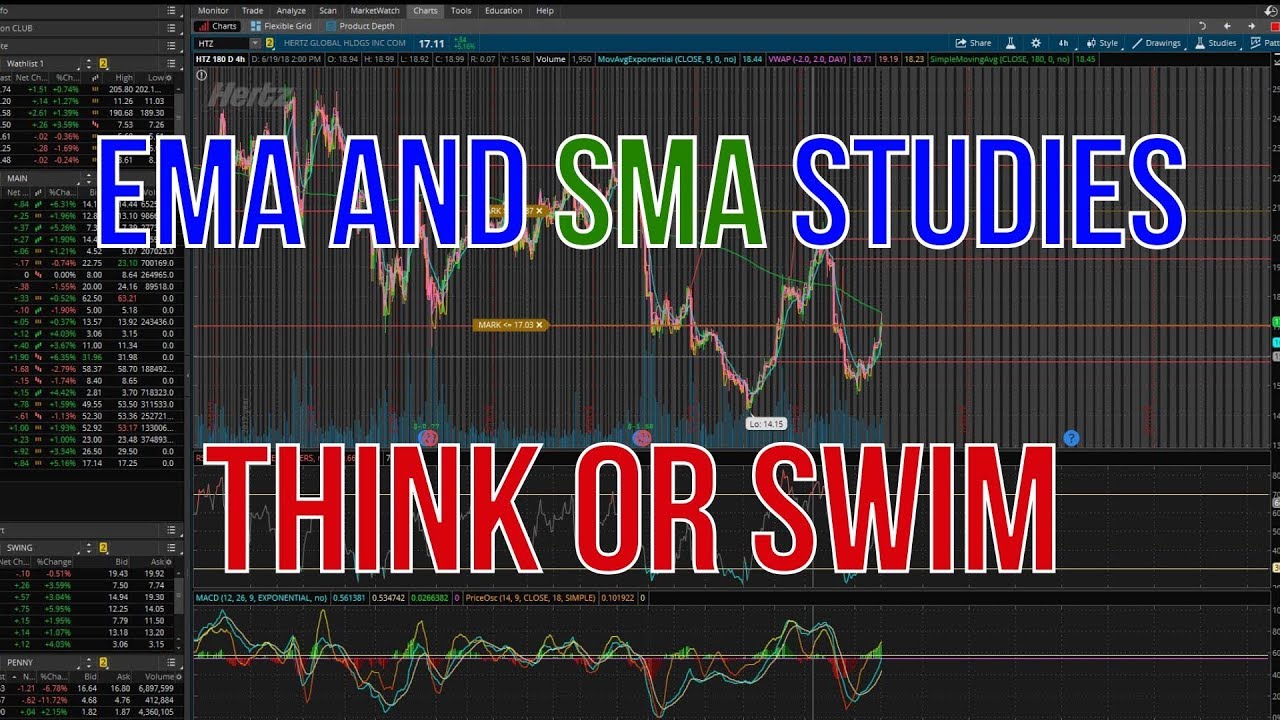

EMA and SMA | How To Set up In Think or Swim

Top YouTube videos relevant with Options Trading, Stock Trading System, Stock Buy Signals, Exit Strategy, and What Is Sma Trading, EMA and SMA | How To Set up In Think or Swim.

How To Set up your SMA and EMA Studies in Think Or Swim. More content about swing and day trading coming soon. Subscribe so you won’t miss the next video.

Join Our Free Chat Room – https://discord.gg/JKkVwK4

What Is Sma Trading, EMA and SMA | How To Set up In Think or Swim.

Different Kinds Of Day Trading Orders

This tool offers a relative meaning of rate highs/lows in regards to upper and lower bands. Palladium looks to be holding while platinum is anyone’s guess at this point. This is to anticipate the future pattern of the cost.

EMA and SMA | How To Set up In Think or Swim, Watch more full length videos related to What Is Sma Trading.

5 Easy Steps – Stock Trading System

Throughout long-term nonreligious bearishness, a buy and hold method hardly ever works. A 50-day moving typical line takes 10 weeks of closing rate data, and then plots the average.

.jpg)

If you have remained in currency trading for any length of time you have heard the following two expressions, “pattern trade” and “counter pattern trade.” These two methods of trading have the same credibility and require simply as much work to master. Because I have discovered a system that enables me to discover high frequency trades, I like trading counter pattern.

3) Day trading indicates quick revenue, do not hold stock for more than 25 min. You can always offer with revenue if it begins to fall from leading, and then buy it back later if it Moving Average Trader end up going upward again.

“Again, I have actually drawn a swing chart over the price bars on this everyday chart. Once you understand swing charts, you will have the ability to draw these lines in your mind and you will not need to draw them on your charts any more,” Peter said.

You need to recognize the beginning of the break out that developed the relocation you are going to trade versus. The majority of people use Support and resistance lines to identify these areas. I find them to be really Forex MA Trading effective for this purpose.

A well indicating friend had actually pointed out an options trading course he had gone to and suggested that trading may be a method for Sidney to Stocks MA Trading above average returns on her settlement payment cash, as interest and dividends would not have the ability to provide sufficient earnings for the household to reside on.

A 50-day moving typical line takes 10 weeks of closing cost data, and after that plots the average. The line is recalculated everyday. This will reveal a stock’s rate pattern. It can be up, down, or sideways.

As you can see, specifying the BI is easy. The 30-minute BI is strictly the high and the low of the very first thirty minutes of trading. I find that the BI often reveals the predisposition of a stock for the day.

Daily Moving Averages: There are lots of moving averages which is simply the average price of a stock over a long duration of time, on a yearly chart I like to use 50, 100 and 200 day-to-day moving averages. They supply a long ravelled curve of the typical rate. These lines will also end up being assistance and resistance points as a stock trades above or below its moving averages.

This is stating the apparent, but it is frequently ignored when selecting a trading technique. Always be aware of your emotions and never make a trade out of fear or greed. Likewise active trading can impact your tax rates.

If you are looking more exciting videos related to What Is Sma Trading, and Exponential Moving Average Forex Indicator, Technical Analysis you are requested to signup in email subscription DB for free.