EMA trading Strategy with Crazy settings.

Top overview relevant with Currency Trading, Sector Trends, Forex Trading, Successful Trading, and What Does Ema Mean in Trading, EMA trading Strategy with Crazy settings..

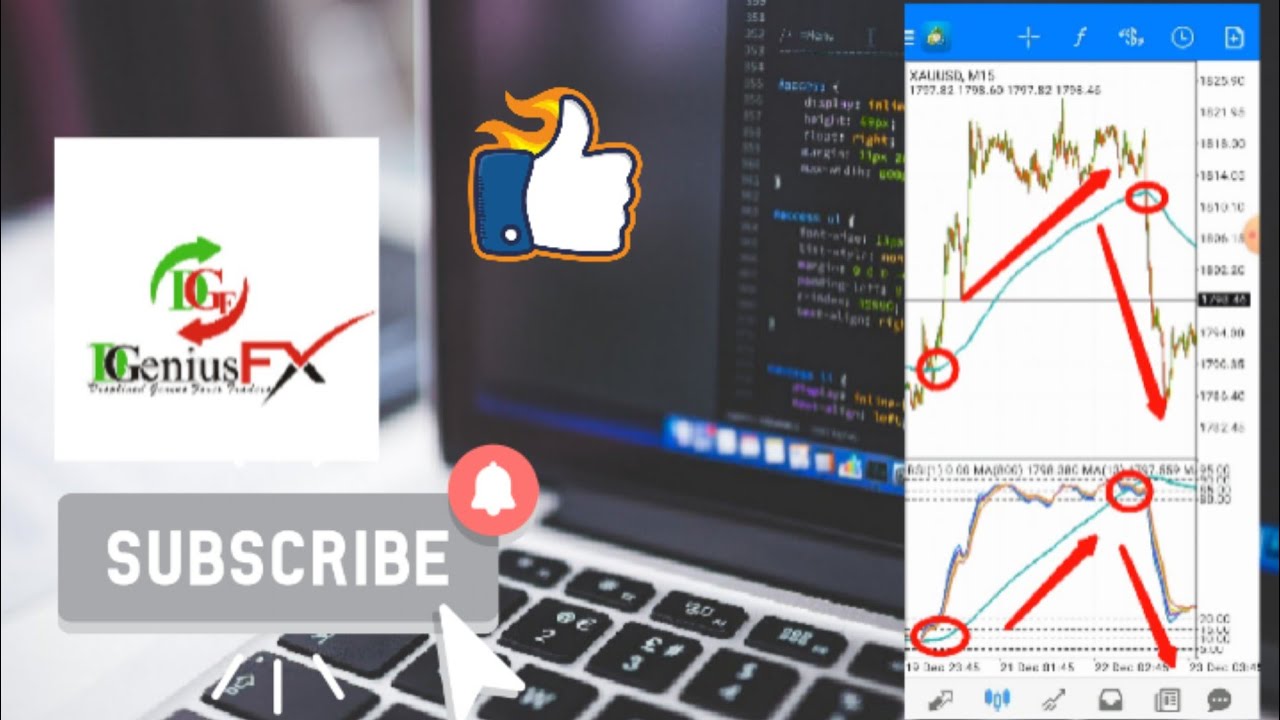

In this video you will discover simple but powerful six exponential moving average to trade and make massive profit. let’s watch

What Does Ema Mean in Trading, EMA trading Strategy with Crazy settings..

6 Trading Habits To Strive For

You are searching for the price to hit the severe band that is against the day-to-day pattern.

Now, this thesis is to help individual traders with criteria that have shown to be rather efficient.

EMA trading Strategy with Crazy settings., Play trending full videos about What Does Ema Mean in Trading.

How To Identify Trends When Trading The S & P 500 Mini Futures Contract

The software the traders utilize at the online trading platforms is more easy to use than it was years ago. Now if you look at a moving average, you see it has no spikes, as it smooths them out due to its averaging.

If you have actually remained in currency trading for any length of time you have actually heard the following two expressions, “pattern trade” and “counter pattern trade.” These 2 methods of trading have the very same credibility and need simply as much work to master. Since I have discovered a system that allows me to find high frequency trades, I like trading counter pattern.

Technical analysis can be really useful for Moving Average Trader to time our entries and exits of the trade. It should not be utilized alone because it can be confusing info if not used properly.

So this system trading at $1000 per trade has a favorable span of $5 per trade when traded over numerous trades. The earnings of $5 is 0.5% of the $1000 that is at threat throughout the trade.

It’s tempting to start trading at $10 or $20 a point just to see how much cash, albeit make-believe cash, you can Forex MA Trading in as brief a time as possible. But that’s an error. If you’re to find out how to trade currencies successfully then you must treat your $10,000 of make-believe cash as if it were real.

Rather of subscribing to an advisory letter you Stocks MA Trading decide to make up your own timing signal. It will take some initial work, once done you will not have to pay anybody else for the service.

Here is a perfect example of a method that is basic, yet clever enough to ensure you some included wealth. Start by selecting a particular trade that you believe pays, state EUR/USD or GBP/USD. When done, choose two indications: weighted MA and easy MA. It is suggested that you utilize a 20 point weighted moving average and a 30 point moving average on your 1 hour chart. The next step is to keep an eye out for the signal to offer.

I have actually mentioned this a number of times, however I believe it deserves mentioning once again. The most common moving average is the 200-day SMA (basic moving average). Extremely basically, when the marketplace is above the 200-day SMA, traders state that the marketplace remains in an uptrend. The market is in a sag when cost is listed below the 200-day SMA.

A method to determine the speed or significance of the relocation you are going to trade against. This is the trickiest part of the formula. The most common method is to determine the slope of a MA versus an otherwise longer term trend.

Nasdaq has actually been developing a rising wedge for about two years. They do not know appropriate trading strategies. Now that you’ve tallied the points, what does it imply? It tracks the price action and always drags it.

If you are looking unique and entertaining comparisons related to What Does Ema Mean in Trading, and Forex Artificial Intelligence, Forex Opportunity, How to Read Stock Charts you are requested to signup for email alerts service totally free.