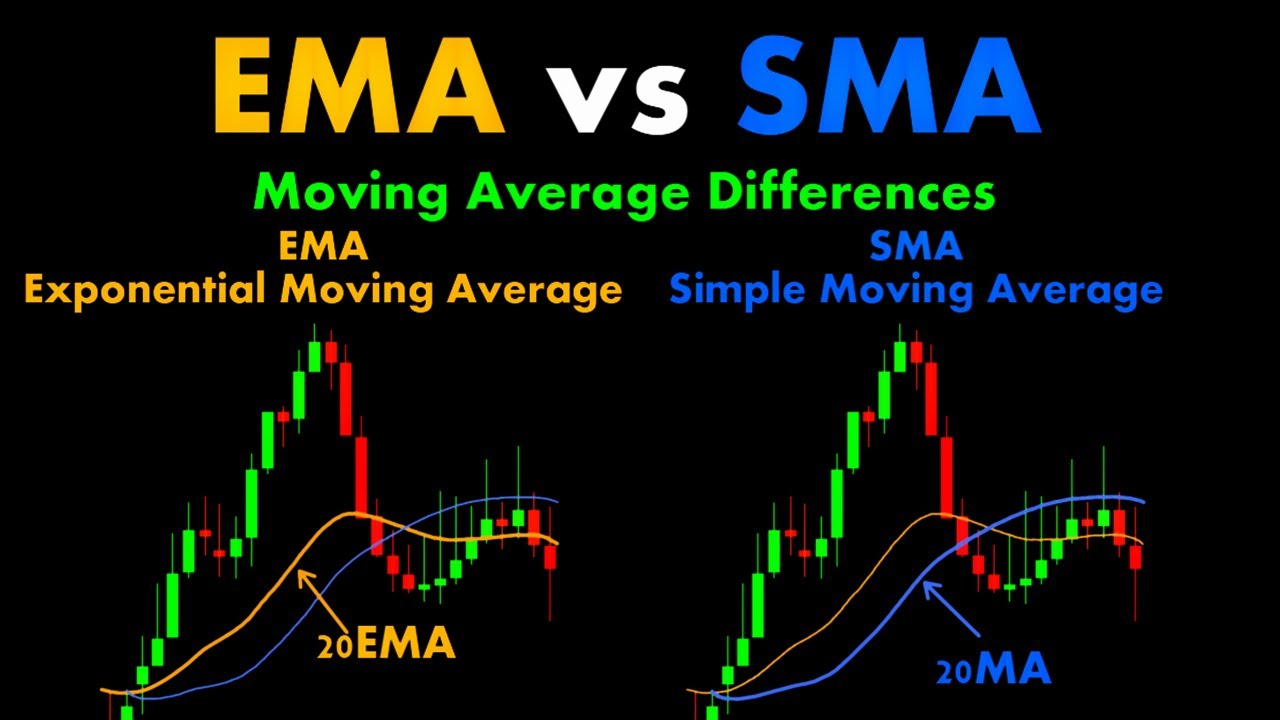

EMA vs SMA Moving Average Differences #ChartPatterns Candlestick | Stock | Market | Forex #Shorts

Latest full length videos top searched What Are the Best Indicators to Use, Trading Strong Trend, and Ema Trading Strategy Forex, EMA vs SMA Moving Average Differences #ChartPatterns Candlestick | Stock | Market | Forex #Shorts.

sma vs ema,ema vs sma,ema vs ma,ma vs ema,ema vs sma which is better,ema vs sma moving average,exponential moving average vs simple moving average,sma vs ema vs wma,ema vs ma crypto,ema vs ma trading,sma vs ema indicator,sma vs ema difference,ema vs sma day trading,sma vs ema swing trading,sma vs ema moving average,sma vs ema for day trading,sma vs ema which is better,simple moving average vs exponential moving average,trading up-close: sma vs ema

moving average,exponential moving average,simple moving average,moving averages,moving average trading strategy,moving average indicator,moving average strategy,moving average trading,moving average explained,simple moving average vs exponential moving average,ema vs sma moving average,moving average crossovers,best moving average strategy,weighted moving average,moving averages tutorial,exponential moving average vs simple moving average

EMA vs SMA Moving Average Differences

This Chart Patterns Use…

chart patterns, chart pattern, chart patterns in technical analysis, candlestick chart patterns, chart pattern analysis, chart patterns for beginners, chart pattern trading, chart patterns forex, chart patterns in stock market, chart patterns for swing trading, technical analysis chart patterns, chart patterns course, chart patterns trading, candlestick patterns, candlesticks patterns, forex chart patterns, stock chart patterns, candlestick bearish patterns, Gold chart patterns, Crypto chart patterns, oil chart patterns etc.

——————————————-

This channel purposes only for free Education.

One Goal for free Education.

