[LIVE] Day Trading | How I Made $460 in 5 Minutes (from start to finish…)

Latest replays related to Average Amount, Three Moving Averages, Stock Market Works, What Are the Best Indicators to Use, and Sma Trading Account, [LIVE] Day Trading | How I Made $460 in 5 Minutes (from start to finish…).

Let me show you how I made over $450 online in less than 5 minutes. I realize this may seem like clickbait, but I promise you it is not. If you are someone looking to make more money online or simply create a side hustle for yourself, this video is for you. While you may not understand everything that is taking place, you’ll see from start to finish how when you have a valid money making strategy, good things can happen. I do want to make clear though that what you see will not happen overnight. In order to make money online as you’ll see in the video, you’ll need to work hard and learn how to develop money making strategies that work for you. If you are dedicated enough and work hard, what you’ll see can become a viable side hustle and consistent stream of income.

Ready To Take Control And Join? go HERE: https://claytrader.com/takecontrol/?utm_source=social&utm_medium=youtube&utm_campaign=livetrade

Sign Up For My Live Webinar HERE: https://claytrader.com/1-hour-trader-transformation/?utm_source=social&utm_medium=youtube&utm_campaign=livetrade

WARNING / DISCLOSURE about this video – https://claytrader.com/videos/free-education-risk-case-study/?utm_source=social&utm_medium=youtube&utm_campaign=livetrade

Learn the Basics of the Stock Market: https://claytrader.com/blog/complete-trading-guide/?utm_source=social&utm_medium=youtube&utm_campaign=livetrade

Watch More Live Trade Videos: http://claytrader.com/video/live-trade/?utm_source=social&utm_medium=youtube&utm_campaign=livetrade

Day Trading, Day Trading Live, Day Trading Penny Stocks, Day Trading Stocks, Day Trading Learn To Trade, Day Trading Technical Analysis, Day Trading Stock Charts, Day Trading Pull Backs, Day Trading For Beginners, Day Trading Strategies, Day Trading BA

Sma Trading Account, [LIVE] Day Trading | How I Made $460 in 5 Minutes (from start to finish…).

Know What A Stock Beta Computation Is

We have to await a setup that assures an excellent return in a brief time. You will frequently see price respecting these lines and then blowing right through them. And the ideal way has 3 essential active ingredients.

[LIVE] Day Trading | How I Made $460 in 5 Minutes (from start to finish…), Explore top explained videos related to Sma Trading Account.

5 Actions To Trading Success Utilizing Technical Analysis

So which ones will respond quicker to the marketplace and be more apt to provide incorrect signals? Generally you will be looking for a short-term profit of around 8-10%. Oil had its largest percentage drop in 3 years.

