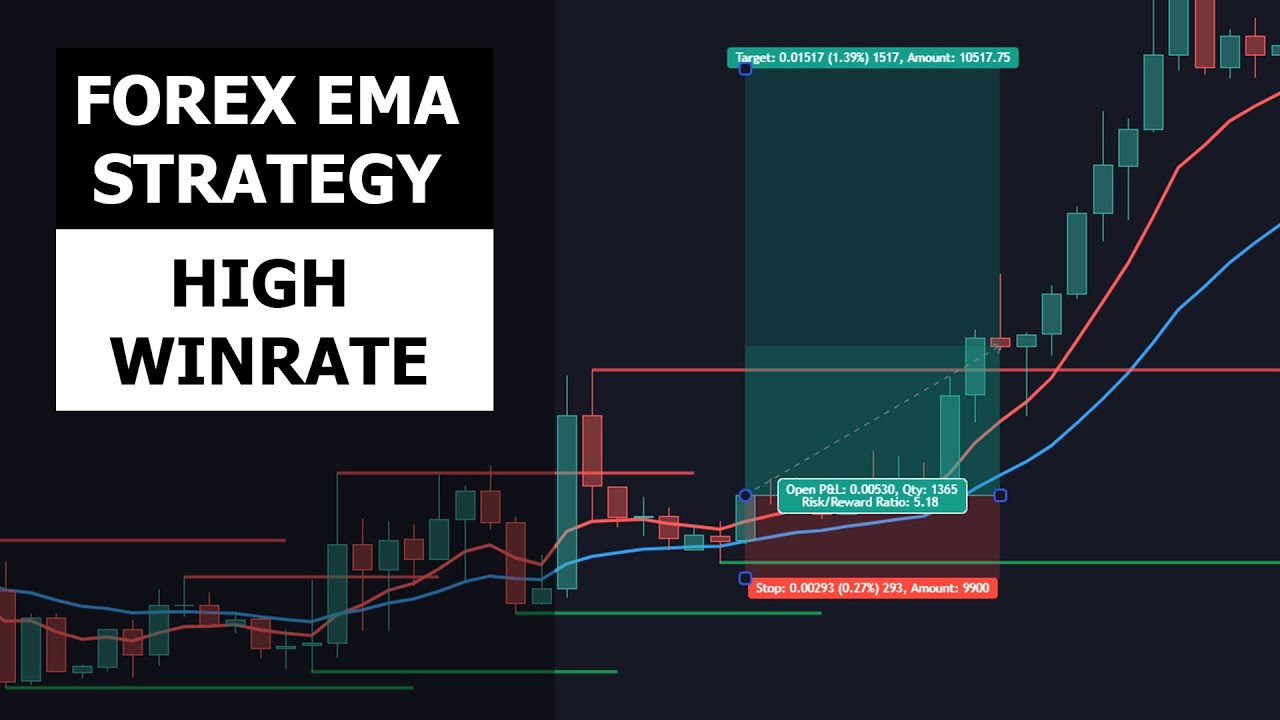

Forex EMA Stochastics RSI Strategy with High Win Rate

Best un-edited videos related to Stock Indicator, Range Trading, Buy Weakness, and How to Use Ema Forex, Forex EMA Stochastics RSI Strategy with High Win Rate.

In this forex trading strategy I use the 8 and 20 exponential moving average (#ema), the #stochastics #rsi and the higher high lower low indicator to find pullback trades on my Forex chart,

You can find my tradingview indicators here:

https://www.tradingview.com/u/trading-guide/#published-scripts

Production Music courtesy of Epidemic Sound: http://www.epidemicsound.com

How to Use Ema Forex, Forex EMA Stochastics RSI Strategy with High Win Rate.

Recognizing Market Tops – A Key To Ending Up Being An Elite Trader

We need to wait on a setup that guarantees a great return in a brief time. You will typically see price respecting these lines and then blowing right through them. And properly has three vital components.

