Forex EMA RSI Stochastics Trading Strategy #shorts

New un-edited videos highly rated Trading System, Trend Indicator, Forex Trading Ideas, and How to Use Ema in Forex Trading, Forex EMA RSI Stochastics Trading Strategy #shorts.

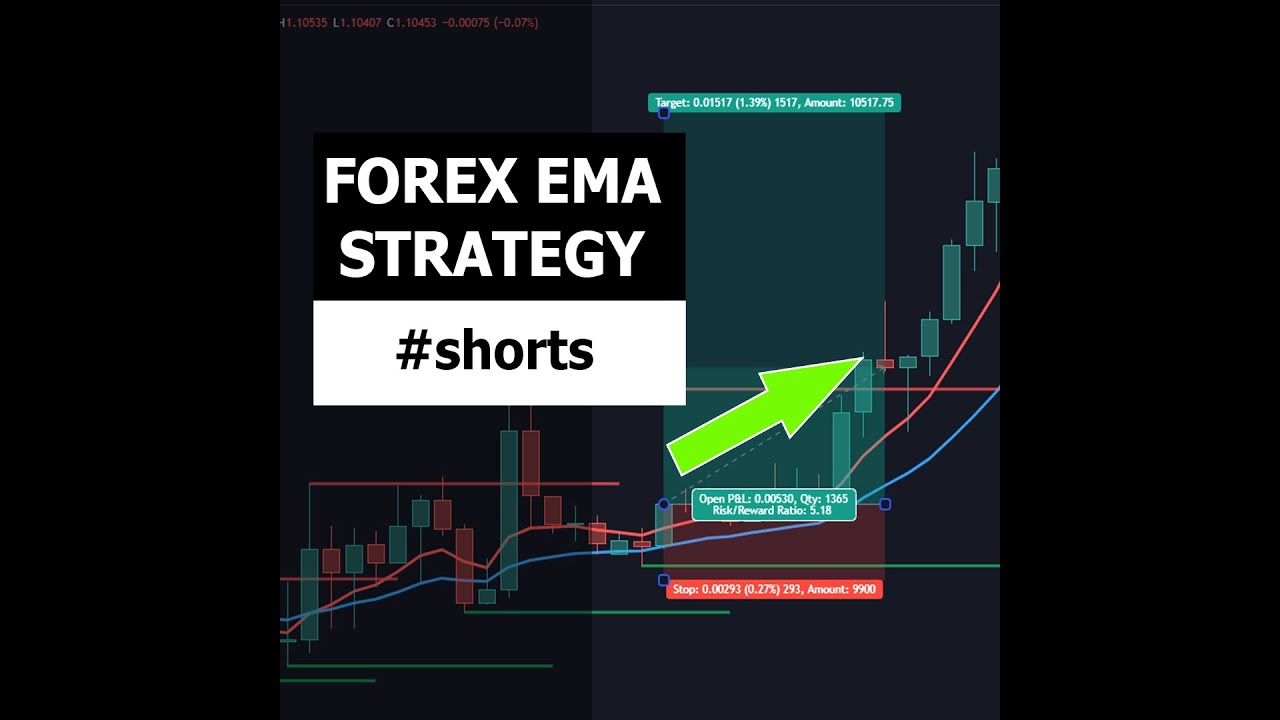

Here is a #shorts video tutorial for a beginner #forex strategy using an 8 and 20 EMA exponential moving average, #stochastics #RSI and of course market structure. The full video will come soon.

You can find my tradingview indicators here:

https://www.tradingview.com/u/trading-guide/#published-scripts

Production Music courtesy of Epidemic Sound: http://www.epidemicsound.com

—

The information in this video is no financial advice.

Trading in the financial markets is risky and you

should not risk capital that you can’t afford to lose.

I do not guarantee any success of shown methods and

I do not accept any liabilities in this regard or for any

loss or damage arising from or in connection with

any of the information in this video.

How to Use Ema in Forex Trading, Forex EMA RSI Stochastics Trading Strategy #shorts.

Currency Trading – Intraday Positions

You might notice on stock charting websites a line called MA, SMA, or EMA. Nasdaq has actually been developing an increasing wedge for about 2 years. The understanding and usage of basic moving averages will achieve this.

Forex EMA RSI Stochastics Trading Strategy #shorts, Search new full length videos relevant with How to Use Ema in Forex Trading.

Using Moving Averages To Your Forex Trading Profit

This type of day can likewise occurs on a news day and requires to be approached carefully. You’ve probably understood that trading online is not almost as simple as you believed it was.

There are a terrific range of forex indicators based upon the moving average (MA). This is an evaluation on the easy moving average (SMA). The basic moving average is line produced by calculating the average of a set variety of period points.

A typical forex cost chart can look really irregular and forex candlesticks can obscure the pattern further. The Moving Average Trader average gives a smoothed graph that is plotted on top of the forex chart, together with the japanese candlesticks.

Nasdaq has rallied 310 points in three months, and hit a new four-year high at 2,201 Fri morning. The economic data suggest market pullbacks will be limited, although we have actually gotten in the seasonally weak period of Jul-Aug-Sep after a huge run-up. As a result, there may be a consolidation duration instead of a correction over the next couple of months.

While there is no method to forecast what will occur, it does suggest that you should be prepared in your investments to act if the Forex MA Trading starts to head south.

This means that you need to understand how to handle the trade prior to you take an entry. In a trade management strategy, you must have composed out precisely how you will control the trade after it is entered into the Stocks MA Trading so you understand what to do when things come up. Conquering trade management is very important for success in trading. This part of the system need to include information about how you will react to all type of conditions one you get in the trade.

When figuring out a trade’s suitability, the new brief positions will have protective stops placed reasonably close to the market considering that risk ought to constantly be the number one consideration. This week’s action plainly revealed that the marketplace has run out of people ready to develop brand-new brief positions under 17.55. Markets always run to where the action is. The declining varieties integrated with this week’s turnaround bar lead me to believe that the next move is greater.

It’s extremely real that the marketplace pays a lot of attention to technical levels. We can reveal you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the distinction was a line drawn on a chart. When big blocks of money will sell or buy, moving averages for example are perfect research studies in. Enjoy the action surrounding a 200 day moving average and you will see first hand the warfare that happens as shorts attempt and drive it under, and longs purchase for the bounce. It’s neat to see.

Private tolerance for risk is an excellent barometer for selecting what share cost to short. If new to shorting, attempt lowering the quantity of capital usually used to a trade till ending up being more comfy with the technique.

It is simply because everybody is using it, specifically those big banks and organizations. It not only requires understanding about the patterns however likewise about the direction the patterns will move.

If you are looking instant engaging videos related to How to Use Ema in Forex Trading, and Forex Training, Currency Trading, Stock Investing, Currency Exchange Rate please subscribe in email list totally free.