How to Use Moving Averages on MT4

Best overview top searched Perfect Systems, Exponential Moving Average Forex Indicator, and Ma Crossover mt4, How to Use Moving Averages on MT4.

Learn how to use Moving Average and SMAs on the MT4 platform, brought to you by Investoo.com.

The Moving Average is by far one of the most popular indicators used by Forex traders on the MT4 platform. Learn how it works and how to apply it to your trading strategy in this short video.

Join Investoo.com today and learn to trade in more than video lessons and trading courses.

LEARN TO TRADE IN OUR FREE TRADING COURSES:

Forex Beginners Course: http://www.investoo.com/forex-trading-beginners/

MT4 Course: http://www.investoo.com/mt4-software-tutorials/

Technical Analysis Course: http://www.investoo.com/advanced-technical-analysis/

Price Action Course: http://www.investoo.com/price-action-trading-course/

Forex Strategies: http://www.investoo.com/forex-beginner-strategies-course/

Advanced Forex Scalping Course: http://www.investoo.com/forex-scalping-course/

Binary Options Course: http://www.investoo.com/binary-options-strategies-course/

Binary Options Strategies: http://www.investoo.com/binary-options-strategy/

Ma Crossover mt4, How to Use Moving Averages on MT4.

Bollinger Band Trading

Any strategy used need to likewise avoid over trading. The 30-minute BI is strictly the high and the low of the very first thirty minutes of trading. Intricately created methods do not constantly work.

How to Use Moving Averages on MT4, Enjoy more full videos relevant with Ma Crossover mt4.

Why Utilize Technical Indications?

Nevertheless it has the advantage of offering, in numerous scenarios, the most inexpensive entry point. You want the larger rate at the end of the trade. It was throughout my search for the perfect robot that I read Marcus B.

You must understand how to chart them if you trade stocks. Some people search through charts to discover buy or sell signals. I discover this wasteful of a stock traders time. You can and need to chart all types of stocks consisting of penny stocks. Charting tells you where you are on a stocks cost pattern this implies it informs you when to sell or buy. There are plenty of fantastic companies out there, you do not wish to get captured buying them at their 52 week high and having to wait around while you hope the price returns to the price you paid.

At times, the changes can occur abruptly. These down and upward spikes are a sign of major modifications within the operation of a business and they set off Moving Average Trader reactions in stock trading. To be ahead of the video game and on top of the situation, strategy ahead for contingency steps in case of spikes.

The most fundamental application of the BI concept is that when a stock is trading above its Bias Sign you must have a bullish predisposition, and when it is trading listed below its Bias Indication you need to have a bearish bias.

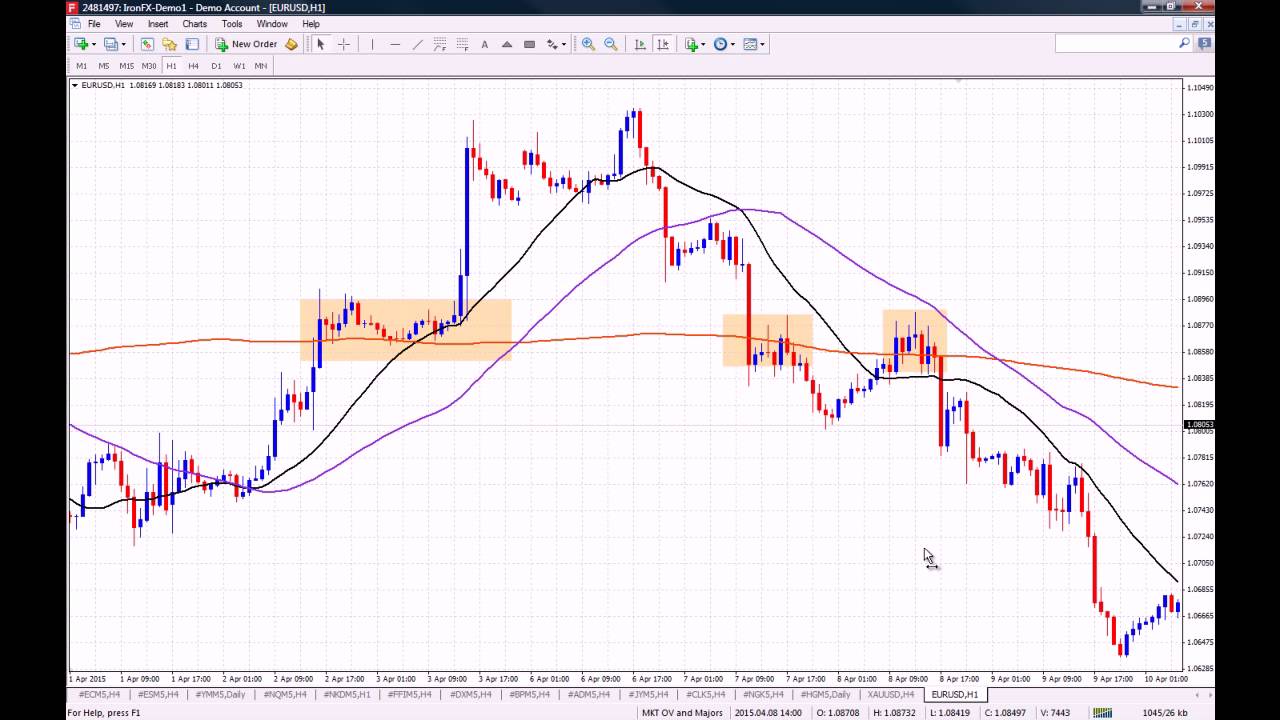

The chart below is a Nasdaq weekly chart. Nasdaq has been producing a rising wedge for about two years. The Forex MA Trading indicator has been relocating the opposite direction of the price chart (i.e. negative divergence). The 3 highs in the wedge fit well. Nevertheless, it doubts if the third low will also give an excellent fit. The wedge is compressing, which should continue to generate volatility. Numerous intermediate-term technical indicators, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, etc., suggest the marketplace will be higher sometime within the next few months.

Rather of registering for an advisory letter you Stocks MA Trading choose to make up your own timing signal. It will take some initial work, once done you will not have to pay anyone else for the service.

As bad as things can feel in the precious metals markets these days, the fact that they can’t get excessive worse has to console some. Gold especially and silver are looking excellent technically with gold bouncing around strong support after its second run at the age-old $1,000. Palladium looks to be holding while platinum is anyone’s guess at this point.

Knowing where to set your stop loss can be challenging – you desire to limit just how much you could possibly lose so you ‘d be tempted to set an extremely small variety, but at the very same time you wish to permit short-term increases and falls so that you do not exit your position too early.

To assist you recognize trends you must also study ‘moving averages’ and ‘swing trading’. For example two standard guidelines are ‘do not purchase a stock that is listed below its 200-day moving average’ and ‘don’t buy a stock if its 5-day moving average is pointing down’. If you don’t comprehend what these quotes imply then you require to research study ‘moving averages’. Best of luck with your trading.

What they want is a forex technique that turns into a profit within minutes of participating in the trade. There is a wide variety of financial investment idea sheets and newsletters on the internet.

If you are finding rare and entertaining comparisons relevant with Ma Crossover mt4, and Greatest Forex Day Trading Strategy, Forex Trading Systems, Market Swings you should list your email address our email alerts service for free.