Forex Trading – Forex Update: Selling AUDUSD Under Resistance and 100 SMA

Latest un-edited videos related to Perfect Systems, Moving Average Crossover, and What Is Sma In Trading Account, Forex Trading – Forex Update: Selling AUDUSD Under Resistance and 100 SMA.

To Get Ross’ Free Forex Update Analysis – Click Here:

http://mytotalsupport.com/cpv/base.php?c=86&key=fd5d14f7ec45b14d31a944108238114b&ls=youtube&keyword=forex_trading&ad=H2ap_-KFXJY

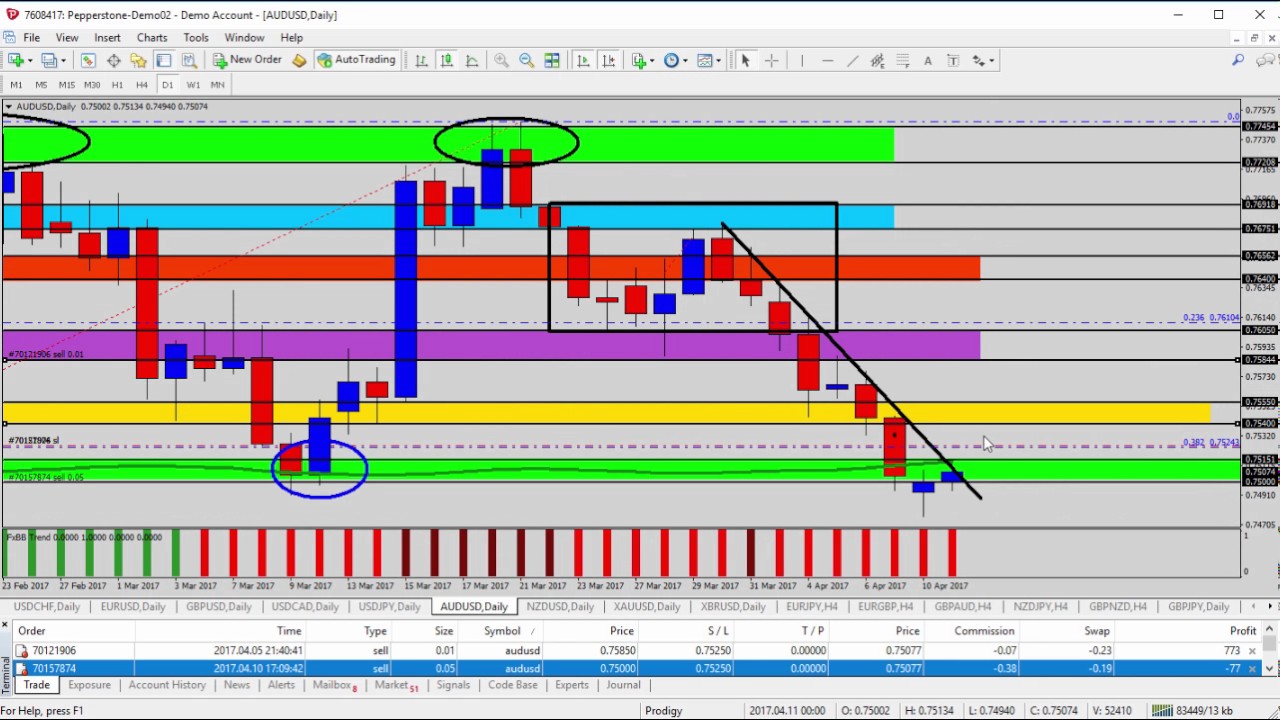

If we’re going to sell this in the direction of the trend, we want it to go up a little bit, and that’s what it’s done yesterday and today. Found the low. It came back up towards the green zone, so it gives us an opportunity at least to go short with lower risk and higher potential reward. Well, at this point, my stop loss would be just above the green-shaded area. That way, if it gets above, I limit the impact to my trading account. So, all that, to me, points to going bearish and looking for the right opportunity to do so just around the 0.7500 to 0.7515-level, which is the entire green-shaded area.

0.7500 to 0.7515. Anywhere within there. So, I have yesterday of course added on the trade at 0.7500, the bottom of the green zone. If you didn’t do that, you could add it closer to the 0.7510-level, and that would get you a little bit better price than what I have. Actually this is an add-on position for me. My original position is all the way up here at the purple zone. When we broke under the purple zone, retested the 0.7585-level, I actually got in all the way up here in the middle of the black trend line. So, that was the original entry and you can see that going down here. I have one lot left on that entry from the purple zone.

