Here's the Best Moving Average Period (tested on 353,236 trades)

Top updated videos about Currency Exchange Rate, Forex Trading Ideas, Share Market, and Ma Crossover Strategy, Here's the Best Moving Average Period (tested on 353,236 trades).

✅ Free webinar – elevate your trading using algorithmic strategies ➔ https://bit.ly/3oaqAsl

✅ My flagship programme (6 strategies, signals, support & community) ➔ https://bit.ly/3IRGcsi

———————–

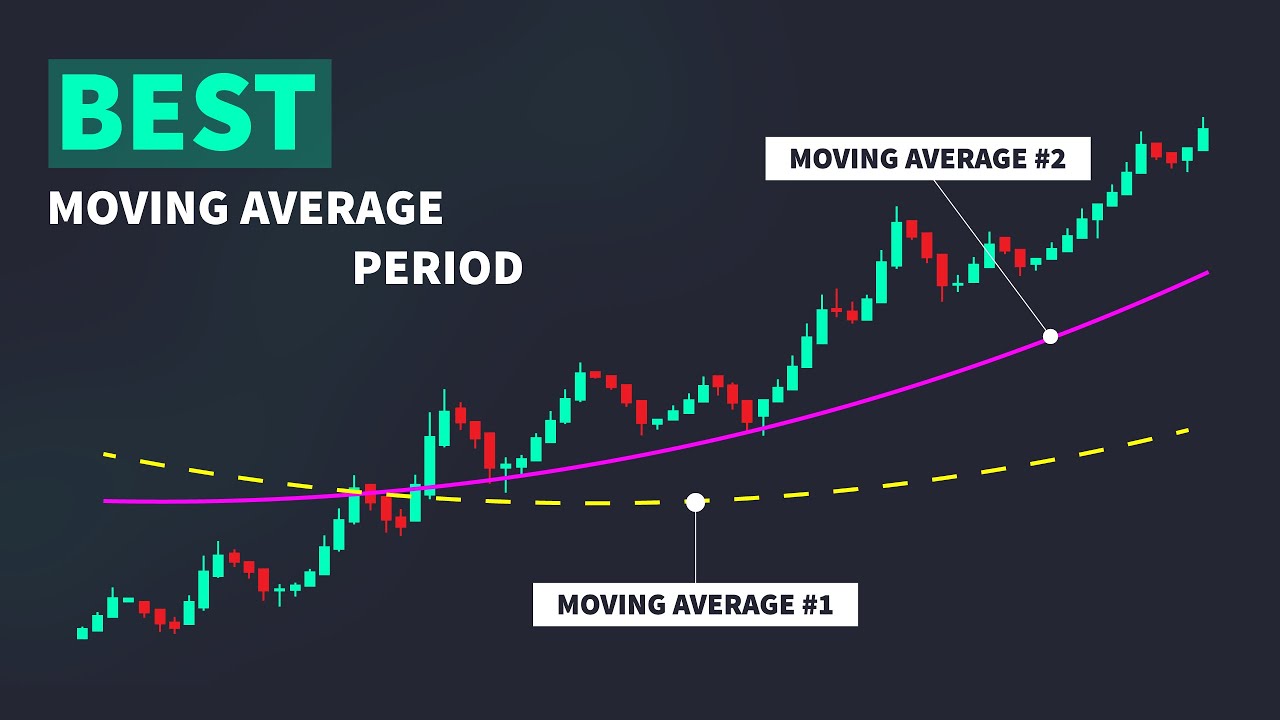

In this video, I take a simple moving average crossover trading strategy and run an extensive optimisation on all S&P 500 stocks to find the best entry and exit parameters

———————–

Rules used in all tests

– S&P 500 stocks, taking historical index constituents into the account

– 10 positions held, 10k capital assumed, no leverage

– Closing price at least 5 USD at time of entry

– In case of multiple signals, signal ranking based on stock’s return over 350 days

– SPX index is greater than its price 126 days ago at time of entry

– 10% trailing stop-loss

———————–

Video chapters:

00:00 Intro

01:12 Finding the best moving average length for entries

04:58 Finding the best moving average length for exits

06:16 Final results comparison – equities & backtest reports

Ma Crossover Strategy, Here's the Best Moving Average Period (tested on 353,236 trades).

Automated Forex System Trading – Keeping Positive Expectancy

Generally, the higher the durations the more earnings the trader can gain and likewise the more risks. Then you need to utilize the indications that professional traders use. Some individuals wish to make trading so difficult.

Here's the Best Moving Average Period (tested on 353,236 trades), Watch trending complete videos related to Ma Crossover Strategy.

Best Stock Indicator To Use For 2011

A normal forex rate chart can look really irregular and forex candlesticks can obscure the pattern even more. Now, another thing that you need to have observed is that all these MAs are the average of past costs.

As soon as in a while the technical indicators begin making news. Whether it’s the VIX, or a moving average, someone gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as a financier one has to ask, “are technical signs really a factor to sell or purchase?” In some respects the answer is no, since “investing” is something different from swing trading or day trading.

If that ratio gets incredibly high, like 100, that means that silver is low-cost relative to gold and might be a great value. If the number is low, silver Moving Average Trader may be getting overly pricey.

Another great way to utilize the sideways market is to take scalping trades. Despite the fact that I’m not a huge fan of scalping there are many traders who effectively make such trades. You take a brief trade when cost approaches the resistance level and exit at the assistance level. Then you make a long trade at the assistance level and exit when cost approaches the resistance level.

Now when we use 3 MAs, the moving average with the least variety of periods is identified as quick while the other two are characterized as medium and slow. So, these 3 Forex MA Trading can be 5, 10 and 15. The 5 being quickly, 10 medium and 15 the slow.

There are numerous strategies and signs to recognize the trend. My favorite ones are the most basic ones. I like to use a moving typical indicator with the a great deal of averaging durations. Increasing Stocks MA Trading indicates the uptrend, falling MA shows the sag.

You will be considered a pattern day trader no matter you have $25,000 or not if you make four or more day trades in a rolling five-trading-day period. A day trading minimum equity call will be issued on your account requiring you to deposit additional funds or securities if your account equity falls listed below $25,000.

Using the moving averages in your forex trading company would show to be really advantageous. Initially, it is so easy to use. It exists in a chart where all you have to do is to keep an eager eye on the very best entryway and exit points. Thats an indication for you to begin purchasing if the MAs are going up. However, if it is decreasing at a constant pace, then you should begin offering. Being able to read the MAs right would surely let you recognize where and how you are going to make more money.

Daily Moving Averages: There are numerous moving averages which is simply the typical rate of a stock over an extended period of time, on an annual chart I like to utilize 50, 100 and 200 day-to-day moving averages. They supply a long ravelled curve of the typical price. These lines will also end up being assistance and resistance points as a stock trades above or below its moving averages.

I then combined this Non-Lagging AMA with another indication called the Beginners Alert. You should constantly secure your trades with a stop loss. So this system has the exact same gaining average over time as turning a coin.

If you are finding unique and exciting videos related to Ma Crossover Strategy, and What Are the Best Indicators to Use, Demarker Indicator you are requested to list your email address our subscribers database now.