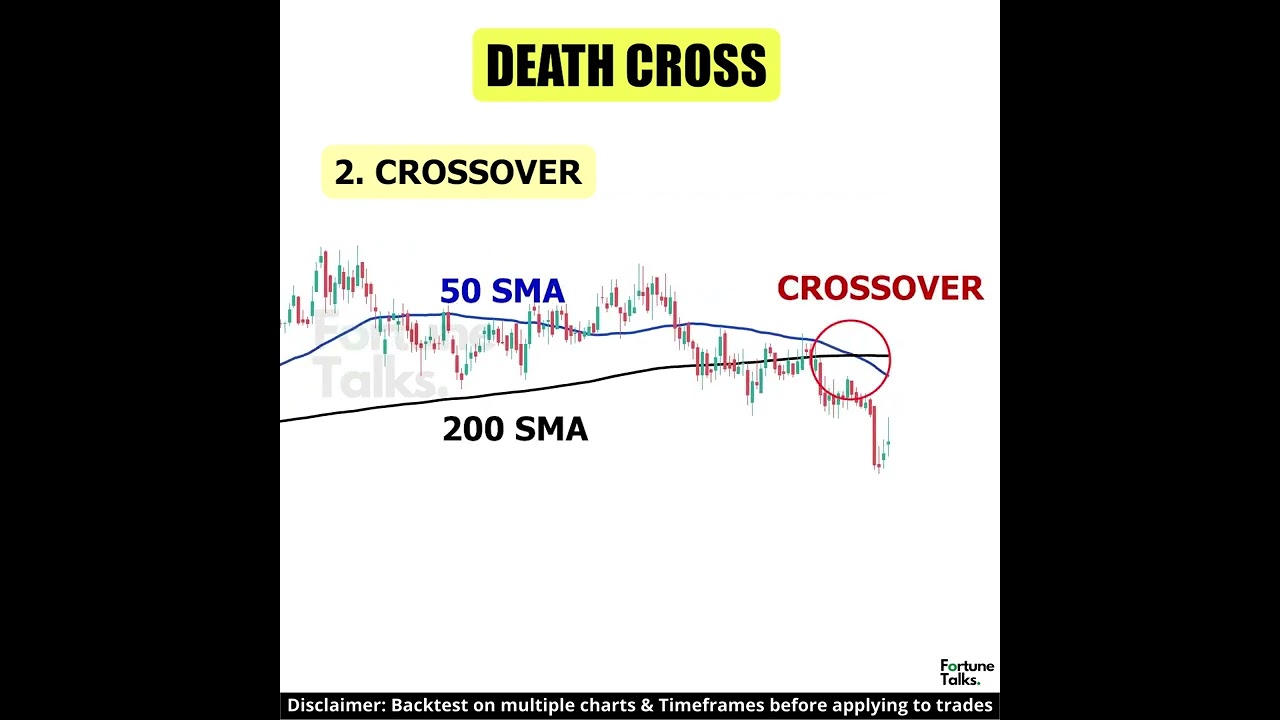

Death Cross Strategy | Moving average death cross | death cross trading strategy | Futures trading

Popular vids highly rated Day Trading, Trading Indicators, Forex Trading School, and Ma Crossover Strategy, Death Cross Strategy | Moving average death cross | death cross trading strategy | Futures trading.

Death Cross Strategy | Moving average death cross | death cross trading strategy | Futures trading

Comment down your suggestions & suggest videos that you want to watch.

Let’s build an interactive community of traders.

Follow us on Instagram for smart infographics😎

https://www.instagram.com/fortunetalks/

Follow us on our other youtube channel, for entertainment videos:

https://www.youtube.com/channel/UCaIVVHk5nig2hhSZ1-72IVQ

This Channel focuses on financially educating the youth & and making them capable of making money by themselves and achieving financial freedom at a very young age.

I am not a SEBI registered analyst. All videos in this channel are strictly for educational purposes. The channel will not be responsible for any personal losses whatsoever.

We don’t provide any paid courses or Trade Signals. We don’t have a telegram group or Twitter account.

Ma Crossover Strategy, Death Cross Strategy | Moving average death cross | death cross trading strategy | Futures trading.

Support And Resistance In Cfd Trading

I find them to be really efficient for this purpose. Now all we require to determine our span is to understand our possibility of a winning trade. On opposite, if 50SMA relocations down and crosses 200SMA, then the pattern is down.

Death Cross Strategy | Moving average death cross | death cross trading strategy | Futures trading, Get most shared replays relevant with Ma Crossover Strategy.

One Technique That Can Bring You Trading Losses

Traders seek to discover the optimal MA for a specific currency set. Assistance and resistance are levels that the marketplace reaches before it turns around. Utilizing signs for forex trading is essential.

I can’t tell you just how much money you are going to require when you retire. If the amount is insufficient it is not ‘when’, however ‘if’. You may have to keep working and hope one of those greeter tasks is available at Wal-Mart.

You don’t have to suffer the 40% portfolio losses that many people performed in 2008. It is difficult to perfectly time the market, however with some knowledge, you can use Put options to secure your Moving Average Trader financial investment from catastrophe.

Also getting in and out of markets although cheaper than in the past still costs money. Not simply commission however the spread (difference between trading rate). Likewise active trading can affect your tax rates.

Forex MA Trading She wrote a greater strike rate this time around since the pattern seemed speeding up and she didn’t desire to miss out on out on excessive capital growth if it continued to rally.

One of the main signs that can assist you develop the way the index is moving is the Moving Typical (MA). This takes the index rate over the last given number of days and averages it. With each new day it drops the first rate used in the previous day’s calculation. If you are looking to day trade or invest, it’s always good to inspect the MA of numerous periods depending. Then a MA over 5, 15, and 30 minutes are a good idea, if you’re looking to day trade. Then 50, 100, and 200 days may be more what you require, if you’re looking for long term investment. For those who have trades lasting a few days to a few weeks then periods of 10, 20 and 50 days Stocks MA Trading be better suited.

In addition, if the five day moving average is pointing down then keep away, consider an additional commodity, one where by the 5-day moving average is moving north. And do not buy a trade stock when it truly is down below its two-hundred day moving average.

The 2nd step is the “Ready” action. In this step, you might increase your cash and gold allocations even more. You may also begin to move money into bear ETFs. These funds go up when the marketplace decreases. Funds to think about include SH, the inverse of the S&P 500, DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

The trader who receives a signal from his/her trading system that is trading on a medium based timeframe is enabling the information to be absorbed into the marketplace before taking a position and likewise to identify their risk. This trader whether he thinks rates are random or not believes that details is collected and reacted upon at different rates therefore providing opportunity to go into along with The Wizard.

It is simply because everyone is utilizing it, particularly those big banks and organizations. It not only requires knowledge about the patterns however likewise about the direction the trends will move.

If you are finding most entertaining comparisons about Ma Crossover Strategy, and Moving Average Parameters, Days Moving Average, Sell Strategy, Megadroid Trading Robot dont forget to subscribe for email subscription DB now.