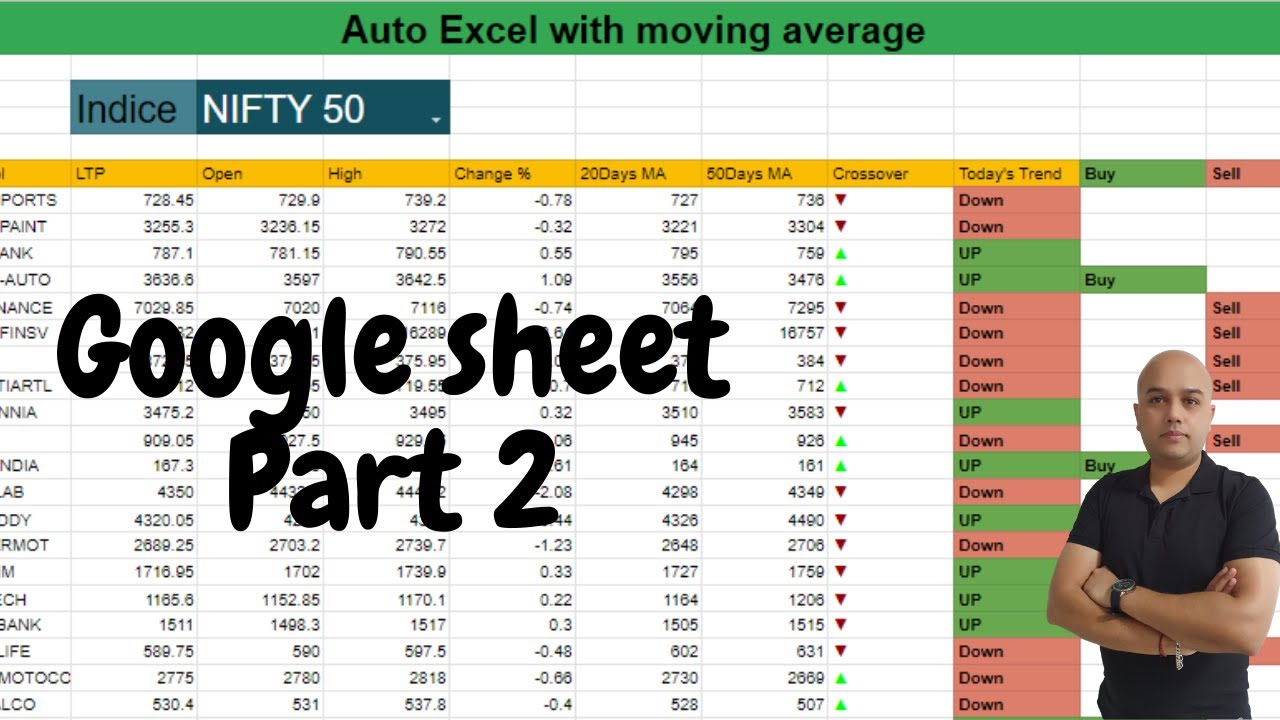

Moving Average Crossover Signal in Google Sheets with One Advance Formula using Google Finance data2

Latest overview about Stock Trading Tips, Trading Time, Option Trading, and Ma Crossover Alert, Moving Average Crossover Signal in Google Sheets with One Advance Formula using Google Finance data2.

How to create your won google sheets with moving average crossover

download file : – https://t.me/DonloadExcelfile

Once you download file , you can import in google sheet for use

Must Watch Playlist: –

Option: – https://youtube.com/playlist?list=PLeDJLHDR5Ku7u2xlhRlqvw-QDedyLoF6x

Price Action: – https://youtube.com/playlist?list=PLeDJLHDR5Ku4XnXSQPF18LHjmVI5Ofsdn

Trading view indicator: – https://youtube.com/playlist?list=PLeDJLHDR5Ku5goWjEVLAwR_M0D1K1cues

Automated Excel: – https://youtube.com/playlist?list=PLeDJLHDR5Ku5goWjEVLAwR_M0D1K1cues

Social Media Links: –

Telegram – https://t.me/SJinvestment2417

Twitter – https://twitter.com/jay_b2427

YouTube – https://www.youtube.com/channel/UC3TZCEMztouSznHXz7mejqg?sub_confirmation=1

HIT THE SUBSCRIBE BUTTON AND CLICK THE BELL icon to get Latest Update!

