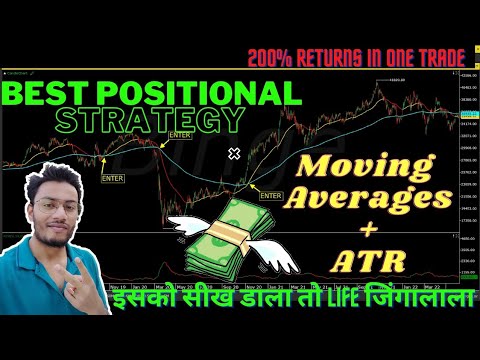

Moving Average Crossover Strategy & ATR | Best Positional Strategy |

Popular full videos relevant with Day Trading, Trading Indicators, Forex Trading School, and Best Ma Crossover, Moving Average Crossover Strategy & ATR | Best Positional Strategy |.

Hello Guys,

Today I have explained a very good Positional strategy using moving average crossover strategy and atr . its accuracy is very good and this Moving average strategy is complete in itself as it tells us trailing stoploss as well.

Hope you like it.

—————————–

Open Demat accounts-

Zerodha-https://zerodha.com/open-account?c=PF…

Fyers- https://open-account.fyers.in/?id=XV1…

Espresso- https://tinyurl.com/y67952je

—————————–

Gadgets I use-

Laptop- Lenovo IdeaPad L340

Mic- Rode NT usb mini

Earphone-

—————————-

Software Used for this video-

Power Point

DaVinci Resolve

Canva

If you like my videos and have any queries or suggestions regarding my videos then please comment below or connect me through my social media handles mentioned in the ABOUT section of my channel.

Please LIKE, SHARE & SUBSCRIBE

Thanks For Watching.

#movingaverage #positionaltradingstrategy #atr

Best Ma Crossover, Moving Average Crossover Strategy & ATR | Best Positional Strategy |.

What To Get Out Of A Lot Of Currency Trading Courses?

Also look at more info on deep in the money calls. However making the right choice is a crucial one, specifically in the existing stock market conditions. We do not even put our hopes in the stock we just offered.

Moving Average Crossover Strategy & ATR | Best Positional Strategy |, Explore top full videos about Best Ma Crossover.

Forex Trading Signs – Cliffsnotes On Moving Averages

The second line is the signal line represented as %D. %D is a simple moving average of %K. Elaborately designed methods do not constantly work. What you likewise need to understand is that there is no perfect system out there.

The Bollinger Bands were created by John Bollinger in the late 1980s. Bollinger studied moving averages and explore a brand-new envelope (channel) sign. This research study was one of the first to measure volatility as a dynamic motion. This tool provides a relative definition of price highs/lows in terms of upper and lower bands.

Out of all the stock trading suggestions that I’ve been offered over the ears, bone helped me on a more useful level than these. Moving Average Trader Utilize them and utilize them well.

So this system trading at $1000 per trade has a positive expectancy of $5 per trade when traded over numerous trades. The profit of $5 is 0.5% of the $1000 that is at risk throughout the trade.

Now when we utilize three MAs, the moving average with the least number of periods is defined as fast while the other two are identified as medium and sluggish. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being fast, 10 medium and 15 the slow.

Taking the high, low, open and close worths of the previous day’s rate action, tactical levels can be recognized which Stocks MA Trading or might not have an impact on cost action. Pivot point trading puts emphasis on these levels, and uses them to guide entry and exit points for trades.

Draw a line to recognize the assistance and resistance levels. The more the line is touched, the more essential it becomes as a support or resistance levels. An uptrend is shown by greater highs and higher lows. A drop is shown by lower highs and lower lows.

It’s very real that the market pays a great deal of attention to technical levels. We can reveal you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the difference was a line made use of a chart. When big blocks of money will sell or buy, moving averages for example are best studies in. See the action surrounding a 200 day moving average and you will see first hand the warfare that happens as shorts try and drive it under, and longs purchase for the bounce. It’s neat to enjoy.

The trader who receives a signal from his/her trading system that is trading on a medium based timeframe is enabling the info to be absorbed into the marketplace before taking a position and likewise to determine their threat. This trader whether he thinks prices are random or not believes that info is gathered and responded upon at different rates therefore offering opportunity to go into alongside The Wizard.

While it is $990 rather of $1,000 it does represent that milestone. You need to master only these two oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence). You just need to have persistence and discipline.

If you are finding unique and entertaining reviews relevant with Best Ma Crossover, and Forex Indicators, Forex Charts, Which Indicators you are requested to subscribe our email subscription DB now.