So, actually this trade for me is add-on position. But if you didn’t get into the purple zone and you’re not in it originally, this gives you an opportunity to do so. Take it down to the four-hour timeframe. And again, doesn’t really change it. We saw the market push under the purple zone. Settle out underneath it. That’s where we got in the original sell. It broke the yellow zone, settled out underneath it, where the black circle is, and then made a new low. And now we’ve broken the green zone. Now we’re looking for a resumption of that pattern where the breakout, resistance, congestion, breakout, resistance, congestion, breakout, resistance. Now we’re needing the market to start working its way back in our direction.

If it doesn’t, like I said, the stop loss should be placed just above the green zone. That way you limit the impact if the market decides to do something different that it’s done through the rest of the trending pattern and go back up. We also have one last clue here. Forex Black Book is red. That also gives us a little bit of a bearish bias. We don’t have a new signal yet for the Forex Black Book, but I would anticipate the longer it stays here in the green zone and any bearish movement at all, may give us a new red or yellow sell arrow for the AUDUSD today.

Disclaimer:

This video is for general information only and is not intended to provide trading or investment advice or personal recommendations. Any information relating to past performance of an investment does not necessarily guarantee future performance. Forex Traders Daily including its analysts shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on any information in this video. Please remember derivatives and FX spot carries significant risks and may not be suitable for all investors. Losses can exceed your deposits.

What Is Sma In Trading Account, Forex Trading – Forex Update: Selling AUDUSD Under Resistance and 100 SMA.

Forex Trading Success – A Basic Technique For Big Gains

Normally, the greater the periods the more earnings the trader can acquire and also the more risks. Then you require to utilize the signs that expert traders utilize. Some people wish to make trading so challenging.

Forex Trading – Forex Update: Selling AUDUSD Under Resistance and 100 SMA, Find top updated videos about What Is Sma In Trading Account.

Trend Trading – Trading Stocks Utilizing Technical Analysis And Swing Trading Strategies

What were these essential experts missing out on? When a trend is in motion, we like to track stops behind the 40 day ma. An uptrend is suggested by greater highs and greater lows. Because they are lagging indications.

In less than four years, the cost of oil has increased about 300%, or over $50 a barrel. The Light Crude Continuous Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Constantly high oil costs will eventually slow economic development, which in turn will cause oil prices to fall, ceritus paribus.

The time frame is brief and is from 2 minutes to 5 minutes. The quickest scalping strategy is tape reading where the Moving Average Trader reads the charts and positions a trade for a brief time period. In this short article is the focus on longer trades than the short tape reading technique.

Another great way to utilize the sideways market is to take scalping trades. Even though I’m not a big fan of scalping there are numerous traders who effectively make such trades. You take a brief trade when cost approaches the resistance level and exit at the assistance level. Then you make a long trade at the support level and exit when price approaches the resistance level.

There is a myriad of investment idea sheets and newsletters on the web. Regrettably, many if not the majority of them are paid to promote the stocks they recommend. Instead of blindly following the recommendations of others you need to develop swing trading guidelines that will trigger you to get in a trade. This Forex MA Trading be the stock moving throughout a moving average; it might be a divergence between the stock price and an indication that you are following or it might be as basic as searching for assistance and resistance levels on the chart.

The founders of technical analysis regarded it as a tool for an elite minority in a world in which basic analysis reined supreme. They concerned themselves as smart Stocks MA Trading predators who would conceal in the weeds and knock off the huge video game fundamentalists as they came rumbling by with their high powered technical rifles.

Another forex trader does care excessive about getting a return on investment and experiences a loss. This trader loses and his wins are on average, much bigger than losing. When he wins the video game, he wins double what was lost. This shows a balancing in losing and winning and keeps the financial investments available to get a profit at a later time.

As soon as the buzz settles and the CME completes its margin increase on Monday, we need to see silver rates support. From my viewpoint, I see $33 as a level I might cautiously start to purchase. I believe assistance will be around $29 till the Fed chooses it’s time to cool inflation if silver breaks below that level.

Do not simply purchase and hold shares, at the same time active trading is not for everybody. Utilize the 420 day SMA as a line to choose when to be in or out of the S&P 500. Traders can likewise aim to trade brief when the market falls listed below the 420 day SMA.

Nasdaq has been developing an increasing wedge for about two years. By doing this, you wont need to fret about losing money whenever you trade. You wish to generate income in the forex, right?

If you are looking updated and exciting comparisons about What Is Sma In Trading Account, and Stock Trading, Beginner Trading, Forex Market dont forget to join our email list now.