EMA CLOUD + HEIKIN ASHI CANDLE (Trading Strategy the 1% Use)

https://www.youtube.com/watch?v=XfBpr59dSGk

New full length videos top searched Counter Trend, Trading Tip, Timing the Market, and Ema Trading Explained, EMA CLOUD + HEIKIN ASHI CANDLE (Trading Strategy the 1% Use).

Free Stock Trading Guide⛔ https://www.marketmovesmatt.com Get My Books https://amzn.to/3hNYAYB TRADE OPTIONS …

Ema Trading Explained, EMA CLOUD + HEIKIN ASHI CANDLE (Trading Strategy the 1% Use).

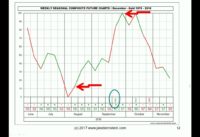

Number 1 Loser Indication – Why Trading Moving Averages Fail

First take a look at the last few days, then the last couple of weeks, months and then year. This tool supplies a relative definition of price highs/lows in terms of upper and lower bands.

EMA CLOUD + HEIKIN ASHI CANDLE (Trading Strategy the 1% Use), Enjoy more high definition online streaming videos about Ema Trading Explained.

Currency Trading – Intraday Positions

Numerous argue that moving averages are the very best indicators for forex. SPX, for example, usually traded within 1,170 and 1,200, i.e. multi-year assistance at 1,165 and the 200 day MA at 1,200.

If you have been in currency trading for any length of time you have heard the following two phrases, “trend trade” and “counter pattern trade.” These 2 techniques of trading have the same credibility and need simply as much work to master. Due to the fact that I have actually found a system that permits me to discover high frequency trades, I like trading counter pattern.

If it is going to be feasible, the DJIA has to stick around its 20-day Moving Average Trader typical. The DJIA needs to get there otherwise it might go down to 11,000. A rebound can result in a pivot point better to 11,234.

Assistance & Resistance. Support-this term describes the bottom of a stock’s trading variety. It resembles a flooring that a stock price finds it hard to penetrate through. Resistance-this term describes the top of a stock’s trading range.It’s like a ceiling which a stock’s price does not appear to rise above. Support and resistance levels are vital ideas regarding when to purchase or offer a stock. Numerous effective traders purchase a stock at assistance levels and sell brief stock at resistance. If a stock manages to break through resistance it could go much greater, and if a stock breaks its assistance it might indicate a breakdown of the stock, and it may go down much further.

Market timing is based on the “reality” that 80% of stocks will follow the direction of the broad market. It is based on the “fact” that the Forex MA Trading trend gradually, have actually been doing so given that the beginning of easily traded markets.

During these times, the Stocks MA Trading consistently breaks support and resistance. Of course, after the break, the prices will typically pullback before continuing its method.

For each time a post has actually been e-mailed, award it 3 points. An e-mailed post means you have at least hit the interest nerve of some member of your target audience. It might not have actually been a publisher so the category isn’t as valuable as the EzinePublisher link, however it is better than a simple page view, which doesn’t necessarily mean that somebody checked out the whole article.

The second action is the “Get Set” action. In this step, you may increase your money and gold allotments further. You may likewise start to move money into bear ETFs. When the market goes down, these funds go up. Funds to think about include SH, the inverse of the S&P 500, DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

Daily Moving Averages: There are numerous moving averages which is simply the average cost of a stock over an extended period of time, on a yearly chart I like to use 50, 100 and 200 everyday moving averages. They offer a long smoothed out curve of the average cost. These lines will also end up being support and resistance points as a stock trades above or listed below its moving averages.

The two most popular moving averages are the basic moving average and the exponential moving average. The decreasing ranges integrated with this week’s turnaround bar lead me to believe that the next relocation is higher.

If you are finding more entertaining comparisons relevant with Ema Trading Explained, and Aocs Currency, Forex Trading Indicators, Forex Trading – Simple Steps to Creating Your Own Profitable Trading System, Distribution Days you should join in email alerts service totally free.