#Niftyprediction #Bankniftyprediction #SgTrader #marketview #intradaystocks

Ma Crossover Alert, Moving Average Crossover Signal in Google Sheets with One Advance Formula using Google Finance data2.

Day Trading – The Very Best Moving Averages For Day Trading

You do not have to suffer the 40% portfolio losses that lots of people carried out in 2008. Moving average is among many technical analysis indicators. Excessive in and out trading can be both psychologically and financially hazardous.

Moving Average Crossover Signal in Google Sheets with One Advance Formula using Google Finance data2, Enjoy most shared videos relevant with Ma Crossover Alert.

My Leading 3 Technical Indicators For Trading Stocks Like A Pro

Let us say that we desire to make a brief term trade, between 1-10 days. There are definitely some variations on this trading strategy too. Small trends can be quickly noted on 5-minute charts.

I have actually been trading futures, choices and equities for around 23 years. In addition to trading my own cash I have actually traded money for banks and I have actually been a broker for personal clients. Over the years I have actually been captivated to discover the distinction in between winners and losers in this company.

Every trade you open ought to be opened in the direction of the day-to-day trend. No matter the timeframe you use (as long as it is less than the daily timeframe), you need to trade with the overall instructions of the market. And fortunately is that discovering the daily trend Moving Average Trader is not tough at all.

The technical analysis needs to likewise be identified by the Forex trader. This is to predict the future trend of the rate. Typical indications used are the moving averages, MACD, stochastic, RSI, and pivot points. Keep in mind that the previous indicators can be utilized in combination and not just one. This is to verify that the rate trend holds true.

Selecting a timespan: If your day trading, buying and offering intra day, a 3 year chart will not help you. For intra day trading you desire to utilize 3,5 and 15 minute charts. Depending upon your longterm financial investment strategy you can look at a 1 year, which I utilize usually to a 10 year chart. The annual chart give me a take a look at how the stock is doing now in today’s market. I’ll look longer for historical support and resistance points but will Forex MA Trading my buys and sells based upon what I see in front of me in the yearly.

Among the primary indicators that can help you develop the way the index is moving is the Moving Average (MA). This takes the index cost over the last specified number of days and averages it. With each new day it drops the very first cost utilized in the previous day’s calculation. It’s constantly good to check the MA of numerous periods depending if you are wanting to day trade or invest. If you’re seeking to day trade then a MA over 5, 15, and 30 minutes are a great concept. Then 50, 100, and 200 days may be more what you require, if you’re looking for long term financial investment. For those who have trades lasting a few days to a couple of weeks then durations of 10, 20 and 50 days Stocks MA Trading be better.

So, when you utilize MAs, they drag the cost action and whatever trading signals that you get are constantly late. This is really essential to comprehend. Another constraint with MAs is that they tend to whipsaw a lot in a choppy market. When the market is trending well however whipsaw a lot under a market moving sideways, they work well. The much shorter the time period used in an MA, the more whipsaw it will have. Shorter period MAs move quick while longer period MAs move slowly.

Shorting isn’t for everyone, but here is among my methods for picking stocks to short. Weakness is a stock trading below the 200 day moving average – make a list of all stocks that are trading underneath that level.

Now, this thesis is to assist individual traders with specifications that have proven to be rather reliable. The majority of skilled traders would choose not to clot up their charts, with a lot of indications. While some might not mind, up until now as what they see on their charts, is clear to them. Now this would depend upon what works best for you so as not to get confused.

This short article has only detailed one technique for each market circumstance. Two moving typical signs need to be utilised one quickly and another slow. Yesterdays SMA was an average of the price points 1 – 8.

If you are searching more engaging comparisons relevant with Ma Crossover Alert, and Foreighn Exchange Market, Market Analysis you should join in email list totally free.