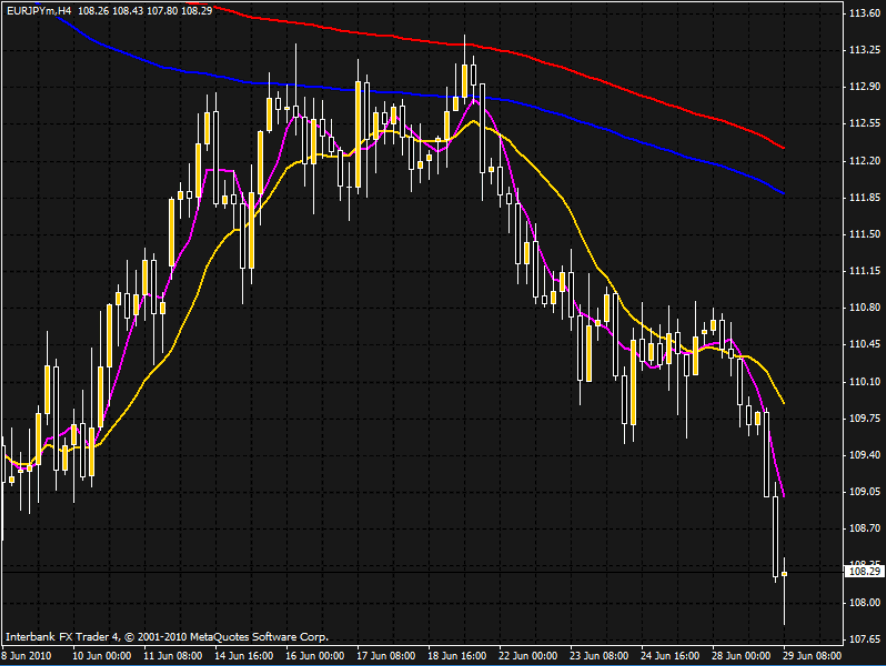

Moving averages (MAs) are one of the most easy yet the most popular technical indicators out there. Computing a moving average is extremely simple and is merely the average of the closing prices of a currency set or for that matter any security over a time period. The timeframe for a MA is identified by the number of closing costs you wish to include. Comparing the closing price with the MA can assist you figure out the trend, among the most crucial things in trading.

The down pattern in sugar futures is well established due to the expectations of a big 2013 harvest that must be led by a record Brazilian harvest. This is news that everybody knows and this fundamental info has actually attracted excellent traders to the sell side of the market. Technical traders have likewise had an easy go of it given that what rallies there have actually been have actually been topped well by the 90 day moving average. In reality, the last time the 30-day Moving Average Trader typical crossed under the 90-day moving average remained in August of in 2015. Finally, technical traders on the brief side have actually collected earnings due to the organized decline of the market so far instead of getting stopped out on any spikes in volatility.

There are a couple of possible explanations for this. The first and most apparent is that I was simply setting the stops too close. This might have enabled the random “sound” of the cost motions to trigger my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was taking part in “stop hunting”. I have actually composed a more complete post on this subject already, but basically this includes market players who try to press the price to a point where they believe a great deal of stop loss orders will be set off. They do this so that they can either get in the marketplace at a much better cost for themselves or to cause a snowballing relocation in a direction that benefits their current positions.

There are Forex MA Trading theories on why this sell-off is occurring. Obviously, any genuine strength or perhaps support in the U.S. dollar will generally be bearish for rare-earth elements like gold and silver. Due to the fact that the U.S. holds the biggest stockpiles of these metals and they are traded in U.S. dollars worldwide, this is mainly. Although gold is more of a recognized currency, they both have sensitivity to modifications in the U.S. dollar’s value.

Instead of signing up for an advisory letter you Stocks MA Trading decide to make up your own timing signal. It will take some preliminary work, once done you will not need to pay anybody else for the service.

Another forex trader does care excessive about getting a roi and experiences a loss. This trader loses and his wins are on average, much larger than losing. He wins double what was lost when he wins the video game. This shows a balancing in losing and winning and keeps the financial investments available to get an earnings at a later time.

Think of the MA as the very same thing as the cockpit console on your ship. Moving averages can tell you how quick a pattern is moving and in what instructions. However, you may ask, exactly what is a moving typical indication and how is it determined? The MA is precisely as it sounds. It is an average of a variety of days of the closing cost of a currency. Take twenty days of closing rates and compute an average. Next, you will graph the current cost of the market.

To help you determine trends you should also study ‘moving averages’ and ‘swing trading’. For example two standard rules are ‘do not buy a stock that is listed below its 200-day moving typical’ and ‘do not purchase a stock if its 5-day moving average is pointing down’. If you don’t comprehend what these quotes indicate then you need to research study ‘moving averages’. Great luck with your trading.

Did you lose money in 2008 stock exchange down turn? Moving averages – These are like trend lines, other than that they recede and stream with the cost of the instrument. Utilizing indicators for forex trading is important.

If you are looking unique and engaging comparisons relevant with Sma Trading Account, and Forex Indicator Systems, Forex Education you are requested to join our email alerts service for free.