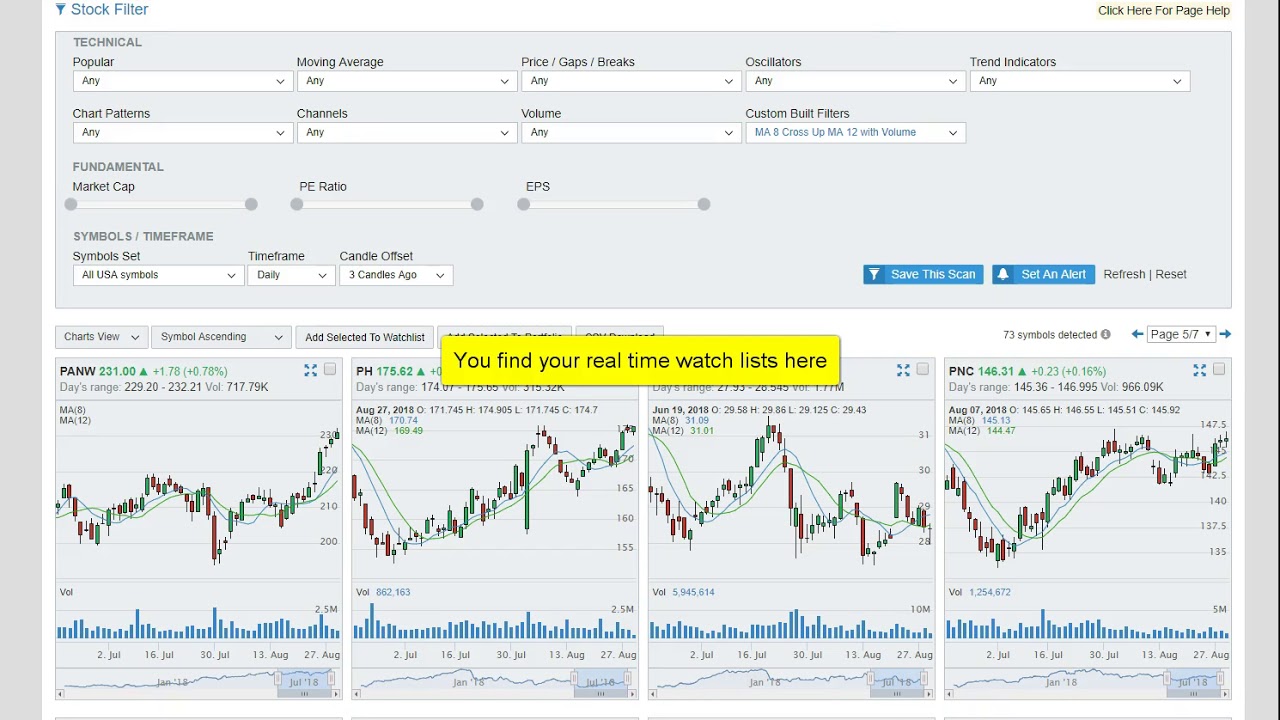

Making a Moving Average Cross with High Volume Stock Screener

Trending complete video related to Forex Market, Fundamental Analysis, and What Happens When 50 Sma Crosses 200 Sma, Making a Moving Average Cross with High Volume Stock Screener.

This is where we edit a pre-set filter and adjust the moving averages and add a second criteria with high average volume. This is a great filter for day trading candidates. This will show stocks on the move that have a lot of momentum.

Try our screener and start a 14 day free trial. No payment required.

https://www.stockmonitor.com/stock-screener/

If you want to read more on how to identify high volume stocks, try our blog post here:

https://www.stockmonitor.com/blog/using-a-stock-volume-scanner-to-find-great-day-trading-stocks/

What Happens When 50 Sma Crosses 200 Sma, Making a Moving Average Cross with High Volume Stock Screener.

How To Earn Money In Forex

Generally, the higher the durations the more revenues the trader can acquire and also the more dangers. Then you require to use the signs that expert traders use. Some individuals wish to make trading so challenging.

Making a Moving Average Cross with High Volume Stock Screener, Explore most searched reviews about What Happens When 50 Sma Crosses 200 Sma.

Stock Exchange Strategy – Stock Trading In A Stock Exchange Crash

You require to set really defined set of swing trading rules. For intra day trading you want to use 3,5 and 15 minute charts. The rate increased up above 0.7580, took me out and then headed south again!

Everyone wants to discover currency trading, or so it appears from the variety of individuals being drawn into the foreign currency, or forex, trend. However, as with the majority of things, there’s an incorrect way and a best method. And the proper way has 3 essential components.

Every trade you open ought to be opened in the instructions of the everyday trend. Regardless of the timeframe you use (as long as it is less than the day-to-day timeframe), you need to trade with the total direction of the marketplace. And fortunately is that finding the daily trend Moving Average Trader is not tough at all.

Grooved range can likewise hold. If the selling is intense, it may push the stock right past the grooved area – the longer a stock remains at a level, the more powerful the support.

You require to identify the beginning of the break out that produced the relocation you are going to trade versus. The majority of people use Support and resistance lines to determine these areas. I discover them to be extremely Forex MA Trading effective for this purpose.

Among the main indicators that can assist you establish the way the index is moving is the Moving Average (MA). This takes the index cost over the last specific variety of averages and days it. With each brand-new day it drops the very first rate utilized in the previous day’s estimation. If you are looking to day trade or invest, it’s constantly good to inspect the MA of a number of durations depending. Then a MA over 5, 15, and 30 minutes are a great idea, if you’re looking to day trade. If you’re trying to find long term financial investment then 50, 100, and 200 days may be more what you require. For those who have trades lasting a couple of days to a few weeks then durations of 10, 20 and 50 days Stocks MA Trading be more suitable.

Let’s expect you are in the exact same camp as we are and you believe the long term outlook on gold is extremely positive. So, each time it dips below a particular value level, you include more to your portfolio, essentially “purchasing on the dips”. This may be rather various from another person who looked at a roll over as a factor to offer out. Yet, both traders are taking a look at the same technical levels.

If the cost of my stock or ETF is up to the 20-day SMA and closes below it, I like to add a couple of Put alternatives– possibly a 3rd of my position. If the stock then continues down and heads towards the 50-day SMA, I’ll include another third. I’ll add another third if the price closes below the 50-day SMA.

I understand these pointers might sound standard. and they are. However you would marvel how many traders desert a great trading system because they feel they ought to have the ability to trade the system with no thought whatsoever. , if you would only learn to trade in the right direction and exit the trade with profits.. your look for a profitable Forex system would be over.

Well, if an effective move is underway, then the rate is moving away from the average, and the bands expand. However this does not suggest you ought to go into every trade signals that turns up.

If you are finding updated and entertaining videos related to What Happens When 50 Sma Crosses 200 Sma, and Forex Training, Currency Trading, Stock Investing, Currency Exchange Rate you should subscribe in email subscription DB now.