Moving Average Crossover Strategy Explained #movingaverage #tradingstrategy #investing

New replays related to Perfect Systems, Moving Average Crossover, and Ma Crossover Strategy, Moving Average Crossover Strategy Explained #movingaverage #tradingstrategy #investing.

#investing #tradingstrategy #movingaverage #technicalanalysis

Are you looking for a simple yet effective trading strategy used by professional traders? Look no further than the “50 and 200 Exponential Moving Average Crossover Strategy.” In this video, we’ll show you how to spot crossovers, confirm trade signals with other indicators, and adjust the strategy based on market conditions and timeframes. Plus, we’ll share tips on how to practice and refine the strategy in a demo account before applying it to live trading.

Ma Crossover Strategy, Moving Average Crossover Strategy Explained #movingaverage #tradingstrategy #investing.

There Is No Such Thing As “Excellent” Stock

Long as the stock holds above that breakout level. It trails the price action and always lags behind it. They did this by correctly analyzing the daily cost and volume action of the NASDAQ.

Moving Average Crossover Strategy Explained #movingaverage #tradingstrategy #investing, Enjoy more explained videos about Ma Crossover Strategy.

Forex Finance – The Secret To Triple Digit Gains

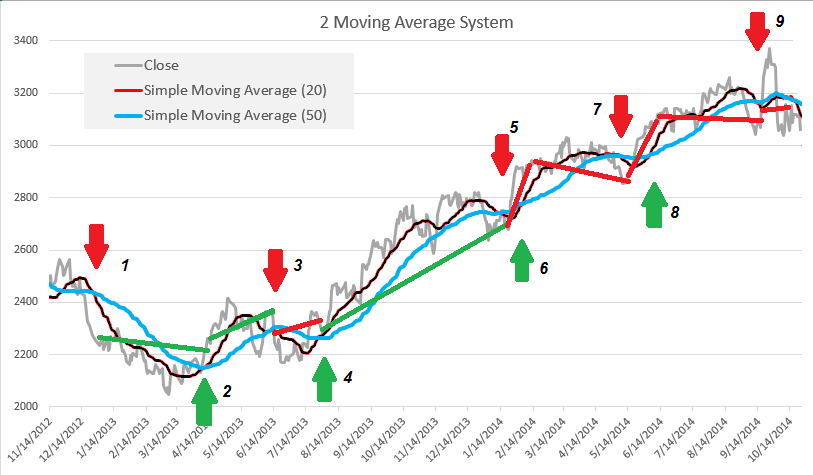

Exponential MAs weigh more recent costs heavier. A 50-day moving typical line takes 10 weeks of closing cost data, and then plots the average. This trader loses and his wins are on average, much bigger than losing.

There are a great range of forex indicators based upon the moving average (MA). This is an evaluation on the easy moving average (SMA). The basic moving average is line produced by calculating the average of a set number of duration points.

At times, the modifications can occur suddenly. These downward and upward spikes are indicative of significant modifications within the operation of a business and they trigger Moving Average Trader responses in stock trading. To be ahead of the game and on top of the scenario, strategy ahead for contingency steps in case of spikes.

Technical Analysis uses historical prices and volume patterns to predict future behavior. From Wikipedia:”Technical analysis is frequently contrasted with essential Analysis, the research study of financial aspects that some experts say can affect rates in financial markets. Technical analysis holds that rates currently reflect all such impacts prior to investors know them, for this reason the research study of price action alone”. Technical Experts highly believe that by studying historic rates and other crucial variables you can predict the future rate of a stock. Nothing is outright in the stock market, however increasing your possibilities that a stock will go the instructions you expect it to based on mindful technical analysis is more accurate.

The chart below is a Nasdaq weekly chart. Nasdaq has actually been producing a rising wedge for about two years. The Forex MA Trading sign has been relocating the opposite instructions of the rate chart (i.e. unfavorable divergence). The 3 highs in the wedge fit well. However, it’s unpredictable if the 3rd low will also give a good fit. The wedge is compressing, which ought to continue to generate volatility. Lots of intermediate-term technical indications, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, etc., suggest the marketplace will be higher at some point within the next couple of months.

A well indicating buddy had actually pointed out an alternatives trading course he had participated in and suggested that trading might be a way for Sidney to Stocks MA Trading above typical returns on her compensation payment money, as interest and dividends would not be able to supply sufficient income for the family to survive on.

Another forex trader does care excessive about getting a return on financial investment and experiences a loss. This trader loses and his wins are on average, much larger than losing. He wins double what was lost when he wins the video game. This shows a balancing in winning and losing and keeps the investments open to get a profit at a later time.

This is where the typical closing points of your trade are calculated on a rolling bases. Say you wish to trade a per hour basis and you want to outline an 8 point chart. Just collect the last 8 per hour closing points and divide by 8. now to making it a moving average you move back one point and take the 8 from their. Do this three times or more to establish a trend.

Constantly be mindful of your emotions and never make a trade out of fear or greed. This is more difficult than it appears. Most amateur traders will pull out of a trade based on what is taking place. However I guarantee you this is constantly bad. To earn money consistently you must build a technique and persevere. So be it if this means setting stops and targets and leaving the room! This might be more difficult to practice than it sounds however unless you get control of your feelings you will never be an effective trader.

Shorting isn’t for everybody, however here is among my techniques for choosing stocks to short. There are a great variety of forex indicators based on the moving average (MA). This doesn’t have to be clinical discovery for Nobel cost.

If you are looking most entertaining comparisons related to Ma Crossover Strategy, and Forex Trading Software Online, Complex Indicators, Forex Timeframes, Disciplined Trader you are requested to list your email address our email list now.