated this Non-Lagging AMA with another indicator called the Beginners Alert. You need to always protect your trades with a stop loss. So this system has the same winning average over time as flipping a coin.

If you are finding updated and exciting comparisons related to Best Ma Crossover, and Trading Forex With Indicators, When to Buy Stocks, Trading Stocks you should join for a valuable complementary news alert service totally free.