How to Use Moving Averages | SMAs and EMAs

Latest videos highly rated 200-Day Moving Average, Trading System Guide, Stock Sell Signals, How to Read Stock Charts, and What Sma Stand For In Trading, How to Use Moving Averages | SMAs and EMAs.

How to Use Moving Averages | SMAs and EMAs

In this video, pro trader Charlie Moon, breaks down moving averages in simple terms and goes into depth on how to use them to your advantage when trading. He covers both SMAs and EMAs, and when you should be looking at one more than the other.

___________________________________

Get access to Charlie Moon’s FREE weekly options watchlist by clicking the link here:

https://trade.moonsrockettrades.com/moon-watchlist-rkt

___________________________________

Chapters:

0:00 Intro

0:40 How They’re Calculated

1:32 SMA vs EMA

2:34 What They Mean

27:00 Summary/Recao

33:22 Outro

___________________________________

© 2021 Prosper Trading Academy.

IMPORTANT NOTICE: Trading Stock, Stock Options, Cryptocurrencies, and their derivatives involves a substantial degree of risk and may not be suitable for all investors. Currently, cryptocurrencies are not specifically regulated by any agency of the U.S. government. Past performance is not necessarily indicative of future results. Prosper Trading Academy LLC provides only training and educational information. By visiting the website and accessing our content, you are agreeing to the terms and conditions. The testimonials contained in this communication were not solicited, no compensation was paid, are not necessarily representative of the experience of all students, and Prosper has not verified the accuracy of the statements contained in any testimonial.

What Sma Stand For In Trading, How to Use Moving Averages | SMAs and EMAs.

Forex Megadroid – Is This Forex Trading Robotic Actually The Finest Of The Finest?

Pivot point trading helps psychologically in establishing the buy zone and the sell zone. There are different patterns that represent bottoms, tops and reversals. What does that market tell you about the direction it is heading?

How to Use Moving Averages | SMAs and EMAs, Search latest updated videos about What Sma Stand For In Trading.

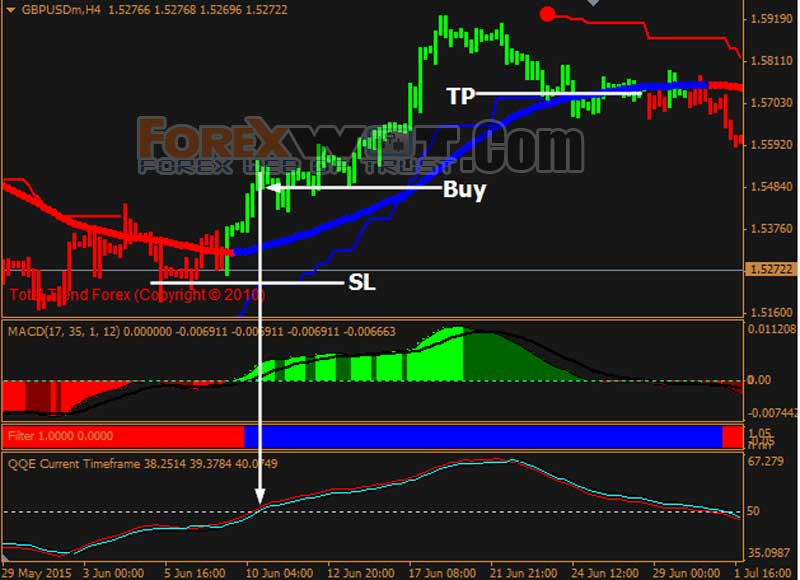

A Forex Trading Tool That No Trader Need To Be Without – Moving Averages

Individual tolerance for danger is an excellent barometer for choosing what share cost to brief. Do this three times or more to develop a trend. Traders wait till the fast one crosses over or listed below the slower one.

You should understand how to chart them if you trade stocks. Some people explore charts to find buy or offer signals. I discover this wasteful of a stock traders time. You can and need to chart all types of stocks including penny stocks. When to offer or purchase, charting tells you where you are on a stocks cost pattern this indicates it informs you. There are plenty of excellent business out there, you don’t wish to get captured purchasing them at their 52 week high and needing to linger while you hope the price comes back to the rate you paid.

However if you have a couple of bad trades, it can truly sour you on the entire trading game Moving Average Trader .When you just have to step back and take an appearance at it, this is. Possibly, you just require to get away for a day or two. Unwind, do something different. Your unconscious mind will deal with the problem and when you come back, you will have a much better outlook and can identify the trading opportunities quicker than they can come at you.

The 2 charts listed below are very same period everyday charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & energy stocks. The two charts listed below show SPX began the current rally about a month prior to OIH. Likewise, the charts suggest, non-energy & utility stocks fell over the previous week or so, while energy & energy stocks stayed high or increased even more.

While there is no way to predict what will happen, it does suggest that you need to be prepared in your investments to act if the Forex MA Trading begins to head south.

You have actually most likely heard the expression that “booming Stocks MA Trading climb up a wall of worry” – well there does not seem much of a wall of worry left anymore. A minimum of as far as the retail financier is concerned.

The brand-new short positions will have protective stops positioned relatively near the market given that risk must constantly be the number one consideration when figuring out a trade’s appropriateness. Today’s action clearly showed that the marketplace has actually lacked people happy to develop new short positions under 17.55. Markets constantly run to where the action is. The decreasing ranges combined with this week’s reversal bar lead me to believe that the next move is greater.

It’s really true that the marketplace pays a lot of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the distinction was a line drawn on a chart. When big blocks of cash will sell or purchase, moving averages for example are perfect research studies in. View the action surrounding a 200 day moving average and you will see first hand the warfare that happens as shorts attempt and drive it under, and longs buy for the bounce. It’s cool to view.

Remember, the secret to knowing when to purchase and sell stocks is to be consistent in applying your guidelines and comprehending that they will not work every time, however it’s a whole lot better than not having any system at all.

While it is $990 instead of $1,000 it does represent that milestone. This study was among the first to measure volatility as a dynamic movement. The 5 being quickly, 10 medium and 15 the sluggish.

If you are searching unique and entertaining reviews relevant with What Sma Stand For In Trading, and Option Trading, Swing Trading, Stock Trading, Momentum Forex Strategy you are requested to list your email address for email alerts service now.