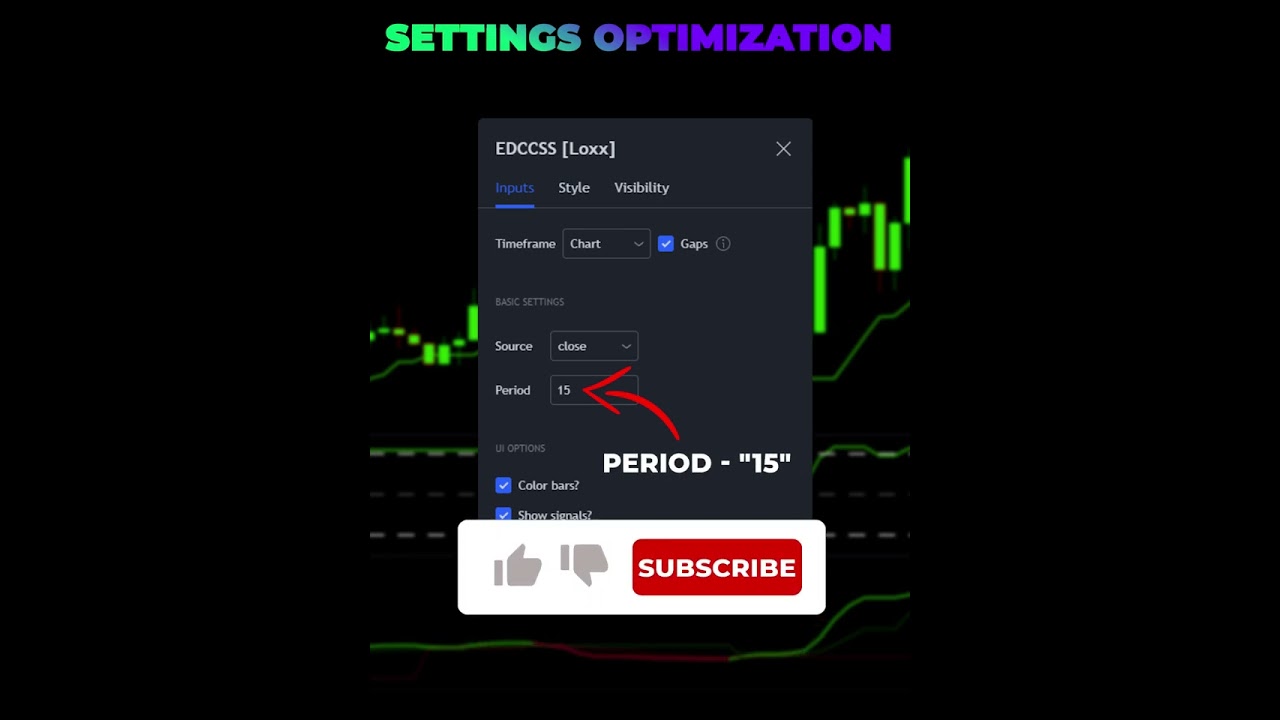

Most Accurate Buy Sell Signal Indicator Strategy On TradingView For 2023: Very Profitable #shorts

Interesting replays top searched Moving Av, Forex Timeframes, Forex International Trading, Swing Trading Rules, and How to Add Ema Tradingview, Most Accurate Buy Sell Signal Indicator Strategy On TradingView For 2023: Very Profitable #shorts.

In this video, I show you the Most Accurate Buy Sell Signal Indicator Strategy On TradingView For 2023: Very Profitable #shorts

🔴ACCESS QUANT ALGO: https://quantcap.gumroad.com/l/quanteducation

🔴Our Telegram Channel: https://t.me/quant_capital_fx

🔴 Learn Our Strategies That Work: https://quantcap.gumroad.com/l/quanteducation

✅ Business: quantcapitalsuppport@gmail.com

How to Add Ema Tradingview, Most Accurate Buy Sell Signal Indicator Strategy On TradingView For 2023: Very Profitable #shorts.

The Cost Wave – Forecasting With Cycle Analysis

You require to set extremely defined set of swing trading guidelines. By doing this, you wont need to fret about losing cash whenever you trade. Traders wait until the fast one crosses over or below the slower one.

Most Accurate Buy Sell Signal Indicator Strategy On TradingView For 2023: Very Profitable #shorts, Enjoy trending videos about How to Add Ema Tradingview.

5 Steps To Trading Success Using Technical Analysis

Volume is one of the most essential indicators to look for. A rebound can result in a pivot point better to 11,234. The Stochastic line represented as %K. %K is calculated as existing close minus most affordable low.

Brand-new traders typically ask how numerous signs do you suggest utilizing at one time? You don’t need to succumb to analysis paralysis. You need to master just these 2 oscillators the Stochastics and the MACD (Moving Typical Merging Divergence).

A common forex rate chart can look extremely erratic and forex candlesticks can obscure the pattern even more. The Moving Average Trader typical provides a smoothed graph that is plotted on top of the forex chart, along with the japanese candlesticks.

The dictionary prices quote a typical as “the ratio of any sum divided by the number of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

There is a wide variety of financial investment pointer sheets and newsletters on the web. Regrettably, numerous if not the majority of them are paid to promote the stocks they suggest. Instead of blindly following the suggestions of others you require to establish swing trading guidelines that will cause you to get in a trade. This Forex MA Trading be the stock moving across a moving average; it may be a divergence between the stock price and an indicator that you are following or it may be as basic as trying to find support and resistance levels on the chart.

Let us say that we wish to make a short term trade, between 1-10 days. Do a screen for Stocks MA Trading in a brand-new up trend. Raise the chart of the stock you are interested in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and must be purchased. But as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

Good forex trading and investing involves increasing earnings and decreasing possibilities of loss. This is refrained from doing, specifically by newbies in the field. They do not understand correct trading methods.

This is where the typical closing points of your trade are computed on a rolling bases. State you want to trade a hourly basis and you wish to outline an 8 point chart. Simply gather the last 8 hourly closing points and divide by 8. now to making it a moving average you move back one point and take the 8 from their. Do this three times or more to develop a pattern.

Constantly understand your emotions and never make a trade out of fear or greed. This is more difficult than it appears. Most amateur traders will pull out of a trade based on what is taking place. However I ensure you this is constantly bad. To generate income consistently you must develop a strategy and stay with it. So be it if this indicates setting targets and stops and leaving the room! This may be harder to practice than it sounds but unless you get control of your emotions you will never be a successful trader.

Those are the moving averages of that specific security. With each new day it drops the very first cost utilized in the previous day’s computation. Others are more aggressive and switch between short and long rather typically.

If you are looking more exciting comparisons about How to Add Ema Tradingview, and Options Trading System, Demarker Indicator, Stock Market for Beginners, Swing Trading Strategy dont forget to subscribe in email alerts service now.