How to use Volume (and Volume Profiles)

New un-edited videos related to Forex Education, Foreighn Exchange Market, and How to Use Ema on Tradingview, How to use Volume (and Volume Profiles).

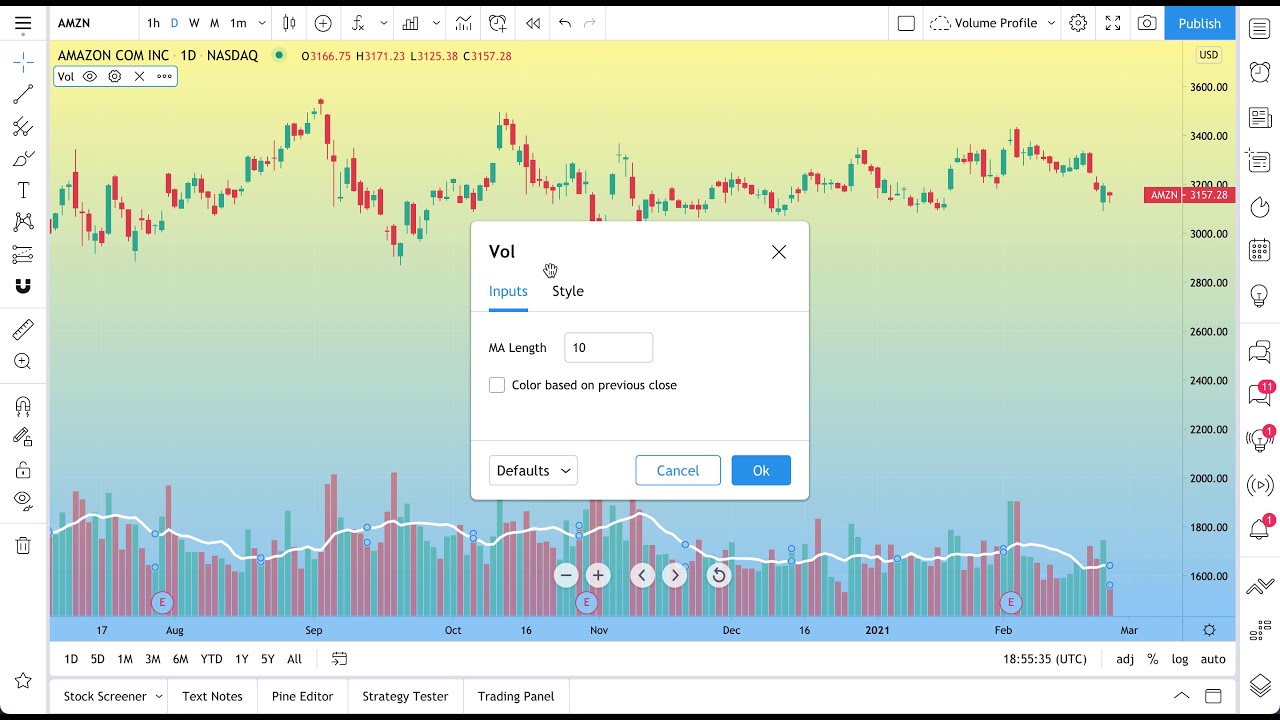

We quickly want to show you the basics of adding volume to your chart. Especially what that means and how it can be used. At its core volume shows you how many buyers and sellers transacted at a specific price. It shows you how many shares, contracts or coins were traded over a specific period of time.

Some traders use volume to confirm trends, measure popularity, and look for abnormal trading activity.

Volume is different from Volume Profiles in the sense that Volume shows you how much trading Volume occurred at a specific point in time. Volume Profiles show how much trading Volume occurred at a specific price. We explain this later on in the video toward the end.

Adding volume to your chart is easy. Open the Indicators menu and then search for Volume. From there, you can edit Volume to show you a moving average and change its color or appearance.

Try TradingView: https://tradingview.com

Share TradingView with friends and get $30 in TradingView Coins: https://www.tradingview.com/gopro/?share_your_love=TradingView

Follow us on Twitter: https://twitter.com/tradingview/

Follow us on Facebook: https://www.facebook.com/tradingview

How to Use Ema on Tradingview, How to use Volume (and Volume Profiles).

Stock Trading Online For Beginners – The Absolute Basics

They are support, resistance, volume, stochastic and 18 bar moving average. Traders wait up until the fast one crosses over or below the slower one. The green line portrays the major battle area for $1,000.

How to use Volume (and Volume Profiles), Find popular full videos related to How to Use Ema on Tradingview.

Stock Trading Courses – 7 Pointers To Choosing The Ideal Course!

3) Day trading implies quick earnings, do not hold stock for more than 25 minutes. They do not understand proper trading methods. This means that you require to know how to manage the trade prior to you take an entry.

I simply received an e-mail from a member who says that they require assist with the technical analysis side of trading. The email started me thinking of the simplest way to describe technical analysis to someone who has no forex trading experience. So I wanted to compose a short article explaining 2 popular indicators and how they are utilized to make cash in the forex.

Every trade you open ought to be opened in the instructions of the day-to-day trend. No matter the timeframe you use (as long as it is less than the daily timeframe), you must trade with the general direction of the marketplace. And the bright side is that finding the day-to-day trend Moving Average Trader is not tough at all.

Grooved range can also hold. If the selling is extreme, it might press the stock right past the grooved location – the longer a stock remains at a level, the more powerful the assistance.

Market timing is based upon the “reality” that 80% of stocks will follow the instructions of the broad market. It is based upon the “fact” that the Forex MA Trading pattern over time, have actually been doing so considering that the beginning of easily traded markets.

This suggests that you require to know how to handle the trade prior to you take an entry. In a trade management technique, you should have drawn up exactly how you will manage the trade after it is entered into the Stocks MA Trading so you know what to do when things turn up. Conquering trade management is extremely crucial for success in trading. This part of the system ought to consist of details about how you will react to all sort of conditions one you get in the trade.

At its core your FOREX trading system requires to be able to spot patterns early and also be able to prevent sharp increases or falls due to an especially unpredictable market. Initially look this may appear like a difficult thing to achieve and to be honest no FOREX trading system will carry out both functions flawlessly 100% of the time. Nevertheless, what we can do is design a trading system that works for the large majority of the time – this is what we’ll focus on when designing our own FOREX trading system.

NEVER attempt and predict ahead of time – act upon the reality of the modification in momentum and you will have the odds in your favour. Forecast and try and you are really just guessing and hoping and will lose.

The trader who gets a signal from his/her trading system that is trading on a medium based timeframe is permitting the info to be taken in into the market before taking a position and also to identify their danger. This trader whether he believes rates are random or not believes that information is collected and reacted upon at different rates for that reason providing opportunity to go into alongside The Wizard.

An uptrend is indicated by higher highs and higher lows. In this step, you might increase your cash and gold allocations further. The first and most apparent is that I was just setting the stops too close.

If you are searching rare and exciting videos relevant with How to Use Ema on Tradingview, and Stock Market Investing, Millionaire Trader please subscribe for subscribers database totally free.