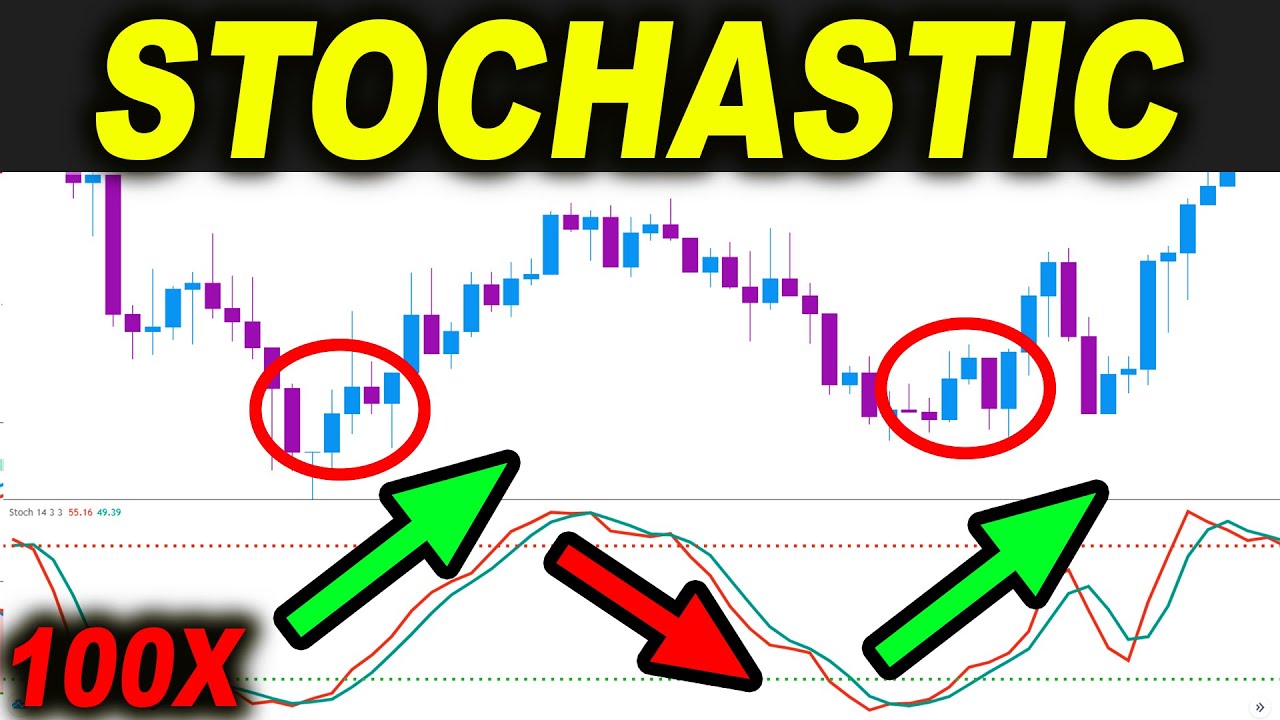

I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading

Top high defination online streaming about Swing Trading Basics, Exponential Moving, Forex Candlestick, and Ema Trading Rush, I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading.

Stochastic Trading Indicator Win Rate?

🌐Official Trading Rush Website: https://tradingrush.net

🟢See How I Made 100% Profit In A Year: https://www.patreon.com/tradingrush

📱Download the Official Trading Rush APP (Thanks): https://bit.ly/tradingrushapp

🟠I made the Best FREE Trading Course / Series: https://tradingrush.net/course/

▶️Subscribe for more Trading Rush !!

Ema Trading Rush, I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading.

Trading Forex Effectively Is Simpler Than You Think

A ‘moving’ average (MA) is the typical closing rate of a specific stock (or index) over the last ‘X’ days.

A lot of amateur traders will take out of a trade based upon what is occurring.

I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading, Get trending high definition online streaming videos related to Ema Trading Rush.

Breakout Trading – A Method To Attain Terrific Wealth

Each market condition needs its own appropriate method. Significant support is around 1,200, i.e. the 200 day MA, and Price-by-Volume bar. New traders often ask how numerous indications do you recommend utilizing at one time?

I can’t inform you just how much money you are going to need when you retire. If the quantity is inadequate it is not ‘when’, however ‘if’. You might have to keep working and hope one of those greeter tasks is offered at Wal-Mart.

When a stock moves between the support level and the resistance level it is stated to be in a pattern and you require to buy it when it reaches the bottom of the Moving Average Trader pattern and offer it when it arrives. Usually you will be searching for a short-term profit of around 8-10%. You make 10% revenue and you offer up and get out. You then search for another stock in a comparable trend or you wait for your original stock to fall back to its assistance level and you buy it back again.

The two charts listed below are same period day-to-day charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & utility stocks. The two charts below program SPX began the recent rally about a month prior to OIH. Also, the charts imply, non-energy & energy stocks fell over the previous week or two, while energy & energy stocks stayed high or increased further.

It’s tempting to begin trading at $10 or $20 a point just to see how much money, albeit make-believe money, you can Forex MA Trading in as short a time as possible. But that’s an error. If you’re to find out how to trade currencies beneficially then you should treat your $10,000 of make-believe cash as if it were genuine.

During these times, the Stocks MA Trading consistently breaks support and resistance. Obviously, after the break, the rates will generally pullback prior to continuing on its way.

The advantage of a frequent trading method is that if it is a profitable trading strategy, it will have a greater return the more times it trades, using a lower utilize. This is mentioning the obvious, but it is typically ignored when choosing a trading strategy. The goal is to make more profit using the least quantity of take advantage of or risk.

Stochastics indicator has got 2 lines understood as %K and %D. Both these lines are outlined on the horizontal axis for a provided period. The vertical axis is outlined on a scale from 0% to 100%.

Now, this really important if you alter the variety of durations of the easy moving average, you must change the standard variance of the bands also. For example if you increase the duration to 50, increase the standard variance to two and a half and if you decrease the period to 10, reduce the basic deviation to one and a half. Periods less than 10 do not appear to work well. 20 or 21 duration is the optimum setting.

This post has only detailed one strategy for each market scenario. 2 moving typical signs need to be used one quickly and another slow. Yesterdays SMA was approximately the rate points 1 – 8.

If you are looking rare and entertaining videos relevant with Ema Trading Rush, and Ema Indicator, Basics of Swing Trading dont forget to join our newsletter for free.