EMA and Support and Resistance Trading Strategy

Top reviews top searched Simple Moving Average, Learn How to Trade, Forex Trading Indicators, Forex Trading for Beginners – How to Properly Use 2 Simple Moving Averages to Find Good Trades, and Ema Trading Bitcoin, EMA and Support and Resistance Trading Strategy.

Welcome to Step Grow Trader’s,

Mastering the EMA and Support and Resistance Trading Strategy

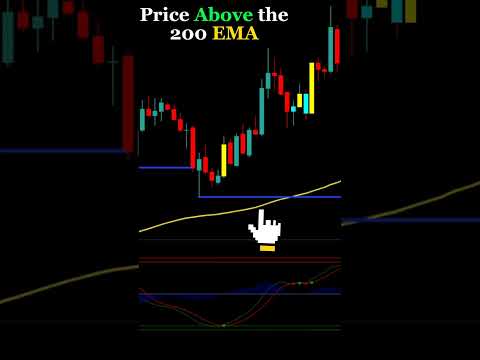

In this video, we’ll dive into one of the most powerful trading strategies in the market – the EMA and Support and Resistance Trading Strategy. This strategy is used by many professional traders and can be applied to any market, including stocks, Forex, and cryptocurrencies. By using this strategy, you can potentially increase your chances of success and make better trading decisions.

In this video, we’ll cover the following topics:

What is the EMA and Support and Resistance Trading Strategy?

How to identify key support and resistance levels

How to use the EMA to confirm your trades

Tips for managing risk and maximizing profits

Whether you’re a beginner or an experienced trader, this video will provide valuable insights into using the EMA and Support and Resistance Trading Strategy. By the end of this video, you’ll have a better understanding of how to identify key levels, use the EMA to confirm trades, and manage your risk to maximize your profits.

So, if you’re looking for a powerful trading strategy that can help you make better trading decisions, this video is a must-watch!

Financial Disclaimer:

I am not a financial advisor. The ideas presented in these videos are personal opinions and for entertainment purposes only.

You (and only you) are responsible for the financial decisions that you make. Ideas presented in these videos are my opinions at the date of filming

and may have changed in the future.

swing trading

scalping trading strategy

no loss crypto trading strategy

best indicator tradingview crypto

5 minutes scalping

Crypto Trading Strategy

Never Lose Again

how to make money online 2023

crypto scalping strategy

forex trading strategy

scalping strategy

best scalping trading strategy

best scalping strategy

best tradingview indicator

crypto day trading

chat gpt to make money

scalping trading

bitcoin

crypto

cryptocurrency

luxalgo

#crypto

#bitcoin

#tradingstrategy

#daytarding

Ema Trading Bitcoin, EMA and Support and Resistance Trading Strategy.

Financiers Check Out Technical Analysis

Easy moving averages weigh every price in the past equally. Buy-and-hold say TV analysts and newsletter publishers who’s customers currently own the stock. Likewise take a look at more information on deep in the money calls.

EMA and Support and Resistance Trading Strategy, Play latest reviews relevant with Ema Trading Bitcoin.

Should You Follow The Trends When Forex Trading?

SPX, for example, usually traded within 1,170 and 1,200, i.e. multi-year support at 1,165 and the 200 day MA at 1,200. You just need to have persistence and discipline. Do this three times or more to establish a trend.

Moving averages are really popular indications in the forex. Many traders utilize them, and some individuals use them exclusively as their own sign. However what is the function of moving averages, and how do you in fact make cash from them?

Nasdaq has actually rallied 310 points in 3 months, and struck a new four-year high at 2,201 Fri Moving Average Trader early morning. The financial information recommend market pullbacks will be restricted, although we’ve gone into the seasonally weak duration of Jul-Aug-Sep after a huge run-up. Consequently, there might be a consolidation duration instead of a correction over the next few months.

“Again, I have actually drawn a swing chart over the price bars on this day-to-day chart. As soon as you understand swing charts, you will have the ability to draw these lines in your mind and you will not need to draw them on your charts anymore,” Peter stated.

The dictionary prices estimate a typical as “the Forex MA Trading quotient of any sum divided by the variety of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

Follow your trading personality. What are your needs? What are your goals? Do the research study, discover the Stocks MA Trading designs that fit your requirements, determine which indicators work for you and so on.

As bad as things can feel in the rare-earth elements markets these days, the reality that they can’t get too much even worse has to console some. Gold particularly and silver are looking good technically with gold bouncing around strong assistance after its 2nd perform at the venerable $1,000. Palladium looks to be holding while platinum is anyone’s guess at this point.

This trading tool works much better on currency pair rate history than on stocks. With stocks, rate can gap up or down which causes it to give incorrect readings. Currency pair’s cost action rarely gaps.

Do not just buy and hold shares, at the same time active trading is not for everyone. Use the 420 day SMA as a line to decide when to be in or out of the S&P 500. When the market falls listed below the 420 day SMA, traders can likewise look to trade brief.

The firm likewise slashed its projection for the very first quarter of next year to simply 0.5%. Now this would depend on what works best for you so as not to get puzzled. Some people wish to make trading so difficult.

If you are searching more engaging comparisons related to Ema Trading Bitcoin, and Trading System Guide, Forex Trading – Simple Steps to Creating Your Own Profitable Trading System dont forget to list your email address in email subscription DB for free.