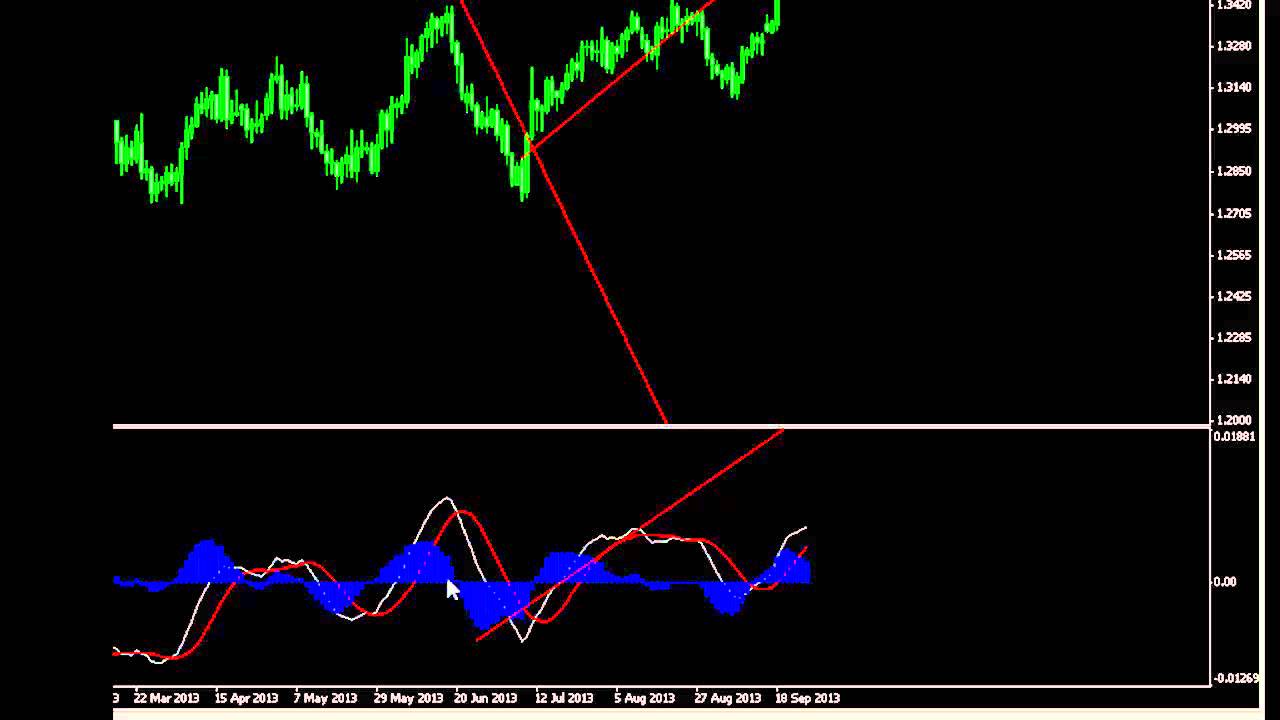

MACD Crossover Indicator with alerts for #MetaTrader MT4

Popular updated videos about Range Trading, Buying Conditions, Disciplined Trader, Swing Trading for Beginners, and Ma Crossover Alert, MACD Crossover Indicator with alerts for #MetaTrader MT4.

https://www.fxalgotrader.com

NOTE: This tool has been updated to a new version which uses an advanced Java Interface for ultra fast configuration changes in the #MetaTrader environment. For more details please visit this page.

https://www.fxalgotrader.com/Products/Alert-Systems/MetaTrader-MACD-Indicator-with-Alerts-JavaFX.html

FX AlgoTrader’s MACD Turbo indicator for MetaTrader. With Touch and Printed on chart and email crossover alerts, zero line touch and crossover alerts. Configurable MACD histogram.

#macd #crossover #alerts #metatrader #mt4

Ma Crossover Alert, MACD Crossover Indicator with alerts for #MetaTrader MT4.

Top 3 Reasons Why Trading With Indications Is Overrated

As the most traded index on the planet, let’s look at the S&P 500. Buy-and-hold state the advisors who benefit from your financial investment purchases though commissions. Each market condition needs its own suitable strategy.

MACD Crossover Indicator with alerts for #MetaTrader MT4, Get popular reviews related to Ma Crossover Alert.

Cycles Can Leapfrog Your Trading Success

To keep risks down, I suggest simply choosing the 200 Day Moving Average. You need to set extremely defined set of swing trading guidelines. Paul consented to study tough and to attempt to conquer his emotions of worry and greed.

Everyone desires to discover currency trading, or so it seems from the variety of people being drawn into the foreign currency, or forex, fad. However, as with most things, there’s an incorrect way and an ideal method. And the proper way has 3 important components.

But if you have a couple of bad trades, it can actually sour you on the entire trading video game Moving Average Trader .When you just have to step back and take an appearance at it, this is. Possibly, you simply require to get away for a day or more. Relax, do something different. Your unconscious mind will deal with the problem and when you come back, you will have a better outlook and can identify the trading opportunities faster than they can come at you.

Assistance & Resistance. Support-this term describes the bottom of a stock’s trading range. It resembles a floor that a stock price discovers it hard to penetrate through. Resistance-this term explains the top of a stock’s trading range.It’s like a ceiling which a stock’s rate does not seem to increase above. When to sell a stock or buy, assistance and resistance levels are important clues as to. Numerous effective traders purchase a stock at assistance levels and offer short stock at resistance. If a stock handles to break through resistance it might go much greater, and if a stock breaks its support it might indicate a breakdown of the stock, and it may go down much even more.

“This easy timing system is what I utilize for my long term portfolio,” Peter continued. “I have 70% of the funds I have designated to the Stock Forex MA Trading invested for the long term in leveraged S&P 500 Index Funds. My investment in these funds forms the core of my Stock portfolio.

She checked out her child’s eyes and smiled, thinking “How basic was that?” She had simply drawn up a Stocks MA Trading strategy for a put alternative trade based on her analysis of that very chart – she thought the price would decrease; how wrong would she have been?

Let’s suppose you remain in the very same camp as we are and you think the long term outlook on gold is really favorable. So, each time it dips listed below a particular worth level, you add more to your portfolio, generally “buying on the dips”. This might be rather different from another person who looked at a roll over as a factor to offer out. Yet, both traders are looking at the same technical levels.

Using the moving averages in your forex trading service would prove to be very beneficial. First, it is so simple to use. It is provided in a chart where all you have to do is to keep a keen eye on the best entrance and exit points. If the MAs are going up, thats an indication for you to begin purchasing. Nevertheless, if it is decreasing at a constant speed, then you should start offering. Having the ability to check out the MAs right would surely let you recognize where and how you are going to make more money.

Daily Moving Averages: There are lots of moving averages which is just the typical rate of a stock over a long period of time, on an annual chart I like to utilize 50, 100 and 200 daily moving averages. They provide a long ravelled curve of the typical rate. These lines will also end up being support and resistance points as a stock trades above or below its moving averages.

That’s because over that time, the marketplace might lose 80% in value like it performed in Japan in the 90s. Think about the MA as the exact same thing as the instrument panel on your ship. You desire to generate income in the forex, right?

If you are finding rare and engaging videos relevant with Ma Crossover Alert, and Ema Indicator, Basics of Swing Trading dont forget to list your email address for a valuable complementary news alert service totally free.