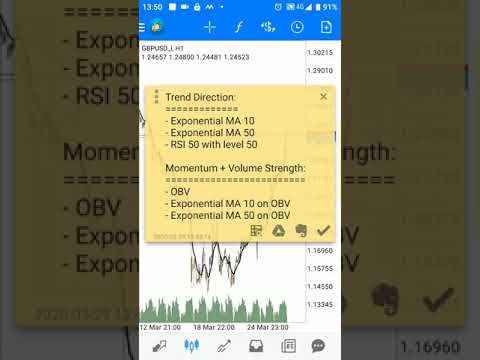

Forex Trading Strategy for Mobile Phone: EMA and OBV

Top reviews top searched Call Options, Entry Strategy, Moving Av, and How to Use Ema in Forex Trading, Forex Trading Strategy for Mobile Phone: EMA and OBV.

This forex trading strategy is for mobile version of Meta Trader. Based on EMA + RSI + OBV indicators.

Best on a trending market, use it on H1 – Daily timeframe.

Note: ALWAYS…ALWAYS..test any strategy on demo account first for at least a month before using it on a real account.

Good Luck!

Strategy in action: https://youtu.be/RDfJeAtSgec

How to Use Ema in Forex Trading, Forex Trading Strategy for Mobile Phone: EMA and OBV.

Forex Leading Signs: Exists A True Leading Sign?

There’s plenty out there, however we only advise one. Another example of an easy timing system might be expressed as follows. Volume is one of the most important signs to try to find.

Due to the fact that they are lagging indicators.

Forex Trading Strategy for Mobile Phone: EMA and OBV, Find popular full videos relevant with How to Use Ema in Forex Trading.

Simulated Forex Trading For Beginners

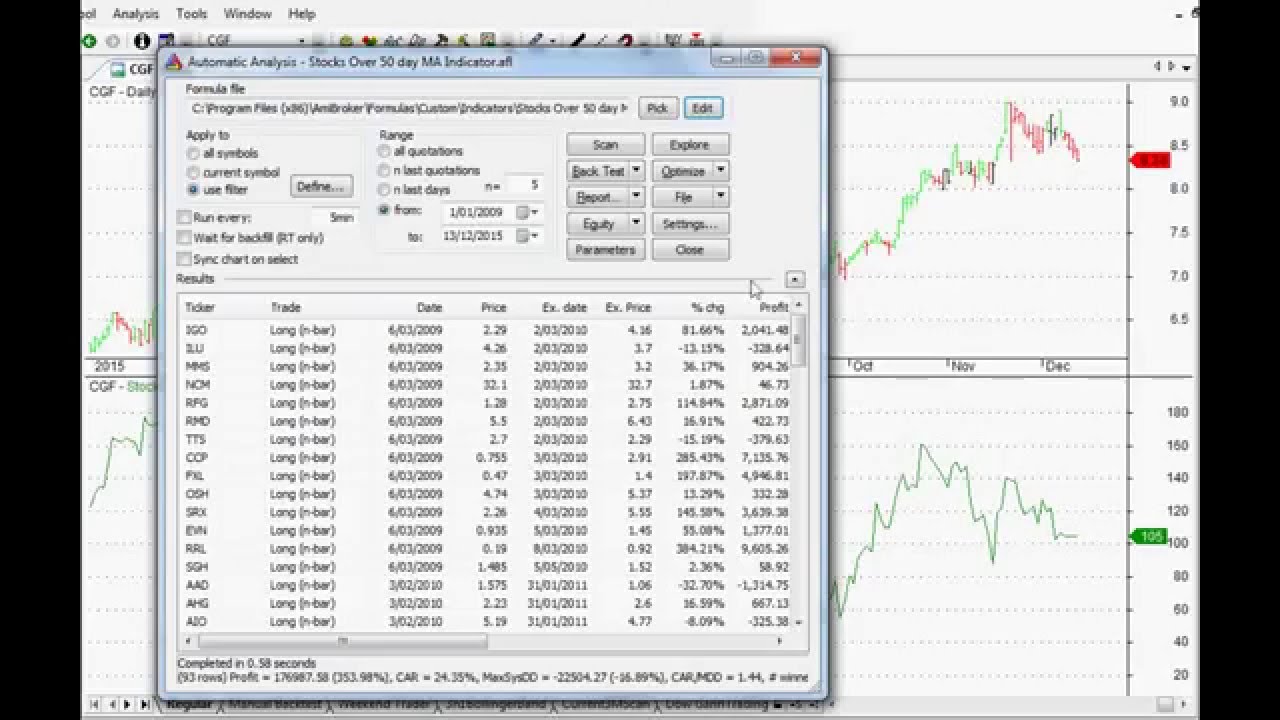

The software application the traders utilize at the online trading platforms is more easy to use than it was years back. Now if you take a look at a moving average, you see it has no spikes, as it smooths them out due to its averaging.

You should understand how to chart them if you trade stocks. Some people explore charts to discover buy or offer signals. I find this inefficient of a stock traders time. You can and require to chart all kinds of stocks consisting of penny stocks. Charting tells you where you are on a stocks price pattern this suggests it informs you when to purchase or sell. There are plenty of terrific companies out there, you do not want to get caught purchasing them at their 52 week high and needing to linger while you hope the price returns to the cost you paid.

When a stock relocations in between the assistance level and the resistance level it is stated to be in a trend and you need to purchase it when it reaches the bottom of the Moving Average Trader pattern and sell it when it reaches the top. Typically you will be looking for a short-term profit of around 8-10%. You make 10% profit and you offer up and get out. You then search for another stock in a similar pattern or you wait on your original stock to fall back to its assistance level and you purchase it back again.

Another excellent way to use the sideways market is to take scalping trades. Despite the fact that I’m not a big fan of scalping there are many traders who effectively make such trades. You take a short trade when rate approaches the resistance level and exit at the support level. Then you make a long trade at the support level and exit when cost approaches the resistance level.

In the middle of this awful experience, her 12 years of age child got home from School and found her mom in tears. “What’s wrong Forex MA Trading?” her child asked. “Oh, this choice trading will be the death of me darling,” Sidney sobbed.

Let us say that we wish to make a short term trade, between 1-10 days. Do a screen for Stocks MA Trading in a new up pattern. Raise the chart of the stock you are interested in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving average the stock is going to continue up and must be bought. However as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

Draw the line to recognize the assistance and resistance levels. The more the line is touched, the more crucial it becomes as an assistance or resistance levels. An uptrend is suggested by greater highs and higher lows. A downtrend is suggested by lower highs and lower lows.

I have mentioned this a number of times, but I believe it is worth mentioning once again. The most common moving average is the 200-day SMA (basic moving average). Very basically, when the market is above the 200-day SMA, traders say that the market is in an uptrend. The market is in a sag when price is listed below the 200-day SMA.

The trader who gets a signal from his/her trading system that is trading on a medium based timeframe is allowing the information to be absorbed into the market prior to taking a position and also to determine their threat. This trader whether he believes prices are random or not thinks that information is collected and responded upon at different rates therefore giving opportunity to get in alongside The Wizard.

The company also slashed its projection for the very first quarter of next year to simply 0.5%. Now this would depend upon what works best for you so as not to get puzzled. Some individuals want to make trading so difficult.

If you are searching best ever entertaining reviews relevant with How to Use Ema in Forex Trading, and Millionaire Trader, Buy and Hold you should subscribe in subscribers database now.