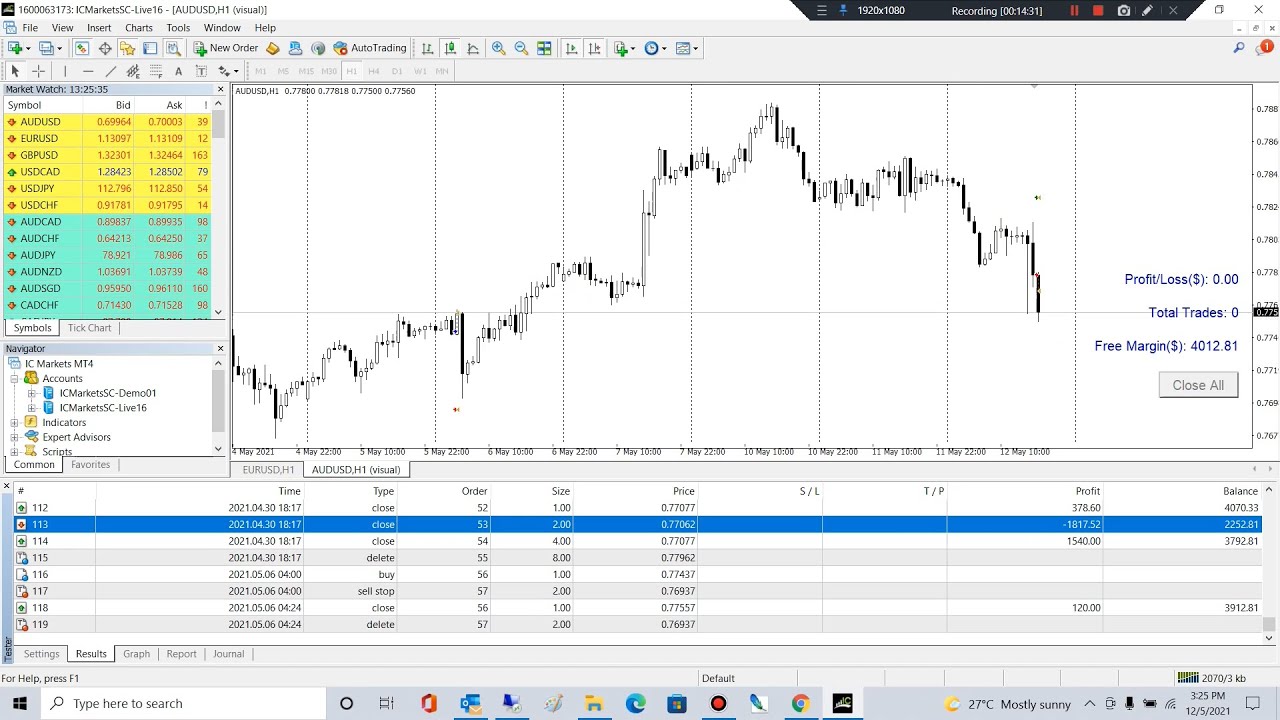

MA Crossover Expert Advisor

Best YouTube videos relevant with What Are the Best Indicators to Use, Trading Strong Trend, and Ma Crossover mt4, MA Crossover Expert Advisor.

13 Crosses 200 SMA – nearly same as golden crossover

Turning $1,000 to $4,000 in three months as back test

Ma Crossover mt4, MA Crossover Expert Advisor.

5 Day Trading Suggestions For Success

Now, another thing that you should have observed is that all these MAs are the average of past rates. The understanding and use of simple moving averages will accomplish this. At least as far as the retail investor is worried.

MA Crossover Expert Advisor, Search interesting replays about Ma Crossover mt4.

Various Types Of Day Trading Orders

Instead, you should focus on four to 5 indicators to make a trading choice. In a varying market, heavy losses will occur. There are numerous techniques and indicators to determine the trend.

I just got an e-mail from a member who says that they require assist with the technical analysis side of trading. The email started me believing about the most basic method to describe technical analysis to somebody who has no forex trading experience. So I wanted to compose a short article describing 2 very popular indicators and how they are used to make cash in the forex.

The down pattern in sugar futures is well established due to the expectations of a big 2013 harvest that need to be led by a record Brazilian harvest. This is news that everybody knows and this essential info has actually drawn in excellent traders to the sell side of the marketplace. Technical traders have also had a simple go of it because what rallies there have actually been have actually been topped nicely by the 90 day moving average. In fact, the last time the 30-day Moving Average Trader average crossed under the 90-day moving average remained in August of last year. Lastly, technical traders on the brief side have actually gathered earnings due to the organized decline of the market hence far instead of getting stopped out on any spikes in volatility.

There are a couple of possible explanations for this. The first and most obvious is that I was simply setting the stops too close. This might have enabled the random “noise” of the price motions to activate my stops. Another possibility is that either my broker’s dealing desk or some other heavy hitter in the market was participating in “stop searching”. I have actually composed a more complete short article on this subject already, but generally this involves market gamers who try to push the rate to a point where they believe a lot of stop loss orders will be activated. They do this so that they can either enter the marketplace at a much better cost on their own or to cause a snowballing relocation in a direction that benefits their current positions.

Choosing a time frame: If your day trading, buying and offering intra day, a 3 year chart will not help you. For intra day trading you wish to use 3,5 and 15 minute charts. Depending upon your longterm investment technique you can take a look at a 1 year, which I use frequently to a 10 year chart. The yearly chart offer me an appearance at how the stock is doing now in today’s market. I’ll look longer for historic support and resistance points but will Forex MA Trading my buys and sells based upon what I see in front of me in the annual.

Let us say that we wish to make a short-term trade, in between 1-10 days. Do a screen for Stocks MA Trading in a new up pattern. Raise the chart of the stock you have an interest in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and should be bought. But as soon as the 9 day crosses over the 4 day it is a sell signal. It is that easy.

So, when you utilize MAs, they lag behind the cost action and whatever trading signals that you get are always late. This is really crucial to comprehend. Another limitation with MAs is that they tend to whipsaw a lot in a choppy market. When the market is trending well but whipsaw a lot under a market moving sideways, they work well. The shorter the time period utilized in an MA, the more whipsaw it will have. Much shorter period MAs move quick while longer duration MAs move gradually.

Stochastics is utilized to figure out whether the market is overbought or oversold. When it reaches the resistance and it is oversold when it reaches the support, the market is overbought. So when you are trading a range, stochastics is the best indication to tell you when it is overbought or oversold. It is also called a Momentum Indication!

A way to measure the velocity or significance of the move you are going to trade versus. This is the trickiest part of the equation. The most common way is to measure the slope of a MA versus an otherwise longer term trend.

You simply have to have perseverance and discipline. As your stock moves up in price, there is an essential line you desire to enjoy. Pivot point trading is just among a toolbox of weapons offered to Forex market participants.

If you are looking rare and engaging reviews relevant with Ma Crossover mt4, and Forex Artificial Intelligence, Forex Opportunity, How to Read Stock Charts you should join in subscribers database totally free.