Forex EMA Stochastics RSI Strategy with High Win Rate, Enjoy new reviews relevant with How to Use Ema Forex.

Complimentary Day Trading System

Did you gain money in the current stock bull-run started given that March of 2009? An e-mailed short article means you have at least strike the interest nerve of some member of your target market.

Once in a while the technical indications begin making news. Whether it’s the VIX, or a moving average, somebody gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as an investor one has to ask, “are technical signs really a factor to offer or purchase?” In some respects the answer is no, since “investing” is something different from swing trading or day trading.

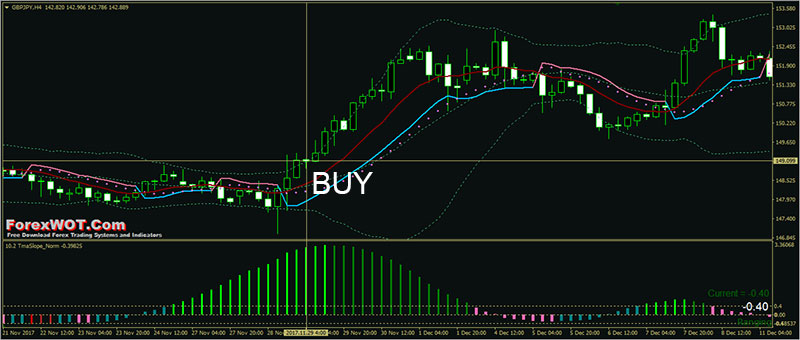

Every trade you open must be opened in the instructions of the everyday pattern. Despite the timeframe you use (as long as it is less than the daily timeframe), you ought to trade with the general instructions of the marketplace. And the bright side is that discovering the day-to-day pattern Moving Average Trader is not tough at all.

The technical analysis should likewise be figured out by the Forex trader. This is to forecast the future trend of the rate. Common indications used are the moving averages, MACD, stochastic, RSI, and pivot points. Keep in mind that the previous indicators can be used in combination and not just one. This is to confirm that the cost trend holds true.

Choosing an amount of time: If your day trading, buying and offering intra day, a 3 year chart will not help you. For intra day trading you want to use 3,5 and 15 minute charts. Depending upon your longterm financial investment strategy you can take a look at a 1 year, which I utilize usually to a 10 year chart. The annual chart provide me a take a look at how the stock is doing now in today’s market. I’ll look longer for historic assistance and resistance points however will Forex MA Trading my buys and sells based on what I see in front of me in the annual.

The frequency is necessary in option. For instance, provided two trading systems, the first with a greater revenue aspect but a radio frequency, and the second a higher frequency in trades however with a lower revenue factor. The second system Stocks MA Trading have a lower revenue factor, but due to the fact that of its higher frequency in trading and taking little earnings, it can have a higher overall earnings, than the system with the lower frequency and higher earnings element on each individual trade.

Draw a line to acknowledge the assistance and resistance levels. The more the line is touched, the more crucial it becomes as a support or resistance levels. An uptrend is shown by greater highs and higher lows. A sag is suggested by lower highs and lower lows.

For these kind of traders short-term momentum trading is the very best forex trading technique. The aim of this short-term momentum trading strategy is to hit the revenue target as early as possible. This is achieved by entering the market long or short when the momentum is on your side.

18 bar moving average takes the existing session on open high low close and compares that to the open high low close of 18 days earlier, then smooths the typical and puts it into a line on the chart to offer us a pattern of the present market conditions. Breaks above it are bullish and breaks listed below it are bearish.

Very first look at the last couple of days, then the last couple of weeks, months and then year. A drop is shown by lower highs and lower lows. When done, choose two signs: weighted MA and basic MA.

If you are searching more engaging comparisons related to How to Use Ema Forex, and Forex Indicators, Forex Charts, Which Indicators you should signup for newsletter now.