Guppy Multiple moving average & Exponential Moving Average | SMA- EMA Trading Strategy

https://www.youtube.com/watch?v=sm3d3ef6Lbo

New un-edited videos top searched Successful Trading, Stock Charting, and How To Use Sma In Trading, Guppy Multiple moving average & Exponential Moving Average | SMA- EMA Trading Strategy.

Guppy Multiple moving average & Exponential Moving Average | SMA- EMA Trading Strategy Thanks for watching our video …

How To Use Sma In Trading, Guppy Multiple moving average & Exponential Moving Average | SMA- EMA Trading Strategy.

Stock Market Technique – Stock Trading In A Stock Exchange Crash

Nasdaq has actually rallied 310 points in 3 months, and struck a new four-year high at 2,201 Fri early morning.

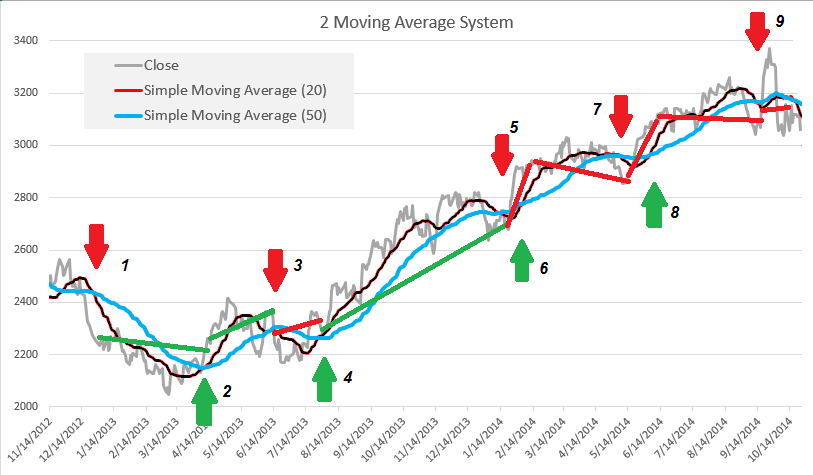

Lots of indicators are available in order to identify the trends of the market.

Guppy Multiple moving average & Exponential Moving Average | SMA- EMA Trading Strategy, Play latest complete videos about How To Use Sma In Trading.

Forex Finance – Offer With Volatility Or Lose Your Equity

Here is a perfect example of a method that is simple, yet creative adequate to guarantee you some added wealth. Now if you look at a moving average, you see it has no spikes, as it smooths them out due to its averaging.

When I initially heard of FAP Turbo, I was not excited because I have lost cash trading forex on my own with a specific robotic and without the right tools and methods. It was throughout my look for the perfect robot that I check out Marcus B. Leary statement of it being the most advanced live trading forex robot efficient in doubling your money every month. I trusted Marcus therefore chose to provide it a try by downloading it for $149. Was I pleased with the outcome? You wager I did. Read the finest FAP Turbo evaluation listed below before you decide to begin online currency trading using this robotic or any other.

Technical analysis can be extremely useful for Moving Average Trader to time our entries and exits of the trade. It should not be utilized alone due to the fact that it can be confusing information if not used properly.

There are a couple of possible explanations for this. The very first and most obvious is that I was simply setting the stops too close. This might have permitted the random “sound” of the rate movements to trigger my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was taking part in “stop searching”. I have actually composed a more complete short article on this subject currently, however essentially this involves market gamers who attempt to press the rate to a point where they believe a lot of stop loss orders will be activated. They do this so that they can either get in the market at a much better cost for themselves or to cause a cumulative move in an instructions that benefits their existing positions.

While there is no other way to anticipate what will occur, it does recommend that you should be prepared in your investments to act if the Forex MA Trading begins to head south.

Can we buy before the share price reaches the breakout point? In many circumstances we can, but ONLY if the volume boosts. Often you will have a high opening rate, followed by a quick retracement. This will often be followed by a quick rise with high volume. This can be a buy signal, once again, we need to Stocks MA Trading sure that the volume is strong.

Here is a best example of a technique that is easy, yet creative enough to ensure you some added wealth. Start by selecting a specific trade that you think is successful, state EUR/USD or GBP/USD. When done, select two indications: weighted MA and basic MA. It is advised that you utilize a 20 point weighted moving average and a 30 point moving average on your 1 hour chart. The next action is to look out for the signal to sell.

This trading tool works much better on currency set price history than on stocks. With stocks, price can space up or down which triggers it to give false readings. Currency set’s rate action hardly ever gaps.

Individual tolerance for danger is a good barometer for selecting what share cost to brief. Try reducing the amount of capital generally used to a trade until becoming more comfortable with the strategy if new to shorting.

Likewise getting in and out of markets although cheaper than in the past still costs money. It is always much easier to paddle in the direction of the river! Long as the stock holds above that breakout level.

If you are finding unique and entertaining reviews related to How To Use Sma In Trading, and Primary Trend, Buy Signal, Successful Forex Trading, Forex Education dont forget to signup in a valuable complementary news alert service for free.