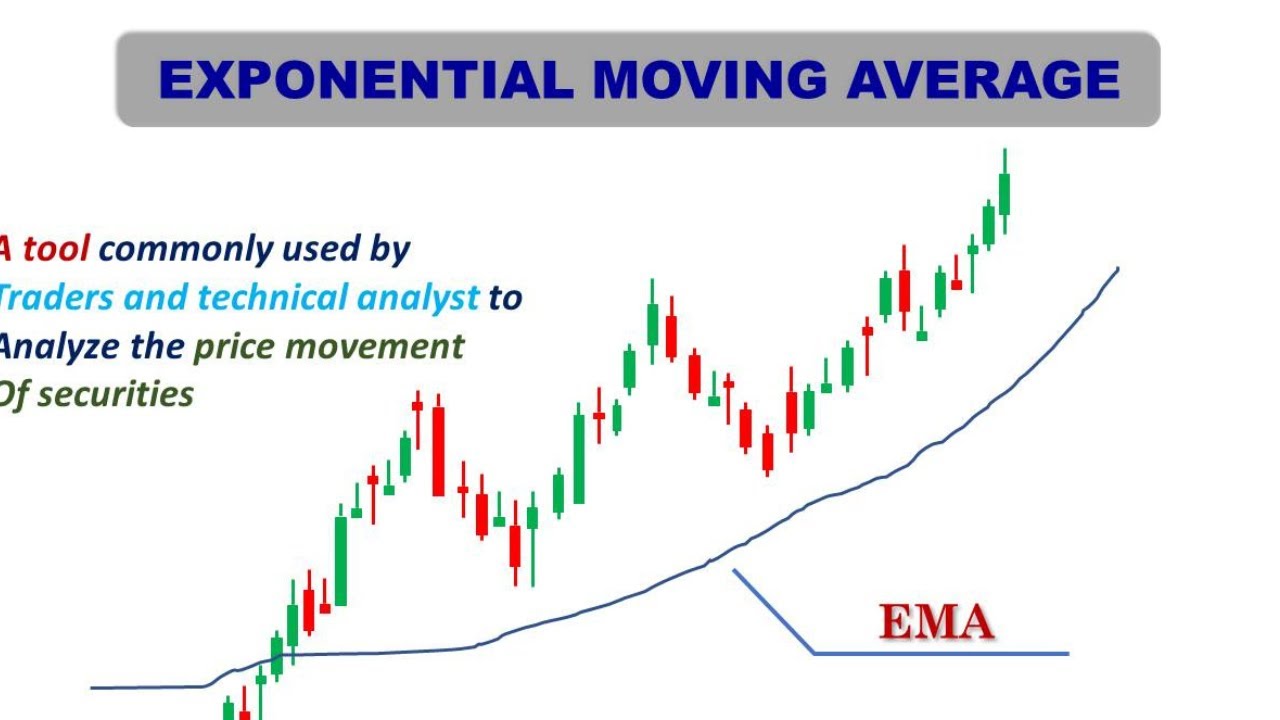

EMA Trading Strategy I How to use EMA in trading I 50 EMA I #shorts #movingaverages #stockmarkets

Interesting un-edited videos top searched How to Make Money in Stocks, 50-Day Moving Average, Beginner Forex Tips – Why You Should Use at Least Two Moving Averages When Trading, and What Is Ema on Trading, EMA Trading Strategy I How to use EMA in trading I 50 EMA I #shorts #movingaverages #stockmarkets.

Learn what is a #movingaverages , Important exponential moving average in trading , 50 Day Moving Average , 100 Day Moving Average, 200 Day Moving Average , Learn the basics , how to use EMA in trading , Step by step guide to learn all about important EMA’s.

I am sure many of you have been searching for questions like , what is Nifty, Bank Nifty & Equity Stocks ? your wait is over, #AffinityBull is here to help you all with these type of queries.

Stay Connected With Us

Telegram ► https://t.me/affinity_bull89

Twitte ► https://twitter.com/AffinityBull?t=Eip2Gfg-D9arwzG2iDliPA&s=08

Whatsapp :- 7500770668

#movingaverage #movingaverages #movingaveragestrategy #affinitybull #stockmarkets #priceaction

What Is Ema on Trading, EMA Trading Strategy I How to use EMA in trading I 50 EMA I #shorts #movingaverages #stockmarkets.

Enhance Your Forex Trading With Moving Averages

Now when a market is trending, it has picked a clear instructions. To reduce the incorrect signal result, there is the technique not to utilize MA + stock cost, however MA + another MA.

EMA Trading Strategy I How to use EMA in trading I 50 EMA I #shorts #movingaverages #stockmarkets, Find most shared full videos relevant with What Is Ema on Trading.

Useful Ideas In Emini Trading

SPX, for instance, typically traded within 1,170 and 1,200, i.e. multi-year support at 1,165 and the 200 day MA at 1,200. You just need to have persistence and discipline. Do this 3 times or more to establish a pattern.

New traders typically ask how numerous signs do you recommend using at one time? You don’t need to succumb to analysis paralysis. You need to master just these two oscillators the Stochastics and the MACD (Moving Average Merging Divergence).

If that ratio gets incredibly high, like 100, that implies that silver is inexpensive relative to gold and might be an excellent value. If the number is low, silver Moving Average Trader may be getting overly pricey.

The dictionary estimates an average as “the ratio of any amount divided by the variety of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

Small patterns can be easily noted on 5-minute charts. Then it is a Forex MA Trading trend, if the existing rate on 5-minute chart is below 60 period moving average and the moving typical line is sloping downwards. , if the existing cost on 5-minute chart is above 60 period moving average and the moving average line is sloping upward this indicates a minor pattern..

Considering that we are using historic information, it is worth noting that moving averages are ‘lag Stocks MA Trading indications’ and follow the real duration the higher the responsiveness of the chart and the close it is to the real rate line.

The brand-new brief positions will have protective stops positioned fairly near to the market because danger should always be the number one factor to consider when determining a trade’s suitability. Today’s action plainly showed that the marketplace has actually lacked people happy to develop new short positions under 17.55. Markets always run to where the action is. The declining ranges integrated with this week’s reversal bar lead me to think that the next move is greater.

As you can see, defining the BI is simple. The 30-minute BI is strictly the high and the low of the very first thirty minutes of trading. I discover that the BI frequently reveals the bias of a stock for the day.

At the day level there are periods likewise that the rate does not mainly and periods that the cost modification largely. The risky time periods are when London stock opens ad when USA stock opens. Also there are large changes when Berlin stock opens. After each one opens, there are often large modifications in the costs for a man hours. The most risky period is the time at which 2 stocks are overlapped in time.

You can utilize any signs that you’re comfy with to go through a comparable treatment. To be ahead of the video game and on top of the situation, strategy ahead for contingency procedures in case of spikes.

If you are looking more exciting comparisons related to What Is Ema on Trading, and Day Forex Signal Strategy Trading, Momentum Forex Trading please signup for email subscription DB for free.