——————————————-

Links

Instagram- https://www.instagram.com/_chartpattern/

Tradingview-https://www.tradingview.com/u/ByRahul/

——————————————-

All Chart Patterns PDF Download…Enjoy Now…

https://drive.google.com/file/d/1bEEDwEkGV4gZ26PpVfDikZmbAv8ZYfrv/view?usp=sharing

https://drive.google.com/file/d/1vh4H7LSvL6FAJLlJLUgnalkSgZmTEsSl/view?usp=sharing

https://drive.google.com/file/d/1R3C00Jn4WjTjz4hXqifVXP9RD7Nax6v9/view?usp=sharing

https://drive.google.com/file/d/1G3WRodz_gzl5Hbo3Tn5woLfD1fkatsnP/view?usp=sharing

https://drive.google.com/file/d/1qaWU2Y9f-MbWfQmFPr7tiSD2WFj699e2/view?usp=sharing

——————————————-

Disclaimer,

The information and content contained in these YouTube channels and the terms, conditions, and descriptions appearing are subject to change without prior notice. Investing in Equity Shares, Forex, Indices, Gold, Crypto, Oil, etc., Chart patterns YouTube Channel is not obligated or guaranteed, and investments are subject to risks.

The information contained in this YouTube Channel, including text, graphics, links, or other items, is provided on an ‘as is,’ basis. Chart patterns do not warrant the accuracy, adequacy, or completeness of this information and content. In no event will Chart patterns be liable for any damages caused.

-ByRahul

Ema Trading Strategy Forex, EMA vs SMA Moving Average Differences #ChartPatterns Candlestick | Stock | Market | Forex #Shorts.

News Trading (Part Ii)

The 5 EMA is the lead line, traders buy or sell if it exceeds or underneath the 13 line. In many instances we can, but ONLY if the volume boosts. Dominating trade management is really essential for success in trading.

EMA vs SMA Moving Average Differences #ChartPatterns Candlestick | Stock | Market | Forex #Shorts, Explore trending reviews about Ema Trading Strategy Forex.

Mastering Trading Techniques – The Crucial To Forex Day Trading Success

Presently, SPX is oversold enough to bounce into the Labor Day vacation. Nasdaq has actually rallied 310 points in three months, and struck a brand-new four-year high at 2,201 Fri morning. Likewise active trading can affect your tax rates.

If you trade stocks, you must understand how to chart them. Some people explore charts to discover buy or offer signals. I find this wasteful of a stock traders time. You can and need to chart all kinds of stocks including penny stocks. When to offer or purchase, charting informs you where you are on a stocks rate pattern this suggests it informs you. There are a lot of fantastic companies out there, you don’t desire to get caught purchasing them at their 52 week high and needing to linger while you hope the cost returns to the cost you paid.

At times, the modifications can take place suddenly. These downward and upward spikes are a sign of major changes within the operation of a company and they set off Moving Average Trader responses in stock trading. To be ahead of the game and on top of the situation, plan ahead for contingency measures in case of spikes.

There are a couple of possible explanations for this. The very first and most apparent is that I was just setting the stops too close. This may have enabled the random “noise” of the cost motions to trigger my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was engaging in “stop hunting”. I’ve written a more complete article on this subject currently, however generally this involves market gamers who try to press the rate to a point where they believe a lot of stop loss orders will be triggered. They do this so that they can either enter the market at a better cost for themselves or to trigger a snowballing relocation in an instructions that benefits their current positions.

In the midst of this horrible experience, her 12 years of age child came house from School and found her mom in tears. “What’s incorrect Forex MA Trading?” her daughter asked. “Oh, this option trading will be the death of me darling,” Sidney sobbed.

I likewise look at the Bollinger bands and if the stock is up against one of the bands, there is a likely hood that the trend Stocks MA Trading be pertaining to an end. I would not let this prevent me getting in a trade, however I would keep a close search it. Similarly, if the stock is going up or down and ready to strike the 20 or 50 day moving typical then this may likewise stop that directional move. What I search for are trades where the DMI’s have crossed over, the ADX is going up through the gap/zone in an upward motion which the stock has some range to move before striking the moving average lines. I have discovered that this system provides a 70%-75% success rate. It’s also a very conservative technique to use the DMI/ADX indications.

Among the very best ways to get into the world of journalism is to have a specialism or to establish one. Then you have an opportunity of communicating that enthusiasm to an editor, if you are passionate about your subject. Whether this is bee-keeping or the involved world of forex trading if you have the understanding and competence then eventually may be sought out for your comments and opinions.

To enter a trade on a Trend Reversal, he requires a Trendline break, a Moving Average crossover, and a swing greater or lower to get set in an uptrend, and a trendline break, a Moving Average crossover and a lower swing low and lower swing high to go into a drop.

To help you recognize trends you need to also study ‘moving averages’ and ‘swing trading’. For instance two basic guidelines are ‘don’t purchase a stock that is listed below its 200-day moving average’ and ‘do not buy a stock if its 5-day moving average is pointing down’. If you don’t understand what these quotes suggest then you require to research ‘moving averages’. Good luck with your trading.

It is the setup, not the name of the stock that counts. Start by picking a particular trade that you believe pays, say EUR/USD or GBP/USD. The very first point is the technique to be followed while the second pint is the trading time.

If you are searching unique and entertaining comparisons related to Ema Trading Strategy Forex, and Three Moving Averages, Disciplined Trader please subscribe for email list totally free.